2009 1231 - Examination Report of AGC Life Insurance Company - Missouri

- 2009 1231 - Missouri - Examination Report of AIG - AGC Life Insurance Company --- [BonkNote] --- 25p

- Filed 2011 0520

- The current full scope financial examination covers the period from January l, 2007, through December 31, 2009

- John Huff, Commissioner

- (p2/6) - AGC Life Insurance Company operates as a holding company that directly owns six domestic life insurance subsidiaries and one foreign subsidiary.

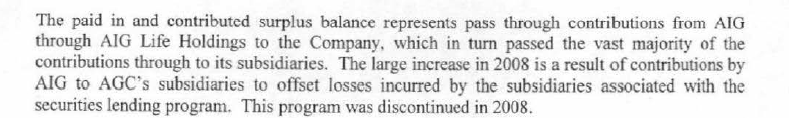

- The domestic subsidiaries lost $17.5 billion in 2008 as a result of their participation in a securities lending program sponsored by its upstream parent, American International Group, lnc. (''AIG").

- AIG made capital contributions in 2008 to substantially offset these securities lending losses from funds primarily obtained from the U.S. government.

- However the subsidiaries incurred significant damage to their reputations because of their association with AIG and this reputational damage resulted in a substantial loss of business that may be considered a threat to their future level of profitability.

- ⇒ As a result the subsidiaries could be dependent on additional capital contributions from AlG to maintain their capital positions.

- ⇒ Because of the damage to its financial condition that developed out of the 2008 financial crisis and the uncertainty of continued support from the U.S. government, it is not certain that AIG will be able to make future contributions to AGC's subsidiaries if needed.

- ⇒ AlG's management performed an assessment in 2009 of its ability to continue as a going concern and concluded that it will be able to finance and operate its businesses for the next twelve months.

- However it also concluded that it is possible that actual outcomes could be materially different, which could result in substantial doubt about its ability to continue to operate as a going concern.

- lf AIG is unable to continue to operate as a going concern, management believes this could have a material effect on AGC and its operations.

- (p1/5) - AGC Life Insurance Company hereinafter referred to as such or as "AGC" or as the "Company."

- The Company's administrative home office is located at 2727-A Allen Parkvay. Houston, Texas 77019, telephone number (713) 522-1111.

- This examination began on May 17, 2010 and concluded on August 5, 2010.

- The current full scope financial examination covers the period from January 1, 2007, through December 31, 2009.

- AIG Inc

- AIG Life Holdings (US) Inc (Parent)

- The company's immediate parent's name was changed in 2007 from American General Corporation to AIG Life Holdings (US), Inc.

- AGC Life Insurance Company operates as a holding company

- AIG <Inc> made capital contributions <$18.3> in 2008 to substantially offset these securities lending losses from funds primarily obtained from the U.S. government.

- ...directly owns six domestic life insurance subsidiaries and one foreign subsidiary.

- ...affiliate American General Life Insurance Company ("AGL'') - domiciliary of Texas

- ...AGC Life Insurance Company was incorporated as a life insurance company on September 1, 1982, under the laws of the state of Missouri.

- AGC is the parent company for most of AIG/AIG Life Holdings' life insurance subsidiaries.

- As of December 31. 2009, AGC owned 100% of the common stock of seven life insurance companies.

- These subsidiaries, in turn, collectively owned 100% of three other insurance companies.

- AIG Life Holdings (US) Inc (Parent)

2009 1231 AIG Examination Missouri 1o2

2009 AIG Examination Missouri 2o2

(p5/9)

Three additional agreements were executed in 2009 between AIG and the New York Fed and/or the U.S. Department of Treasury that "increased the federal rescue package to over $180 billion and whjch required AIG to issue equity interests in some of its subsidiaries for a reduction in the outstanding balance and maximum amount available to be borrowed under the Fed Facility.

AGC was not one of the subsidiaries for which equity interests were issued.

Certain of the Fed Facility obligations are guaranteed by certain AIG subsidiaries and are secured by a pledge of certain assets of AIG and its subsidiaries; however AGC is not a guarantor and has not pledged any of its assets to secure those obligations.

(p10/14)

Investment Advisory Agreement

Effective January 1, 2002, the Company agreed to the transfer by American General Investment Management, L.P. to AIG Global Investment Corp. of all its rights and all its obligations under the Advisory Agreement effective June 1, 1998.

- The advisory fees under the agreement are equal to .01 percent of the market value of assets managed. The Company incurred fees of $36,872, $17,807 and $27.544 in 2009, 2008 and 2007, respectively.

- As part of the sale of AIG's third party asset management business, the Advisory Agreement was assigned to AIG Asset Management (U.S.), LLC.