Problem - Premium

- Permanent (cash value) life insurance pays the beneficiary whenever the insured dies, as long as premiums have been paid. (p38)

2016 11 - FIO (Federal Insurance Office) - Report on Protection of Insurance Consumers and Access to Insurance - 58p

2017 1115 Letter - NAIC Life Insurance Buyer's Guide Working Group (LIBGWG) , ACLI Redlined Draft

Permanent (cash value) insurance covers you for your entire life Unlike a term policy, which can end after a specified number of years, permanent life insurance will continue to the policy’s maturity age so long as premiums are paid.

-

(Note that this isn’t exactly accurate for UL, where policies can continue as long as the cash value is sufficient to pay the policy charges. We may want to make that distinction.) <<< ----ACLI Wording??>>>

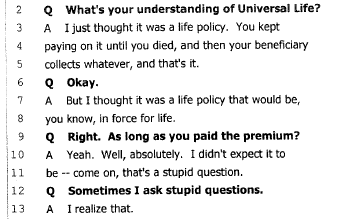

Blumenthal v New York Life - Deposition - Pay Premium

- After receiving these notices, John <Policyowner> contacted Glasgow <Agent> who had retired in 2000, to inquire why his policies would be terminating, even though he had timely paid the premiums on the policies for approximately 18 years. (p4-5)

- The undisputed facts indicate that Glasgow <Agent> did in fact procure two universal life-insurance policies for the Maloofs and that, had the Maloofs <Policyowner> continued to pay sufficient premiums on those policies, they would have remained in effect and the benefits of those policies would have been available for any purpose after John died. (p21)

2010 - Legal Case - Maloof v. John HancockLife Ins. Co. - 60 So. 3d 263 - Alabama Supreme Court Opinion - 39p

- Commissioner Hager of the Universal & Other Plans (A) Task Force stated that there appeared to be disclosure problems with universal life plans and that the identification of these items should be placed on the Actuarial Task Force agenda.

- The members present agreed that the disclosure issues extended to variable life as well as universal life.

- Some of the items identified which should be disclosed:

- (2) adequate disclosure of the fact that a premium quoted will not support the contract for the whole life if the policy is a universal life policy;

- Some of the items identified which should be disclosed:

1988-2, NAIC Proc.

- 7.10 If the guideline level premium will not provide coverage to the end of the term of the contract, does the illustration have to display the annual term charges allowed by § 7702 or can the illustration explain that the coverage will terminate?

- See Question 7.9. Either may be illustrated as long as the insurer discloses the effect of what is illustrated.

NAIC - Questions & Answers: Life Illustrations Model Regulation. As of March 19, 1997 - 22p

- 6. Agreed to Discuss Universal Life Policies

- Kim O'Brien (Americans for Asset Protection-AAP) said:

- there is a growing problem with universal life insurance policies that is hitting the elderly particularly hard.

- Due to the low interest rate environment, policies purchased 10 and 20 years ago require additional premiums to stay in force, and the premium hikes are particularly difficult for the elderly to pay.

- Commissioner Ommen said:

- he would put the issue on the agenda for a future meeting.

- the issue might be one for the Market Regulation and Consumer Affairs (D) Committee, as well.

2018-3, NAIC Proc. (LIAC)

- When is a Premium Not a Premium, Richard Weber - 4p

- Premiums

- Guaranteed Maturity Premium (GMP)

- Guideline Premium

- Planned Premium

- Target Premium

- R Ratio

Blumenthal vs New York Life - Sanderford (Plaintiff Expert Witness) - Actuarial Absurdity - Guaranteed Maturity Premium

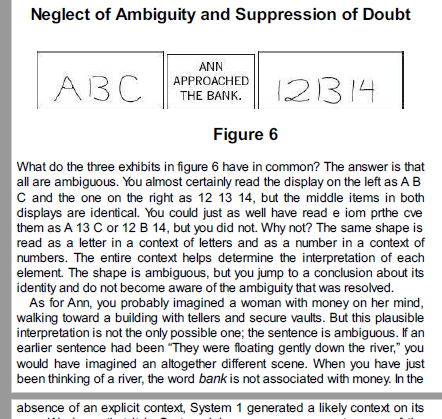

2011 - Thinking Fast and Slow, Daniel Kahneman

- In a universal life policy, you can choose a flexible premium payment pattern as long as you pay enough to keep your policy in force. (p2)

- Be Sure You Can Afford the Premium

Before you buy a life insurance policy, be sure you can pay the premiums. Can you afford the initial premium? If the premium increases later, will you still be able to afford it? The premiums for many life insurance policies are sensitive to changes in the company’s investment earnings, claims costs,

and other expenses. If those are worse than expected, you may have to pay a much higher premium. Ask what might be the highest premium you’d have to pay to keep your coverage. (p3)

2018 - NAIC Life Insurance Buyer's Guide - 8p

- MassMutual

- Term insurance is for a specific period of time whereas permanent is for life as long as the premiums are paid. - [link]