Draft - Short List

- Benefits

- Costs / Unbundled

- Policy Overview Ideas

- Premium

- Roles

- Agents

- Understanding / Explaining UL

- General

- Focus Groups

- Performance / Volatility / Duration

- Finding Stuff

MarkUps

- NAIC Illustrations Model Regulation - MarkUp

- NAIC Universal Life Model Regulation - MarkUp

- Leslie Scism - Article - MarkUp

Policy Overview Docs

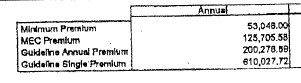

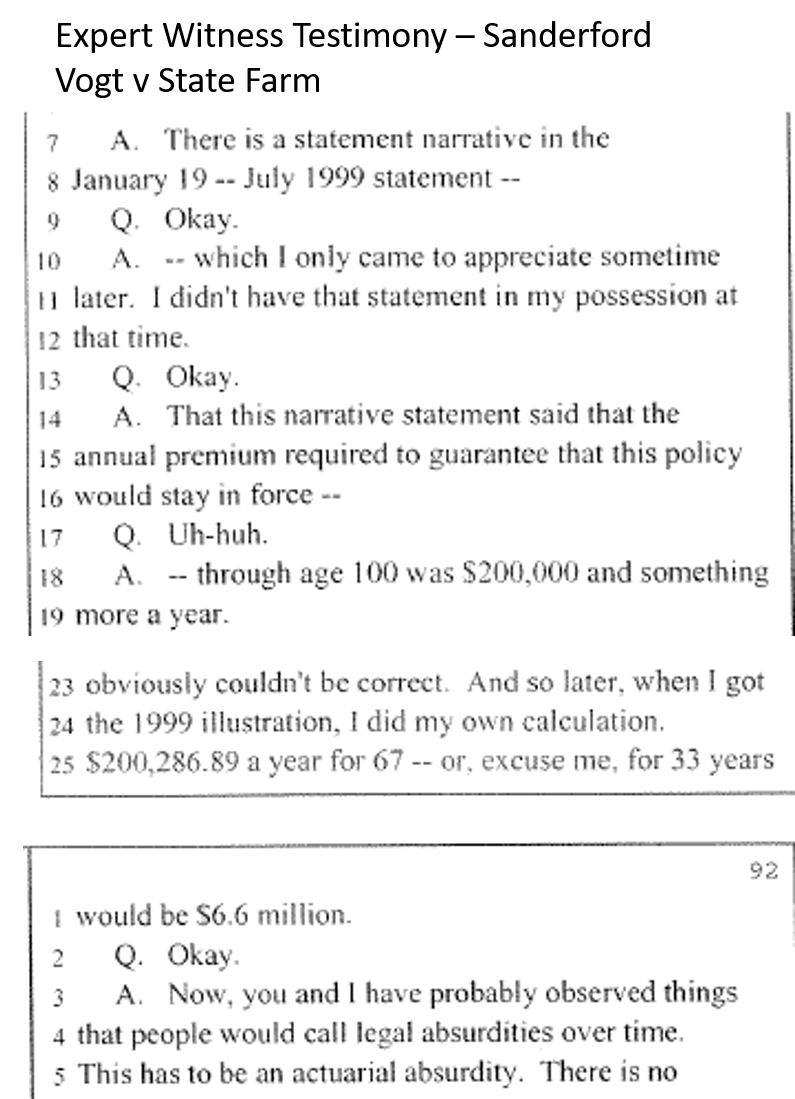

- Vogt v State Farm

- Annual Summary Reports

- Illustrations

- LC - Adjustable Life - 1,2,3, page

- SOA - MisMatch Life

- Book - Valuation - Claire - Data Page

- Chart 215 - 2020 pics

-

2014 ACLI Description of Product - Example (Proceedings)-OneNote

http://www.naic.org/documents/prod_serv_naic_state_min_acom.pdf

FOCUS GROUPS / CONSUMER TESTING

NAIC

What they did not understand, they did not find useful.

1990-1A, NAIC Proceedings - NAIC / LIMRA - Universal Life Disclosure Form Focus Group Summary, Consumer Issues Disclosure Working Group - NAIC --- [BonkNote] --- 10p

| 2016/5/17 LIIIWG 2016-2 |

He <Mr. Wicka> said that a report could include a recommendation that consumer testing is needed. |

| 2020/7/24 LIIIWG Richard Wicka |

That's <Consumer Testing> not something that our Working Group can do on it's own, but if that is the will of the Working Group we can certainly make a recommendation to the A Committee that Consumer Testing be explored. And, I guess, there's some disagreement around whether or not that's needed at all. |

INDUSTRY

| 2016/5/17 LIIIWG 2016-2 |

John Feeney (Prudential Life Insurance) said that the American Council of Life Insurers (ACLI) task force formed to discuss the Life Insurance Illustration Issues (A) Working Group is chaired by Prudential Life Insurance and Northwestern Mutual Life Insurance. He said the companies participating on the ACLI task force are not supportive of consumer testing at this time |

| 2020/7/24 LIIIWG ACLI - Pat Reeder |

3 Broad Recommendations: 1) Consumer Testing -Fundamental Question: Will this form enhance the customer experience? |

CONSUMER REPS

|

2020/7/24 |

In terms of Consumer Testing, we always asked for Consumer Testing, but it requires funding and the Working Group is not a position to either ask for or direct the expenditure of such funding. |

Actuarial

MR. KELLER: I'll respond briefly to the suggestion that we use focus groups to get the consumer point of view. We did consider that early on in our work and rejected it for a couple of reasons.

- One was the time constraints we were under and the cost of doing focus groups.

- But probably the most important reason is that if you get 15 people in a room who are recent purchasers of life insurance and then spend an hour or two dissecting the sales process and the use of their illustrations in that sales process, you're likely to have 13 people coming out slightly or greatly disillusioned over what they just did.

We found that our field force and our marketing department didn't like that idea at all.

So if somebody could think of a way to get to the consumer without causing real problems among recent buyers, who are our most fragile customers, we would like to hear it.

1991 - ILLUSTRATIONS, Society of Actuaries

DISCLOSURE

NAIC

The premiums you pay (less expense charges) go into a policy account that earns interest, and charges for the insurance are deducted from the account. Here, insurance continues as long as there is enough money in the account to pay the insurance charges.

1983-1, NAIC Proc

ACTUARIAL

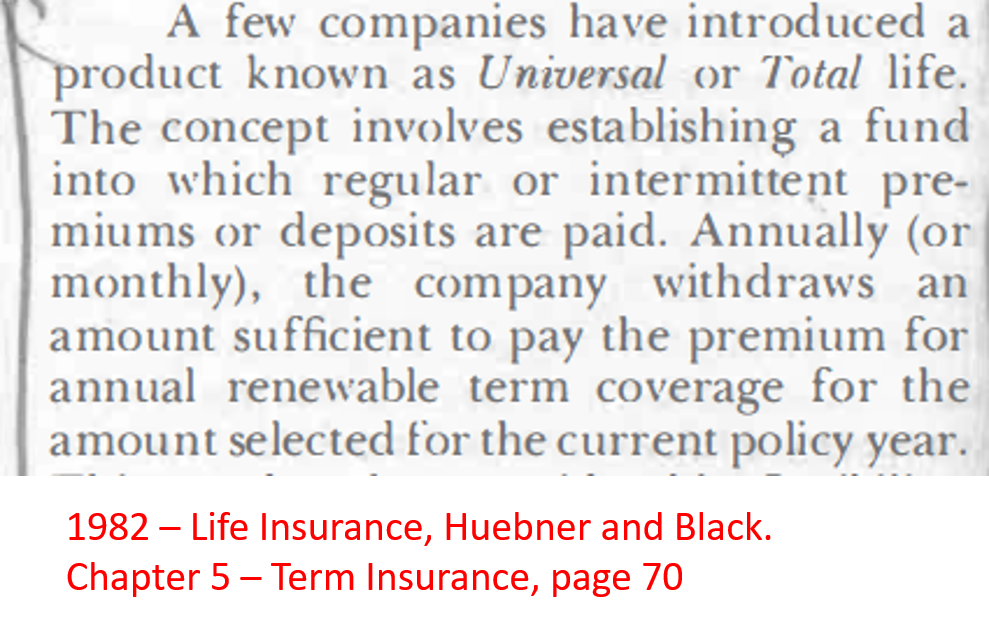

With this product <Universal Life>, the mechanic is "unbundled" and open.

But events that are now observable may be misinterpreted. --Douglas Doll <Actuary>

1988-2, NAIC Proceedings

INDUSTRY

- Its <Universal Life> fundamental "mechanics" are indistinguishable from those underlying traditional life insurance products.--Samuel H. Turner, President - The Life Insurance Company of Virginia

1982 - Journal of Insurance Medicine - 1p

.... the policy summary should include a statement on the point at which the policy will expire based on the policy guarantees and the anticipated premiums shown in summary.

...Universal Life should be treated as a life insurance plan with a nonguaranteed cost element for cost disclosure purposes.

1982-1, (ACLI) presented a paper on cost disclosure for universal life products.

"He said many consumers cannot distinguish between universal life and whole life. He said a narrative explanation was needed because many did not understand the numbers or the fact that a universal life policy might drain the cash value until there was no coverage left." Mr. Barkacs <BN: (Western Southern)>

1994-3 NAIC Proceedings

BACKGROUND

- How did the industry, in the 1980s and 1990s, get into a situation where it was selling illustrations instead of value?

-- Roger R. Heath

1991 - SOA - Disclosure Systems: Can an Ideal Method be Found?, Society of Actuaries - 22p

GOVERNMENT

Many insurance companies even have a way to get a consumer's money without the consumer ever knowing about it.

Then, without even telling the policyholder, the company can raid the savings to pay itself more premium. --Senator Metzenbaum (page 3)

1992 - GOV - Consumer Disclosure of Insurance - Page 3

LAW REVIEWS

- 2017 - LR - Coverage Information in Insurance Law, 101 Minnesota Law Review 1457, Daniel Schwarcz - 72p

- Despite this fact, policy information can serve a number of important consumer protection goals by providing coverage information to non-contracting parties, including regulators, lawyers, and market intermediaries.

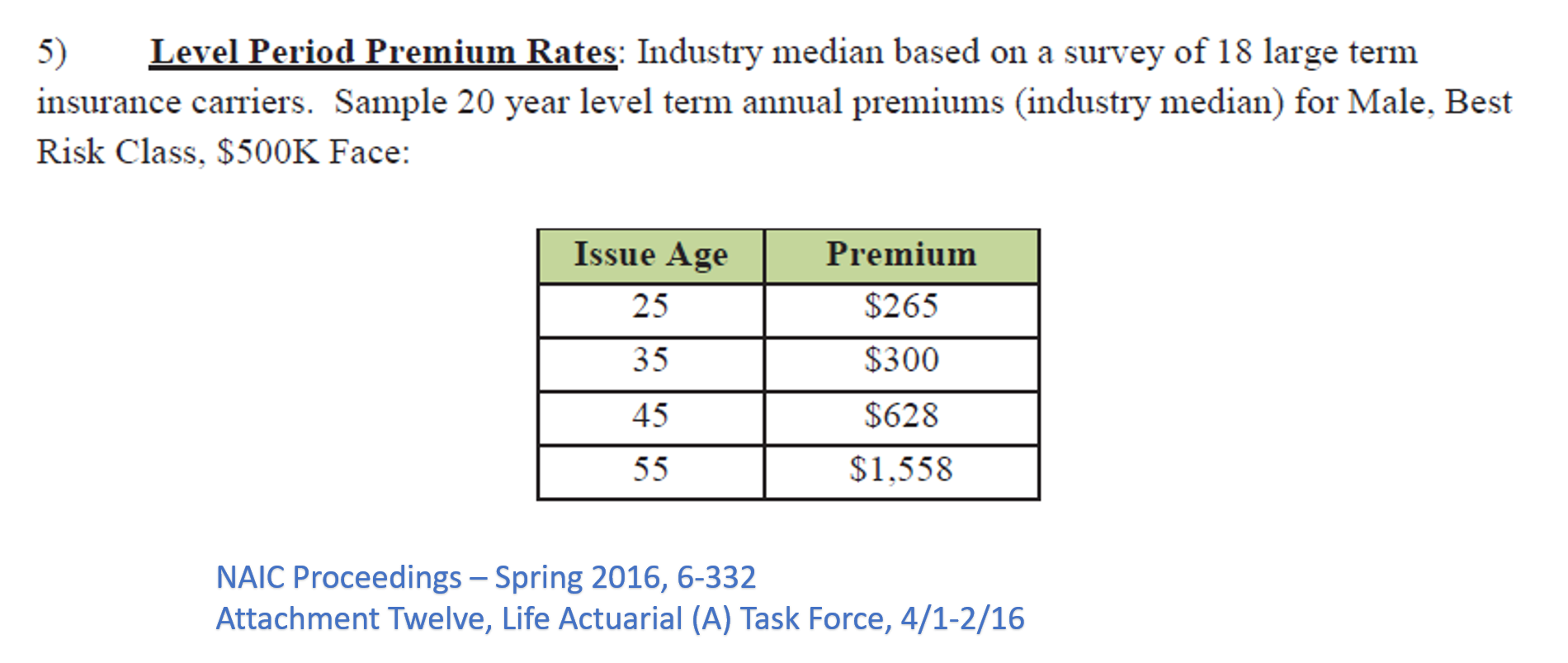

PREMIUMS

TYPES OF PREMIUMS

NAIC

It was suggested that disclosure requirements be placed in the illustrations section of the models as well as in the contract itself. -- (2) adequate disclosure of the fact that a premium quoted will not support the contract for the whole life if the policy is a universal life policy;

1988-2 , 566. <Universal Life Model Regulation - Citations (ULMR) (MDL-585)>

ACADEMIC

Video: Exam MLC Problem 297 "Learning Objective "Universal Life." Question: Calculate the Level Annual Premium that results in an account value of 0 at the end of the 20th year." - UW- Madison / SOA - <Bonk: Goal: use a Universal Life policy to design a 20-year term policy.>

ACTUARIAL

...how does an agent program somebody? How does he tell a person what he needs to pay to keep his premiums level or to have paid-up insurance at age 65? -- ALLAN W. SIBIGTROTH

1979 - FUTURE TRENDS AND CURRENT DEVELOPMENTS IN INDIVIDUAL LIFE PRODUCTS, 24p, Society of Actuaries

"The complications begin with a very simple question: What's the premium for Universal Life? It could be almost anything. Then what's the cash value? That depends on the premium. It is the relationship between the premium and cash value that determines the product characteristics of Universal Life." --BEN H. MITCHELL

1981, UNIVERSAL LIFE, Society of Actuaries

You’re caught into this box where you’ve got a product that, when you go back to that format, it’s an iteration of the product that can’t exist.

- The intent is, if you’re selling this thing as a level premium permanent product, there should be a way of dealing with that.

- I really think it’s just again hitting another flaw and another hole in how the UL model regulation applies to the real world today.

--Craig R. Raymond

1999 - SOA - 1999 Valuation Actuary Symposium, (va99-44of), Edward L. Robbins, Society of Actuaries - 28p

LEGAL CASE

2010 - Maloof v John Hancock - Alabama Supreme Court Opinion - 39p

- After receiving these notices, John <Policyholder> contacted Glasgow <Agent>, who had retired in 2000, to inquire why his policies would be terminating, even though he had timely paid the premiums on the policies for approximately 18 years. (page 5)

UNIVERSAL LIFE IS...

NAIC

"Completely Flexible" - "The completely flexible life insurance plans are sometimes called "universal life insurance plans."

1981, NAIC Proceedings

"Mr. Montgomery <Regulator> commented on the flexible premium universal life policy and the fact that it is not really a whole life policy, but a term policy until the premium is actually paid."

1988-2, NAIC

H. “Universal life insurance policy” means a life insurance policy where separately identified interest credits (other than in connection with dividend accumulations, premium deposit funds, or other supplementary

accounts) and mortality and expense charges are made to the policy.

A universal life insurance policy may provide for other credits and charges, such as charges for the cost of benefits provided by rider.

Drafting Note: ... . Although highly flexible, universal life insurance is generally considered a permanent life insurance plan.

Most companies encourage a premium level which will provide lifetime insurance protection.

Every universal life insurance policy of which the drafters are aware has a “net level premium” that could be computed which would guarantee permanent protection.

As a result, it is expected that most universal life insurance policies will be sold as permanent plans.

- PowerPoint pic

- Whole, Permanent, Cash Value, Dynamic

INDUSTRY

"They <Universal Life Policies> merely afford purchasers greater flexibility in designing their contracts so as to meet their individual needs."

1982-1 - NAIC Proc. - ACLI Paper

Universal life insurance: ... ..Also known as adjustable life insurance.

Adjustable life insurance: A type of life insurance that allows the policyholder to change the plan of insurance, raise or lower the policy’s face amount, increase or decrease the premium, and lengthen or shorten the protection period.

2017 - GLOSSARY OF INSURANCE-RELATED TERMS, ACLI FACT BOOK

ACTUARIAL

The Universal Life style of Adjustable Life product carries its own set of unknowns and potential problems, as would any new and innovative product. --DAVID R. CARPENTER

"The contract <Universal Life> is a lot like the Adjustable Life concepts of The Bankers and Minnesota Mutual, with the significant, additional flexibility that a plan change is not required each time there is a change in premium payments." -- SPENCER KOPPEL

1979 - FUTURE TRENDS AND CURRENT DEVELOPMENTS IN INDIVIDUAL LIFE PRODUCTS, 24p, Society of Actuaries

Universal Life is a ratebook and more, all by itself.

If you say you have Universal Life, you in fact have more of a product than you probably have in your current portfolio at the present time. MR. EASON

1983, INDIVIDUAL LIFE INSURANCE, Society of Actuaries

"Dynamic Products" are products with premiums and benefits that can fluctuate from month to month, depending on the premiums the policyholder pays, the withdrawals the policyholder makes, the investment returns credited to the policy, and the mortality and expense charges deducted from the policy."

"Some common names for dynamic products include universal life, variable universal life, unit-linked life, and adjustable life."

2000, Life Insurance Products and Finance, page 288, D.B. Atkinson and J.W. Dallas

CONSUMER REPS

|

Brenda Cude No Date |

Comment [BJC2]: Permanent insurance is a term used only by the industry – not by consumer educators. We would prefer – Life insurance comes in two basic types: Term and whole life (also referred to as permanent insurance). |

ACADEMIC

GOVERNMENT

"A universal life policy with a large insurance component can become a close substitute for renewable term insurance..."

1984 - GOV - THE TAXATION OF INCOME FLOWING THROUGH LIFE INSURANCE COMPANIES, U.S. Treasury Department,

The revenue service raised the question,"was the universal life design a side fund with term insurance, or was it like the traditional life insurance contract where the cash value is an integral part of the overall life insurance contract?"

They decided it was an integrated contract, and that it would qualify under Section 101.

-- WILLIAM B. HARMAN, JR

1981 - Universal Life, Society of Actuaries

LEGAL CASE

Mr. Affleck states that using the term "permanent" is "deceptive" with regard to universal life insurance.'

Universal life is considered "permanent insurance" in the industry.

For example, a governmental website for seniors, maintained by the Social Security Administration, has the following definition "Permanent Insurance -- including whole, ordinary, universal, adjustable and variable life -- is protection that can be kept in force for as long as you live"8

Original REBUTTAL OF MR. AFFLECK'S REPORT BY DONNA R. CLAIRE, 2003 Misc

PERFORMANCE / VOLATILITY / DURATION

NAIC

In my experience very smart people don't really know what all the components mean. I mean I feel like it does lead to confusion. So, I think ... if you can refer to the eventual illustration and just show the cash value.

2019/9/17, NAIC LIIIWG - Teresa Winer

in particular, the impact consumer payment patterns have on the performance of the product.

Mr. Wicka said the paper advocates for: 1) additional information to be provided to consumers regarding how the timing of their payments impacts the product; and 2) follow-up information to be provided to consumers at the time their payments go off-track so that consumers are aware of the impact to their policies.

2016 5 17 - LIIIWG, Assurity White Paper

It was suggested that disclosure requirements be placed in the illustrations section of the models as well as in the contract itself. -- (2) adequate disclosure of the fact that a premium quoted will not support the contract for the whole life if the policy is a universal life policy;

1988-2 , 566. <Universal Life Model Regulation - Citations (ULMR) (MDL-585)>

"Also, because most people presume that if you pay your premium continuously, your policy will remain in effect, quite a few people had a hard time understanding how or why the policy would terminate in policy year 31. This was simply foreign to their way of thinking."

1990-1A NAIC Proceedings - NAIC LIMRA - Universal Life Disclosure Form Test Market Results - 10p

"Tony Higgins (N.C.) asked the working group to consider projections into the future for only a few years of the non-guaranteed elements, and then projections further into the future of standardized assumptions or guarantees."

1993-3 NAIC Proc.

"IMPORTANT POLICY OWNER NOTICE: During the past year, previously illustrated values for your policy in the area of [describe which values have diminished] have diminished and may have an impact on your expectations."

1995-1 NAIC Proc.

ACTUARIAL

"II. REGULATORY REQUIREMENTS FOR LIFE INSURANCE ILLUSTRATIONS

The policy performance and features illustrated to the buyer have been an issue with regulators for at least a century." (page 143)

C. Universal Life

From the beginning, a necessity for successful marketing of universal life has been the ability of the seller to illustrate the performance of a policy tailored (within policy limits) to the needs and resources of the prospective purchaser.

The agent and prospect have the ability to choose almost any pattern of benefits and premiums. No longer is the sale limited to one of several fixed plans of insurance from a ratebook. Each one is different. (p151)

1991-1992 - FINAL REPORT* OF THE TASK FORCE FOR RESEARCH ON LIFE INSURANCE SALES ILLUSTRATIONS - 142p, Society of Actuaries

I’ll talk about the complications.

The typical policy <Universal Life> that runs into this issue is a policy with a 3% interest guarantee where the guideline level premium requires a 4% interest guarantee.

Therefore, under the policy guarantees, and by paying the guideline level premium year by year, the policy will expire at age 68 without value.

It’ll be term to 68. Your guideline level premium is less than the premium that would be theoretically required to mature the policy at age 100 or 95. Therein lies the problem.

Let me give an example. I’m going to contradict what I just said in this example. The policy doesn’t really expire at age 68 because there’s a provision in 7702 that enables you to pay YRT premiums if the policy would otherwise lapse." --Edward L. Robbins

1999 - 1999 Valuation Actuary Symposium - Session 44, Society of Actuaries - 28p

Prior to the introduction of universal life and accumulation annuities, death benefits and cash values from the issue date to the maturity date could be determined at the time the policy was issued. (page 121)

Statutory Valuation of Individual Life and Annuity Contracts | 5th Edition -- Claire, Lombardi and Summers,

ACADEMICS

.... UL has always been a simple question of Duration.

201x - AP - Universal Life Insurance Duration Measures - 14p

LEGAL CASES

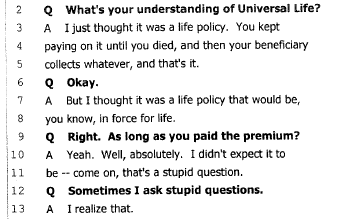

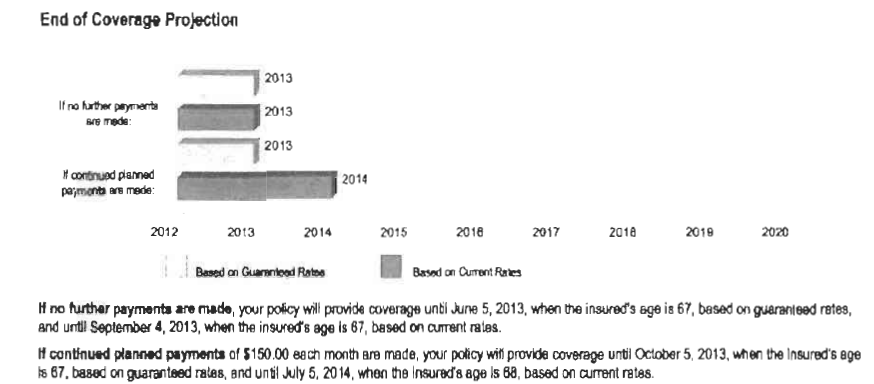

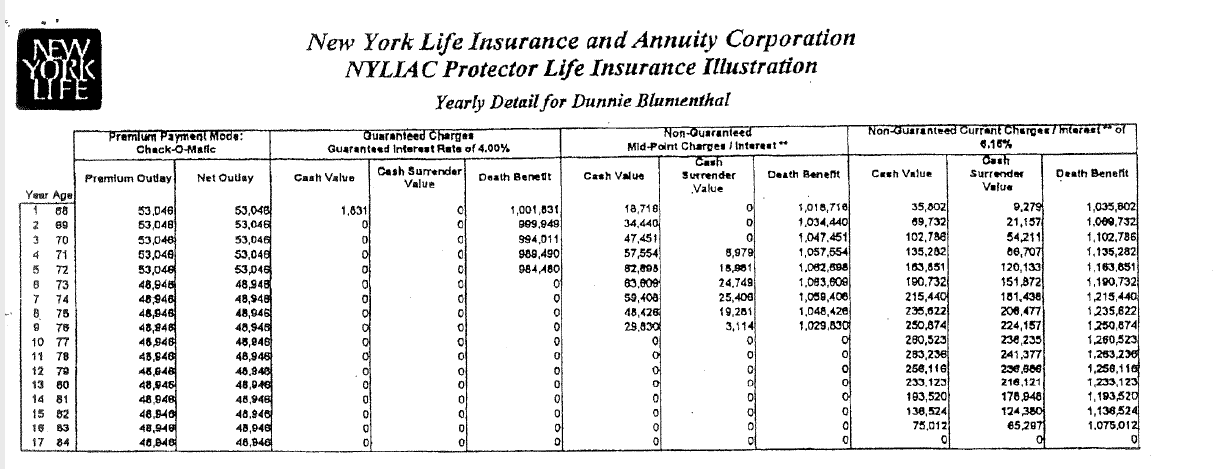

"Mrs. Vogt’s testimony reveals that the Vogts’ actual grievance with the policy performance arose from their agent’s alleged oral representation in 1999 that if they paid a $150 premium each month, their $100,000 policy would remain in force and would never lapse. (Ex. A at 17:17-20:12.)"

Vogt v State Farm - DEFENDANT STATE FARM LIFE INSURANCE COMPANY’S SUPPLEMENTAL EVIDENCE IN OPPOSITION TO PLAINTIFF’S MOTION FOR CLASS CERTIFICATION

COSTS

"Ironically, all the columns, figures, pages, disclaimers, and disclosures do not tell consumers what they really want to know -- What does the insurance cost? Below are my suggestions for what an illustration should tell a consumer."

--Robert Hunter, Commissioner of Insurance, Texas Department of Insurance

1994-2 NAIC

ACTUARIAL

While many of the original intentions of issuers of universal life was to make clear the exact costs of life insurance by showing and charging exactly the interest, mortality and expenses incurred, most insurers do not observe this at the present time. (p15)

2007 - Book - Actuarial Aspects of Individual Life Insurance And Annuity Contracts, Easton and Harris

BENEFITS

NAIC

|

How much do the benefits build up in the policy? How will the timing of money paid and received affect interest? |

|

2018 - LIBGWG - Cude Letter / Markup Life Insurance Buyer's Guide - Revised 2-9-18 for discussion on conference call 2-22-18

INDUSTRY

...performance may also have a bearing on the duration of the death benefit. (ACLI)

1983 - Federal Register / Vol. 48, No. 231 / Wednesday, November 30

“….provide illustrations based on different assumptions. This would serve to demonstrate to the consumer the effect on future benefits of changes in assumptions.”

STATEMENT ON BEHALF OF THE AMERICAN COUNCIL OF LIFE INSURANCE TO THE NAIC MARKET CONDUCT SURVEILLANCE (EX3) TASK FORCE, June 13, 1988

1988-2, NAIC Proceedings

ACADEMICS

"In fact, a UL <Universal Life> policy will turn out to provide term life insurance, whole life insurance, or endowment insurance, depending on the premiums paid and other policy factors."

2015, Life Insurance, Black Jr., Skipper, Black III, (Huebner Series)

ACTUARIAL

- Maybe he is not getting all the disclosure he needs, as far as the continuing benefit is concerned, when the interest rates change from that illustrated.

-- Gary P. Monnin, Senior Vice President, Chief Actuary of American Founders Life Insurance Company

1982 - SOA - Universal Life (rsa82v8n111), Society of Actuaries - 14p

Messrs. Chalke and Davlin have written an interesting paper on products of the "universal life" type.

the BGA <Benefit Generating Account> is the "cash value."

The benefits generated by the cash-value account <BGA> include loans, surrenders, extended term and reduced paid-up benefits, and annuity benefits.

1983 - UNIVERSAL LIFE VALUATION AND NONFORFEITURE: A GENERALIZED MODEL, by SHANE A. CHALKE AND MICHAEL F. DAVLIN,

AGENTS

NAIC

An insurance agent, financial advisor, or insurance company representative can help you evaluate your insurance needs and give you information about available policies.

"Mr. Montgomery asked how companies would control brokers who were selling insurance."

"Problems that occur now are sometimes because the company did not see what the agent had prepared."

1994-3, NAIC Proceedings

"Mr. DeAngelo said he did not recall seeing incorrect or misleading training materials, so this is somewhat a theoretical question."

"Mr. Hanson responded that he had seen misleading materials in market conduct examinations."

"What the regulators really want to say is that the agent training materials should not be misleading or incomplete."

1999-4 NAIC Proc. - Agent Training

>>>>>>John: I think that there are 2 wildcards that need to be considered….one put an illustration together for a particular message to be conveyed …that's not necessarily the message that the prospect is going to get. Nor is it necessarily what the prospect is going to be looking for.

And the other Wild Card is…we're working with the perceptions of someone and what we intend may not be what is exactly going on in their mind. The other thing is, I guess, involved the Agent. And the value of the Illustration … is shaped a lot of times by how it's presented by the Agent. And if you provide an Illustration that doesn't provide what the Agent thinks the prospect is looking for … then maybe that Illustration doesn't get put in front of the prospect. ….those are two Big Wild Cards that affect everything we're trying to do here.

2020/3/12 - IULWG <Bonk>

ACTUARIAL

The normal agent's contract authorizes him to do three things: submit

applications, deliver policies, and collect the initial premium thereon.

In no way is he authorized to do such things as secure policy loans for the insured, let alone to answer questions about policy provisions and dividends, which he probably is not qualified to do. --Albert Easton

1974 - CONSUMERISM AND THE COMPENSATION OF THE LIFE INSURANCE AGENT, by Anna Rappaport, Society of Actuaries

"The educational task is huge, and it's not just with the customers; it's with our agents also. I would say to all of you that if you think that you don't have any customers or any agents who fail to understand what a nonguaranteed illustration really means, you're kidding yourself." MR. MILLER <Prudential>

1991 - Illustrations, Society of Actuaries

"MS. SUSAN OBERMAN SMITH: I think that one problem, even with the illustration disclosure, is that you are still not controlling what the agent actually says to the client, even when he or she sees that illustration."

1995 - PRACTICAL ILLUSTRATIONS AND NONFORFEITURE VALUES, Society of Actuaries - 14p

INDUSTRY

- We designed commission rules that anticipated a relatively large number of rollovers of existing policies;.

- ..full commissions are paid provided the new Universal Life face amount is at least two times the face amount of the replaced policy.

-- Phillip B. Norton, not a member of the Society, is Vice President of The Lincoln National Life Insurance Company

1986 - SOA - Individual Life Insurance Retention and Replacement Strategies, Society of Actuaries - 24p

2011 Survey of Ethics in the Life Insurance Industry

#1 Ethical Issue - Lack of knowledge or skills to competently perform one's duties

rated by the CLUs and ChFCs responding to the survey among the 10 key issues perceived as presenting the greatest challenges to those in the industry seeking to resolve ethical dilemmas in an appropriate manner.

2011 - The Ethical Environment of the Life Insurance Industry: The Impact of the Recession and Slow Recovery. by Robert W. Cooper, PhD and Garry L. Frank, PhD - JOURNAL OF FINANCIAL SERVICE PROFESSIONALS

OLD

No difference how well-intentioned and honest an insurance man's advice may be it may prove very expensive and harmful if not based on accurate knowledge.

1914 - Conference on Life Insurance and Its Educational Relations

GOVERNMENT

The training we received was sales training only.

The home office people who came to the Sioux City, lA, office said: Don't try to become a Ph.D. in variable life insurance; just learn enough to sell it and go. This is what they told the whole office, and this was how I trained any new men that I hired: Just sell it; do not worry about it. -- Jerry Keating, (John Hancock)

1993 - GOV - When Will Policyholders be Given the Truth About Life Insurance?

LEGAL CASE

2010 - Maloof v John Hancock - Alabama Supreme Court Opinion - 39p

-

However, the Maloofs could not have reasonably relied on the alleged misrepresentations concerning the availability of benefits from those policies to pay estate

taxes due upon John's death in light of the clear language of the insurance policies. (page 20)

Market Conditions

Greg Gurlick (Northwestern Mutual Life) said that if consumers are not satisfied with results of their IUL policies, it will not only impact the reputations of the companies selling the products but also the entire industry will be painted with a broad brush.

2014/11/14-15, IULWG - 6-63

OTHER

"As the cases of Metropolitan Life and Prudential suggest, no amount of oversight or self-policing will protect consumers from unethical or illegal company and agent practices. The structure of the market needs to change." Consumers Union,

1994-1 NAIC Proc.

ACTUARIAL

A third problem is of great concern to me...

A few years ago, an awful lot of universal life policies were sold using, in effect, level premium illustrations - your policy will go for all of life or whatever - with companies using 10% or 11% interest rates, which is what the interest rate environment was then.

The concern that I have, which may soon give much of the industry a very black eye....created an illusion that will crash down on many people that they had whole life coverage, and now they find themselves with what is truly annual renewable term to insolvency. -- BRUCE E. NICKERSON

1991 - Illustrations, Society of Actuaries

INDUSTRY

Moss Committee Report of 1978

The findings and conclusions, and this is the part that created the explosion, were that there is a shortfall of information, particularly with respect to ordinary life and that consumer experience does suggest that the consumer is not able to adequately determine the suitability of the product, the quality of the product, or the cost of the product.

As a consequence, consumers are sustaining losses, and this would be a definite indication of a market failure.

-- JACK E. BOBO, Executive Vice President of

the National Association of Life Underwriters (NALU)-- NAIFA

1979 - Cost Disclosure. 18p, Society of Actuaries

"So our challenge is to learn and to respond. I sincerely believe it's a shared responsibility by all of us - agents, the actuarial profession, company leadership, regulators and even the consumer. Our biggest mistake would be to delay.

I don't believe the consumer will tolerate or forgive us, let alone the regulators, if we do nothing." Robert M. Nelson (Chairman- National Association of Life Underwriters (NALU) Task Force on Illustrations)

1993 - SALES ILLUSTRATIONS - WE CAN'T LIVE WITH THEM, BUT WE CAN'T LIVE WITHOUT THEM!, Society of Actuaries

PERSPECTIVES

When I attended the first meeting, I very much wanted to repent and take a different course.

In that first meeting, I was hearing some things that I knew were very much fraught with problems, it was important to observe that these nonactuary regulators, experienced, competent people, were seeing a different set of problems than we, as actuaries, were used to focusing on.

-------Robert E. Wilcox - Chairman of the Life Disclosure Working Group (NAIC)

1994, PROBLEMS AND SOLUTIONS FOR PRODUCT ILLUSTRATIONS, Society of Actuaries

WILLIAM A. WHITE: After twenty years with life insurance companies, one

year with a trade association, and thirteen with the New Jersey Insurance

Department, it is my perception that most actuaries do not know how

insurance regulation works and how it is changing. This lack of knowledge

generally doesn't deter actuaries from criticizing and suggesting radical

modifications to, or even the complete elimination of, regulation.

1983 - DEREGULATION OF LIFE INSURANCE, Society of Actuaries - 22p

GENERAL

ACTUARIAL

"The "unbundling" of services and other product differences between Universal Life and Ordinary Life cause current literature to be inapplicable, as well as insufficient, for Universal Life."

1984, STATEMENT 1984-32, Academy Journal, American Academy of Actuaries (page 217)

Ralph Didn't Say It

MS. DAPHNE D. BARTLETT: I'm a member of the NAIC working group that developed this regulation and I am terribly disappointed.

1995 - SALES ILLUSTRATIONS, Society of Actuaries - 14p

"Commissioner Wilcox said that he admitted that the working group <Life Disclosure Working Group> had gotten a little sloppy on its terminology, but it had been clear all along that the working group was focusing on sales."

1996-4V2, NAIC Proc. re: Illustrations Model Regulation

"Fred Nepple (Wis.) asked if a charge was not rational, did that mean it could not be charged or it could not be illustrated? The working group agreed that the result was that it could not be illustrated."

1995-1, NAIC Proceedings -