WSJ - Wall Street Journal

- 2020 0107 - WSJ - It’s the Hottest Thing in Life Insurance. Are Buyers Aware of the Risks? Regulators worry insurers are underplaying the dangers of a product tied to the performance of the U.S. stock market, by Leslie Scism - [link]

- One concern is that existing consumer materials “can lead to unrealistic expectations,” said Fred Andersen, an actuary with the Minnesota Department of Insurance who is a leader in the effort at the National Association of Insurance Commissioners.

- Paul Graham, chief actuary with trade group American Council of Life Insurers, said the industry supports development of materials and disclosures that help consumers “make the right decisions,” though “we do have different views amongst our companies as to how to best accomplish that on rather complex IUL products.”

- Some regulators and advisers fear indexed universal life will offer a repeat of what many consumers experienced with a policy known as basic universal life.

- Those policies were a sensation in the 1980s when U.S. interest rates were in double digits.

- 2022 0922 - WSJ - Rising Rates Make Life Insurance Funded With Debt More Costly Multimillion-dollar policies are supposed to pay for themselves but are coming up short, by Leslie Scism - [link]

- 2022 1007 - WSJ - Private Equity’s Pension-Plan Takeovers Face Backlash Some lawmakers say the transfer of pension liabilities to private equity-linked insurers puts workers at risk, by Chris Cummings - [link]

- 2022 1224 - WSJ - Stock Selloff Hits Life Insurers’ Fastest-Growing Product Indexed universal-life policies grew with low rates and soaring markets, by Leslie Scism - [link]

- The insider joke about indexed universal-life policies is that it takes an actuary, an attorney and maybe even an engineer to understand how the product works.

- Some regulators worry that hypothetical projections of savings growth using these indexes are overly rosy and can lead to unrealistic consumer expectations.

- If a projection proves faulty, a buyer could be stuck with an unaffordable insurance bill.

1960s

- <WishList> - 1967 0905 - WSJ - Article, "Insurers Under Fire, Critics Say Practices of Industry Confuse Life Insurance Buyers" - p2996

- 1967 - GOV (Senate) - Consumer Credit Industry

- PART 3A-APPENDIX -

- 1973 - GOV (Senate) - The Life Insurance Industry: Hearings Before the ...

[ From the Wall Street Journal ] INSURERS UNDER FIRE - CRITICS SAY PRACTICES OF INDUSTRY CONFUSE LIFE INSURANCE BUYERS COMPARING PRICES OF POLICIEs

- 1967 - GOV (Senate) - Consumer Credit Industry

1970s

- <WishList> - 1977 08 - WSJ - Title-?

- 1977 - SOA - Report of the Historian, Society of Actuaries - 22p

- According to an August, 1977, Wall Street Journal article, the Treasury Department is considering, as a part of President Carter's comprehensive tax reform legislation, taxation of the "inside buildup" in cash-value life insurance policies

- 1977 - SOA - Report of the Historian, Society of Actuaries - 22p

1980s

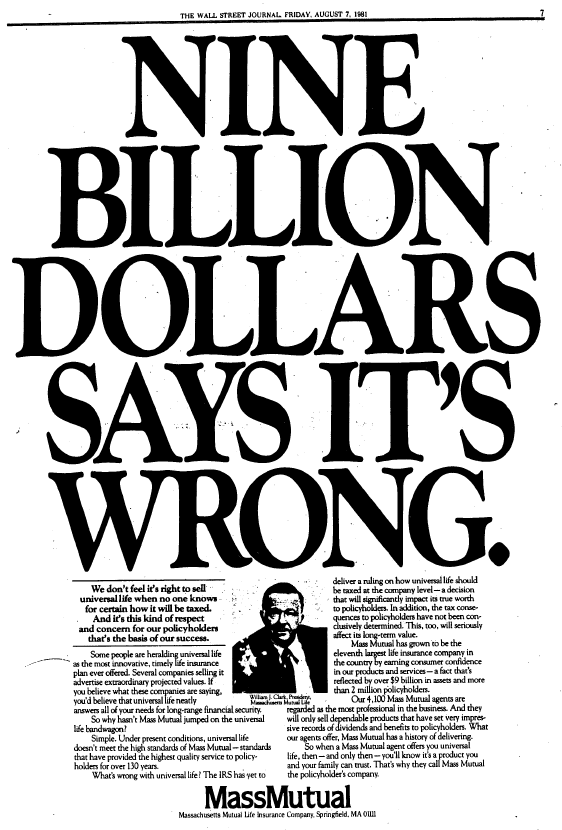

- 1981 0504 - WSJ - New Life Insurance Policies Are Better Deal: They Offer Decent Returns Besides Protection, by Jill Bettner - 1p

- 1981 - SOA - The Future of Permanent Life Insurance (rsa81v7n36), Society of Actuaries - 22p

- Stanley B. Tulin: The Wall Street Journal, in a back page article several weeks ago, discussed Universal Life Products, Variable Life and traditional permanent insurance - both participating and non-participating.

- The Journal's comparisons showed the Universal and Variable Life products to great advantage.

- Of course, a critical aspect of the illustrations - for both Universal and Variable - is the assumed rate of interest.

- The Wall Street Journal article assumed a rate of approximately 11% for the Universal Life and Variable Life illustrations.

- Stanley B. Tulin: The Wall Street Journal, in a back page article several weeks ago, discussed Universal Life Products, Variable Life and traditional permanent insurance - both participating and non-participating.

- 2009 - Journal of Financial Planning - Life Insurance in Times of Uncertainty, by David M. Cordell and Thomas P. Langdon - 2p

- We have a yellowed Wall Street Journal article dated May 4, 1981, in which the introductory paragraph Of the article was: "Where can you get one of the highest tax-deferred or tax-free—yields on your savings? Try life insurance."

- The author proceeded to discuss "'two products that truly advance the state of the art" and were "real breakthroughs for consumers." They were called -ahem- universal life and variable life. Yes, there really was a time when these two life insurance staples were exciting new products.

- 1981 - SOA - The Future of Permanent Life Insurance (rsa81v7n36), Society of Actuaries - 22p

- 1986 0202 - WSJ - 9. "Your Money Matters (Return on Universal Life Insurance Can Be a Lot Less Than Expected)," The Wall Street Journal, p. 37. - <WishList>

- 1987 - AP- ARIA - The Rate of Return on Universal Life Insurance - 22p - JSTOR

1990s

- 1995 0103 - WSJ - Fine Print Victims: Some Agents 'Churn' Life Insurance Policies, Hurt Their Customers, by Leslie Scism - <WishList>

- 1997 1024 - WSJ - MONY Wins Dismissal of Suit Over 'Vanishing Premium' Policies, by

- 1998 0821 - WSJ - AIG Says It Will Buy SunAmerica In Deal Valued at $16.5 Billion - [link]

- 1999 0709 - WSJ - Prudential Fined $20 Million by NASD Over Sales of Variable Life Insurance, By Bridget O'Brian - [link]

- 1998 - MDL-1061 - LC - Prudential Insurance Co. of America Sales Practices Litigation - [BonkNote]

2000s

- 2001 0314 - WSJ - Prudential Plans to 'Demutualize'; Shift Worries Policyholder Advocates, by Christopher Oster - [link]

- Industrywide, buyers of variable life insurance, a product whose value depends on investment results, tend to be in higher income brackets.

- Prudential said Pruco Life customers make up about 5% of the policyholders eligible to receive its IPO shares.

- 2001 1214 - WSJ - Ex-Marketing Executive Says Prudential Knew Misleading Materials Were in Use - [link]

- 2006 1118 - WSJ - GIC Issuers Receive Subpoenas - [link]

- 2008 0917 - WSJ - Paulson’s Statement on Fed’s Actions Surrounding AIG - [link]

- 2008 0917 - WSJ - Throwing a Lifeline to a Troubled Giant, Andrew Ross Sorkin - 6p

- ⇒ 2008 0918 - WSJ - Bad Bets and Cash Crunch Pushed Ailing AIG to Brink - [link]

- On Sunday, Treasury Secretary Henry Paulson told bankers considering financing for AIG that government officials "don't have a clear sense of how big the problem is."

- 2008 0923 - WSJ - Insurance Companies Need a Federal Regulator, by J, , and Ed Royce - [link]

- 2008 0926 - PEW - U.S. Lawmakers Fault States for AIG Collapse, Stephen Fehr - [link]

- 2008 0926 - WSJ - AIG's Problem Is Not Insurance Regulation by States, by Sandy Praeger, Kansas Insurance Commissioner / President - National Association of Insurance Commissioners - [link]

- 2008 1010 - WSJ - AIG Increases Borrowings While Racing to Sell Assets, by Liam Pleven, Carrick Mollenkamp and Craig Karmin - [[link-Free]

- Securities Lending, Doug Slape

- 2009 0305 - GOV (House) - Perspectives on Systemic Risk, Paul Kanjorski (D-PA) --- [BonkNote]

- 2008 1010 - WSJ - Further Loan To AIG Shows Fed Miscalculated Risks, By Liam Pleven, Carrick Mollenkamp and Craig Karmin - 2p - <WishList>

- 2008 1025 - WSJ - U.S. Mulls Widening Bailout to Insurers,

By Deborah Solomon and Leslie Scism - [link-Free] - 2008 1028 - WSJ - Storm-Proofing the Economy: A guide to Wall Street's turmoil--and what to do about if, By Nicole Gelinas - [link]

- 2008 1028 - WSJ - U.S. Mulls Widening Bailout to Insurers, By Deborah Solomon and Leslie Scism - [link]

- 2008 1030 - WSJ - Securities-Lending Sector Feels Credit Squeeze, by Craig Karmin and Leslie Scism - <WishList>

- 2008 1031 - WSJ - Behind Fall, Risk Models Failed to Pass Real-WorId Test, Carrie Mollenkamp, Serena Ng, Liam Pleven, and Randall Smith, <and/or 1103 2008> - <WishList>

2010s

- 2010 0202 - WSJ - What I Learned at the AIG Meltdown: State Insurance Regulation Wasn’t the Problem, by Eric Dinallo - [link]

- 2010 0226 - WSJ - Volcker Says States Share Some Blame On AIG Woes, by Leslie Scism And Serena Ng - [link]

- 2010 0910 - WSJ - 'Systemic Risk' Stonewall: Some bailout questions the Fed still hasn't answered --- [BonkNote] --- [link]

- [Bonk: Who authored this article?]

- 2015 0513 - WSJ - Federal Scrutiny of MetLife Isn’t Focused on Its Biggest Business, by Leslie Scism - [link]

- 2016 0901 - WSJ - Life Insurance Customers Push Back Over Surprise Cost Increases: Policyholders are filing suit, as big U.S. life insurers blame the Federal Reserve’s decision to keep interest rates lower for longer, by Leslie Scism - [link-Gift]

- 2017 0615 - WSJ - Chinese Banks Limit Exposure to Anbang - [link]

- 2018 0226 - WSJ - Who Will Be Called On to Clean Up the Anbang Mess? - [link]

- 2018 0919 - WSJ - Universal Life Insurance, a 1980s Sensation, Has Backfired: A long decline in interest rates caused premiums to soar when they were supposed to stay level, by Leslie Scism - [link-Gift]

- ... in 2000 that the universal-life policy she bought in 1983 was financially off track.

- 2018 1004 - WSJ - Canadian Insurers Fight Cattle Farmer’s Investment Strategy, Fearing Stampede: Legal battle could determine whether investors can funnel potentially limitless sums into accounts with high-interest payouts, by Jacquie McNish and David Benoit - [link]

2020s

- 2020 0106 - WSJ - The Hottest Thing in Life Insurance Has Serious Risks: Indexed Universal Life insurance, tied to stock market gains, can generate sizable returns for investors. But Wall Street Journal reporter Leslie Scismexplains how insurers could be underplaying serious risks to policyholders., by Leslie Scism - [AUDIO-link]

- 2020 0107 - WSJ - It’s the Hottest Thing in Life Insurance. Are Buyers Aware of the Risks? Regulators worry insurers are underplaying the dangers of a product tied to the performance of the U.S. stock market, by Leslie Scism - [link]

- One concern is that existing consumer materials “can lead to unrealistic expectations,” said Fred Andersen, an actuary with the Minnesota Department of Insurance who is a leader in the effort at the National Association of Insurance Commissioners.

- Paul Graham, chief actuary with trade group American Council of Life Insurers, said the industry supports development of materials and disclosures that help consumers “make the right decisions,” though “we do have different views amongst our companies as to how to best accomplish that on rather complex IUL products.”

- Some regulators and advisers fear indexed universal life will offer a repeat of what many consumers experienced with a policy known as basic universal life.

- Those policies were a sensation in the 1980s when U.S. interest rates were in double digits.

- WSJ - A Small Tax Change Is a Boon for Permanent Life Insurance - Insurers worried that a government rule from 1984 threatened certain products—and sought Washington’s help, by Leslie Scism - [link]

- 2022 0922 - WSJ - Rising Rates Make Life Insurance Funded With Debt More Costly Multimillion-dollar policies are supposed to pay for themselves but are coming up short, by Leslie Scism - [link]

- 2022 1007 - WSJ - Private Equity’s Pension-Plan Takeovers Face Backlash Some lawmakers say the transfer of pension liabilities to private equity-linked insurers puts workers at risk, by Chris Cummings - [link]

- 2022 1224 - WSJ - Stock Selloff Hits Life Insurers’ Fastest-Growing Product Indexed universal-life policies grew with low rates and soaring markets, by Leslie Scism - [link]

- The insider joke about indexed universal-life policies is that it takes an actuary, an attorney and maybe even an engineer to understand how the product works.

- Some regulators worry that hypothetical projections of savings growth using these indexes are overly rosy and can lead to unrealistic consumer expectations.

- If a projection proves faulty, a buyer could be stuck with an unaffordable insurance bill.

- 2023 0504 - WSJ - Podcast / Transcript - How Paperwork Errors Cost Families Life-Insurance Payouts Hundreds of families who paid life-insurance premiums were denied millions of dollars in death benefits because of missteps by both their employer and their insurance company. WSJ reporter Leslie Scism joins host J.R. Whalen to explain how it happened - [link]

- 2011 0627 - Book - Agent Ethics and Responsibilities, by Michael Lustig

- On Monday, March 28, 1988, a "Wall Street Journal" column entitled Your Money Matters told a story about disenchanted owners of universal life policies.

- As predicted, the cash accumulation account of the contracts sold to these policyowners was not earning as high an interest rate as the nonguaranteed sales illustrations had projected.

- As a result, the policyowners had received notice from the carrier that their vanished premiums had reappeared, and, unless they resumed premium payments, the death benefit would begin to vanish.

- These policyowners, and undoubtedly many others, have by now learned that the carrier was obligated to meet only the policy's contractual guarantees, not the illustrations.

- The article noted that the policyowners had filed a lawsuit against the carrier and the agent.

- This type of situation presents the question: What duties does the producer owe, and to whom, when dissatisfied clients turn to those who have sold the policies with the age old complaint. "But you promised...?"

- 1988 - SOA - Are Current Illustrations Supportable?, Society of Actuaries - 20p

- soa.org/globalassets/assets/library/newsletters/the-actuary/1988/december/act-1988-vol22-iss11-stoltzmann-frankel.pdf

- 1992 - JIR / NAIC - Insurance Agent or Broker Liability to the Insured, Burke A. Christensen - 30p

- 2009 0305 - GOV (House) - Perspectives on Systemic Risk - [PDF-254p,

- (p35) - Ed Royce (R-CA) - Let me just read from the article from the Wall Street Journal: ``Securities lending has long been a reliable side business for life insurers, approved by state regulators. But Moody's warned in April about the risks that insurers were taking related to these programs.

- ``Hampton Finer, a deputy to New York State Insurance Superintendent Eric Dinallo, said policyholders in AIG's life-insurance subsidiaries weren't at risk due to the securities-lending program. But, he said, New York will review what types of assets insurers are allowed to invest securities-lending collateral in.

- ``Mr. Slape said his team is keeping a close watch on three AIG insurance units because of the securities-lending exposure. Ohio's Department of Insurance said it is investigating the securities-lending activities of at least one life insurer. Darrel Ng, a spokesman for the California Department of Insurance, said the state is `looking at the securities-lending practices of those insurers domiciled in California,' along with AIG's.''

- The Wall Street Journal story is accompanied by a graph indicating the model AIG used to invest in subprime residential mortgage backed securities, which ultimately led to their demise.

- The Wall Street Journal, in a back page article several weeks ago, discussed Universal Life Products, Variable Life and traditional permanent insurance - both participating and non-participating.

- The Journal's comparisons showed the Universal and Variable Life products to great advantage.

- ⇒ Of course, a critical aspect of the illustrations - for both Universal and Variable - is the assumed rate of interest.

- The Wall Street Journal article assumed a rate of approximately 11% for the Universal Life and Variable Life illustrations.

-- Stanley B. Tulin

1981 - SOA - The Future of Permanent Life Insurance (rsa81v7n36), Society of Actuaries - 22p