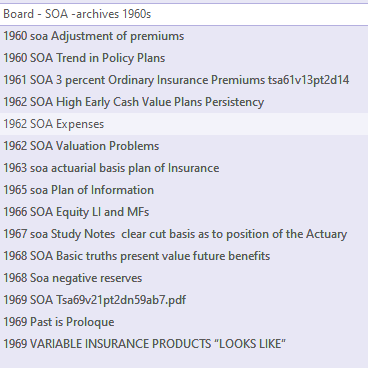

1960s - SOA - Society of Actuaries

- 1960 - SOA - Premiums and Dividends for Individual Ordinary Insurance, Society of Actuaries - 30p

- 1960 - SOA - The Life Insurance Company Income Tax Act of 1959, Society of Actuaries - 24p

- 1961 - SOA - Marketing Trends, Society of Actuaries - 10p

- A. What steps can life insurance companies take to regain a greater share of the available savings dollars?

B. Is a trend likely to develop toward a separation of the insurance and investment elements of life insurance contracts?

C. Would the ability of insurance companies to attract savings dollars be improved by providing a "variable" return with respect to (a) the investment element of life insurance contracts or (b) settlement provisions?

- A. What steps can life insurance companies take to regain a greater share of the available savings dollars?

- 1961 - SOA - Ordinary Insurance Premiums, Society of Actuaries - 3p

- 1962 - SOA - Discussion of Subjects of Special Interest: Agency Compensation, Society of Actuaries - 11p

- 1961 03 - HBR - The Mystique of Super-Salesmanship, by Robert N. McMurry, Harvard Business Review - [link]

- 1962 - SOA - Digest of Discussion of Subjects of Special Interest Individual Life Insurance: Individual Life Insurance, Society of Actuaries - 4p

- Joseph Belth, Net Cost, Dividends, Illustrations, pre-ELAD

- 1962 - SOA - Life Insurance and Savings in the Economy, Society of Actuaries - 15p

-

1964 - SOA - A General Treatment of Insurance for Face Amount Plus Reserve or Cash Value, by Franklin C. Smith, Society of Actuaries - 15p

- 1967 - SOA - Apportionable Basis for Net Premiums and Reserves, tsa67v19pt1n5411, by J Alan Lauer - 21p

- 1967 - SOA - Digest of Discussion of Subjects of Special Interest - 25p

- 1967 - SOA - Digest of Discussion of Subjects of Special Interest - Individual Life and Health Insurance, Society of Actuaries - 62p

- 1967 - SOA - Individual Life and Health Insurance, Society of Actuaries - 62p

- 1967 - SOA - New Company Problems, Society of Actuaries - 38p

- 1968 - SOA - New York Actuaries Club Discusses "Belth" Theory - The Actuary, Society of Actuaries - 2p

- 1968 - SOA - Premiums and Dividends for Individual Ordinary Insurance, Society of Actuaries - 30p

- [Bonk - Grading, Interest Rate, PVFB=PVFP, Mortality - Term higher than Perm]

- Samuel P. Adams: All these methods are based one way or another on the ancient truth that the present value of benefits, expenses, and margins must equal the present value of premiums.

- When one considers the interest assumption, it must be remembered that rates are presently very high but may be showing signs of leveling off.

- It seems inconceivable in view of the past that interest rates will stay at their present levels for a long period of time.

- If the interest assumption in the early policy years is taken as the rate on new investments, the actuary should allow for the possibility of a reduction after the first few policy years and provide for a more conservative rate at the later policy durations.

- When one considers the interest assumption, it must be remembered that rates are presently very high but may be showing signs of leveling off.

- CHAIRMAN Robert W. WALKER: We also recognize the difference between term and permanent mortality with a higher mortality charge on term contracts.

- RUSSELL E. MUNRO: We also develop our rate structure so as to reimburse our agency force on a basis which does not place the agent in an awkward position in his recommendations for his client cost per $1,000 at risk.

1968 - SOA - Premiums and Dividends for Individual Ordinary Insurance, Society of Actuaries - 30p