1973-1974 - GOV (Senate) - The Life Insurance Industry - Phillip Hart (D-MI)

- 1973 / 1974 - GOV (Senate) - The Life Insurance Industry - Phillip Hart (D-MI) - 4 Parts --- [BonkNote]

- 1973 0220 - Part 1 of 4 --- [BonkNote-Part 1 of 4] --- [PDF-815p-GooglePlay]

- 1973 0221 and 0222 - Part 2 of 4 --- [BonkNote-Part 2 of 4] --- [PDF-733p-GooglePlay]

- 1973 0223 - Part 3 of 4 --- [BonkNote-Part 3 of 4] --- [PDF- 641p-GooglePlay]

- 1974 0716 - Part 4 of 4 --- [BonkNote-Part 4 of 4] --- [PDF-807p-GooglePlay]

- Senate - Committee on the Judiciary - Subcommittee on AntiTrust and Monopoly

- TILI - Truth In Life Insurance

- 3 E. J. Moorhead, "The Hart Hearings in Perspective," Best's Review, January, 1974, p. 16:

- "First is the massive ignorance of policyholders about their life insurance.

- It is hard to believe that people know as little about their life insurance property as the surveys show."

- 4 Ibid.. p. 70. Mr. Moorhead points to five probable thrusts of the Hart hearings:

- (1) price and quality of our products,

- (2) freedom of the agent,

- (3) sales practices,

- (4) sales interference, and

- (5) efficiency of state regulation.

1974 - SOA - Consumerism and the Compensation of the Life Insurance Agent, Anna Maria Rappaport - 68p

Part 1

- Armstrong Report - Armstrong Investigation

- TNEC - Temporary National Economic Committee

- 1938-1941 – GOV (Senate) – TNEC – Temporary National Economic Committee, Joseph C. O’Mahoney (D-WY) --- [BonkNote]

- 1941 - GOV (Senate) - TNEC - Final Report and Recommendations of the Temporary National Economic Committee, Investigation of Concentration of Economic Power - 464p

- (p113-175) - Understanding your Life Insurance, Institute of Life Insurance

-

The Widows Study - LUTC and LIAMA

-

(p313-391) - The Onset Of Widowhood, vol. 1

-

(p392-508) - Adjustment to Widowhood, vol. 2

-

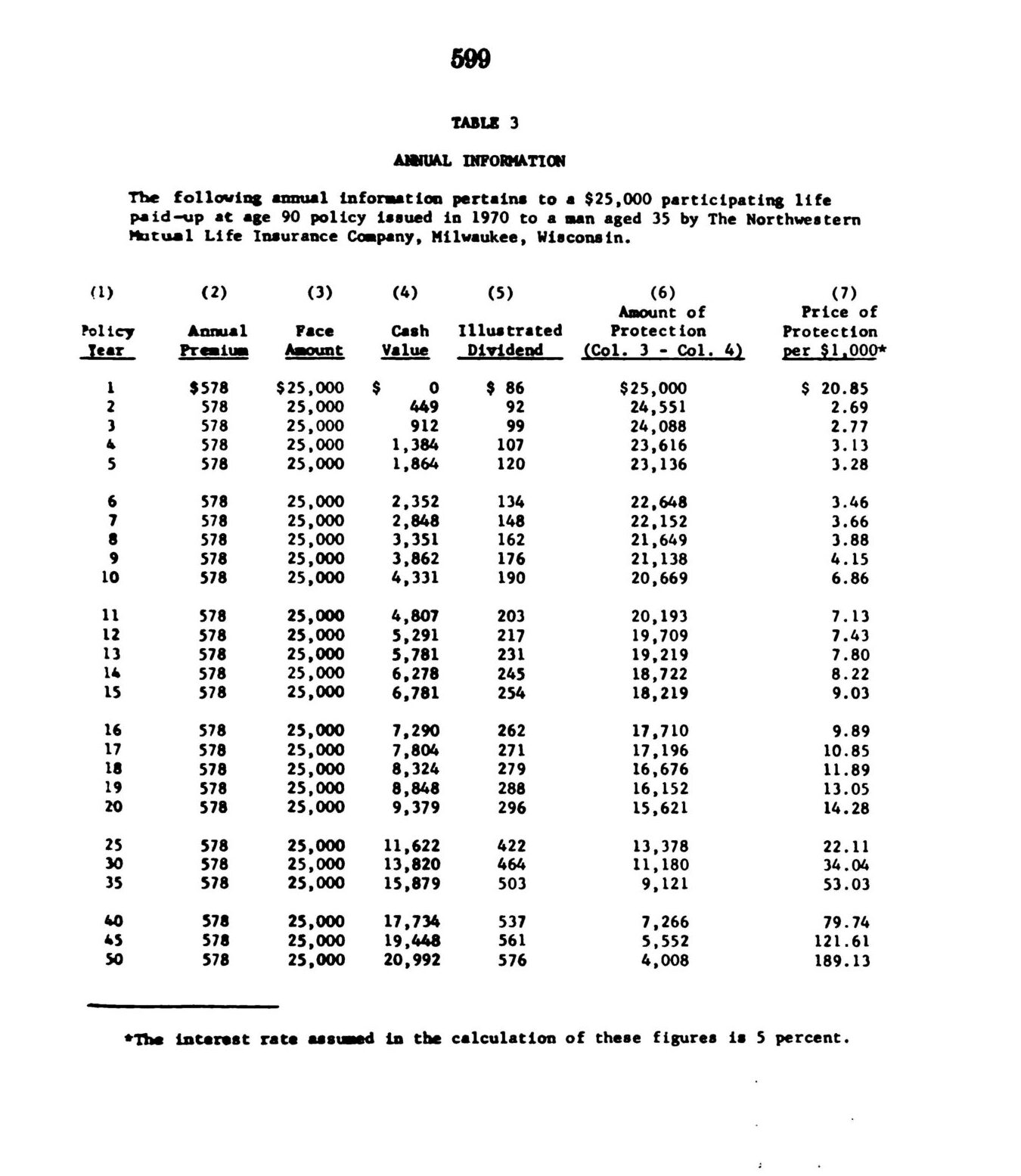

- (p566-610) - Statement of Joseph Belth

- p599 - Table 3 - Annual Information

- (p720-748) - Joint Special Committee on Life Insurance Costs --- [BonkNote] --- 29p

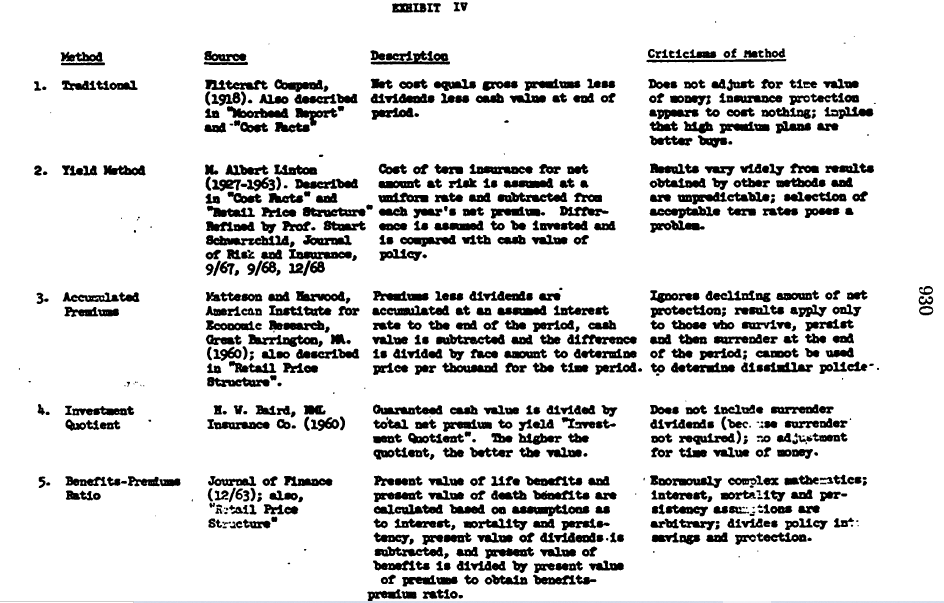

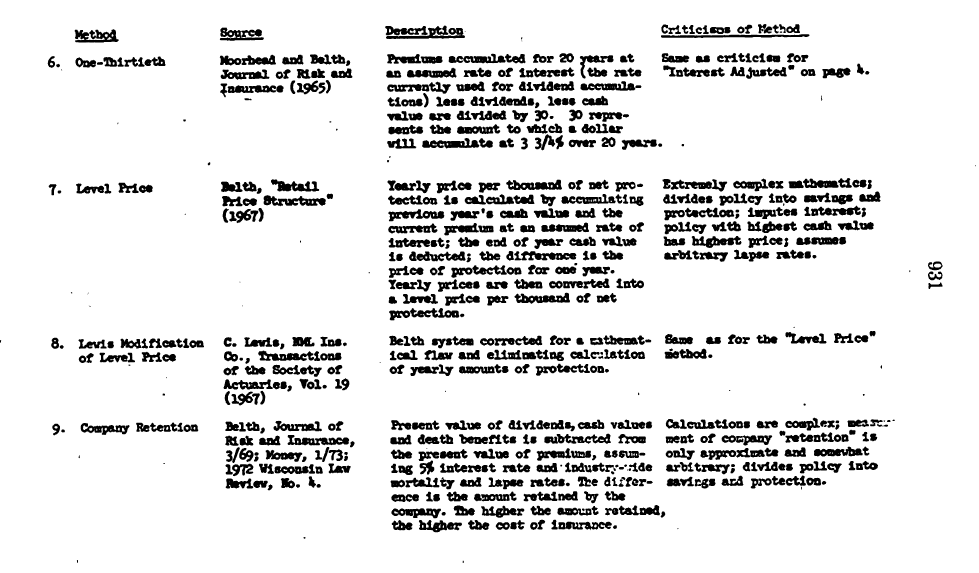

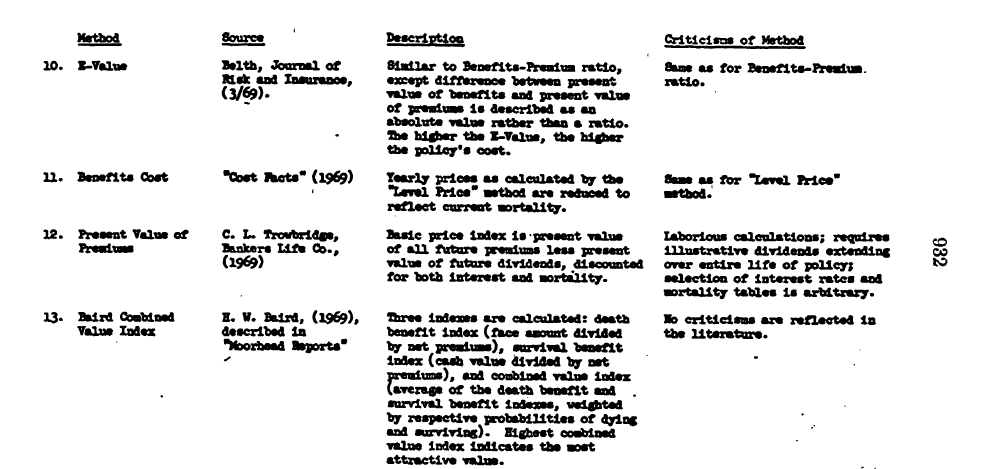

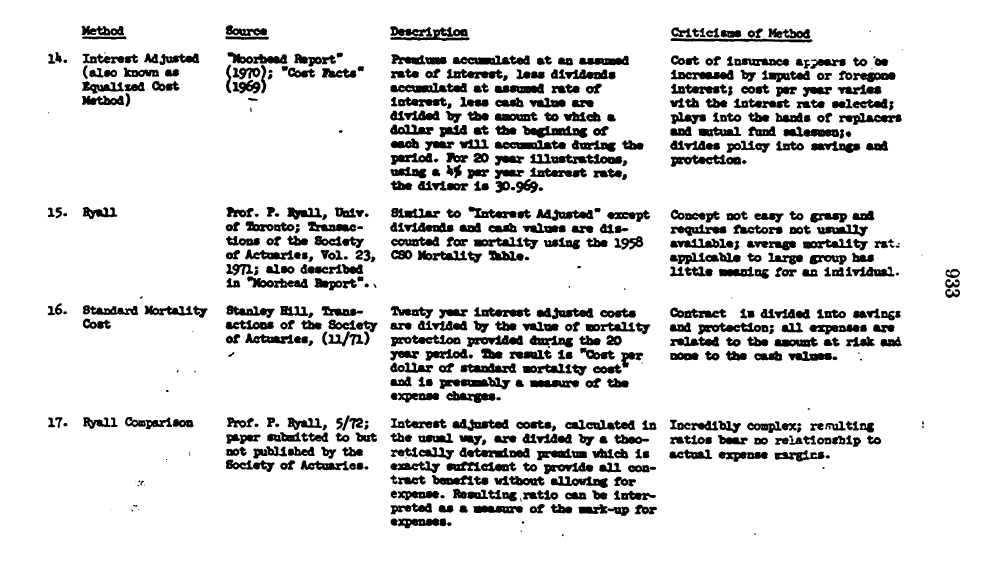

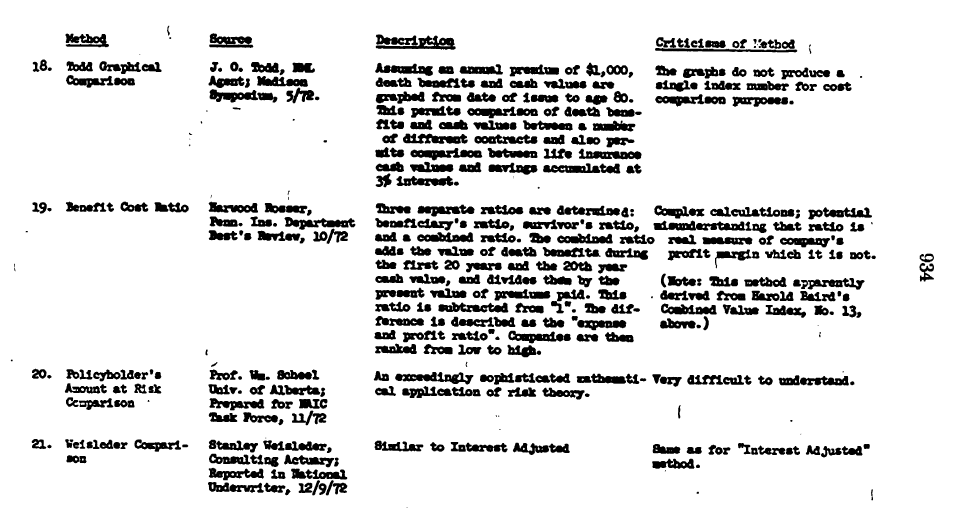

- Cost Comparison Methods Table

- (p749-759) - Speech of E.J. Moorehead, 1970/11/09

- (p1) - Senator Philip Hart – (D-MI) - .....American consumers pay a bill without having more than a somewhat vague idea of what they are buying.

- If this were the result of flimflam, enforcement agencies would have been all over the sellers years ago.

- But this is not intentional flimflam it is as the man in "Fiddler on the Roof” explained away so many things— "tradition."

- These 140 million consumers, at an outlay of about $23 billion a year, are buying life insurance policies.

- If this were the result of flimflam, enforcement agencies would have been all over the sellers years ago.

Part 2

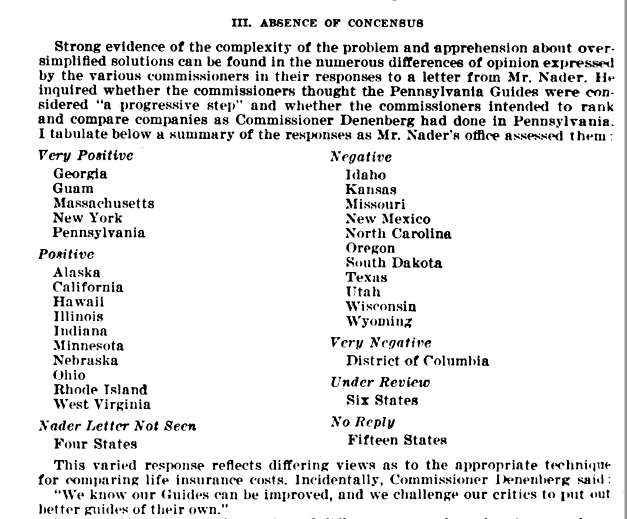

- (p117-120) Exhibit Il which shows that, in the last fifty years, no less than 21 different attempts have been made to solve this problem.. insurance departments.

- Furthermore, enacting a federal statute on life insurance cost disclosure would only address itself to part of the problem.

1973-2, NAIC Proceedings, (p107-131)

-- Statement of Stanley C. DuRose, Jr. - Commissioner of Insurance - Wisconsin / NAIC

- (p993) - Life Insurance "Cost," "Price." and "Value" - Presentation

- (p1020) - NAIC Proposed Report of the Life Insurance Cost Comparisons and Price Disclosure

- (p899) 1960 - The Construction of Persistency Tables, by Ernest J. Moorehead (EJM), Society of Actuaries

- Interest Adjusted Method (IAM)

- Hruska, John Durkin, New Hampshire Insurance Commissoner

- 1973-2, NAIC Proceedings - GOV (Senate) - NAIC - Testimony Stanley DuRose (Wisconsin Insurance Commissioner / NAIC) - p107-131 - 25p

- 1973 0221/ 1972 0221 - GOV (Senate) - The Life Insurance Industry - NAIC - Stanley Durose (Insurance Commissioner - WI), (Typo -1973, not 1972) - TILI, Senator Philip Hart (D-MI) - 64p

- 1973 0221 / 1972 0221 - GOV (Senate) - The Life Insurance Industry - NAIC - Stanley Durose (Insurance Commissioner - WI), (Typo -1973, not 1972) - TILI - 56p

Part 3

- Pennsylvania Life Insurance Shopper's Guide - Denenberg

- John C. Bogle

- (p1818) - Consumers Union

- (p17) - Federal interest in disclosure has extended into the automobile business (price stickers in windows), lending (truth-in-lending laws), drugs (truth in labeling), etc.

- Such things can be stated with certainty, e.g. the price of an automobile or accessories, the rate of interest being charged on a loan, or the amount of certain ingredients in drugs.

- ⇒ But, we have seen that a life insurance cost illustration is different.

- No one knows or can predict with certainty what the results will be.

- We have seen that refining the illustration for that is what the various proposals over the years have undertaken to do -- cannot add to their certainty.

1973 0221/ 1972 0221 - GOV (Senate) - The Life Insurance Industry - NAIC - Stanley Durose (Insurance Commissioner - WI), (Typo -1973, not 1972) - TILI - Truth in Life Insurance, Phillip Hart (D-MI) - 64p