Cash Value

- Gary Sanders (National Association of Insurance and Financial Advisors—NAIFA) agreed that use of the term “cash value” was confusing.

2017 0217 - NAIC - LIBG WG Conference Call

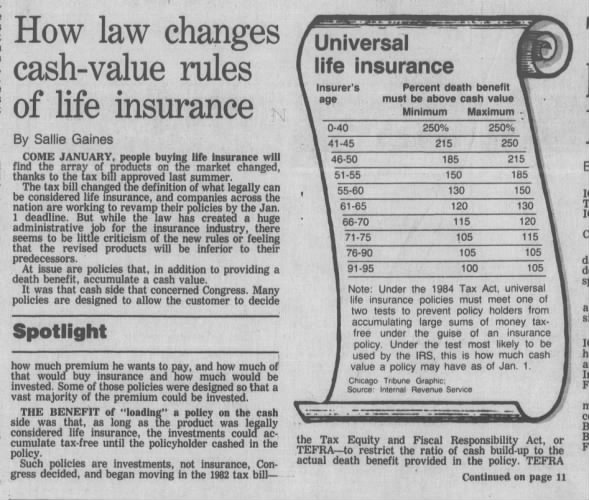

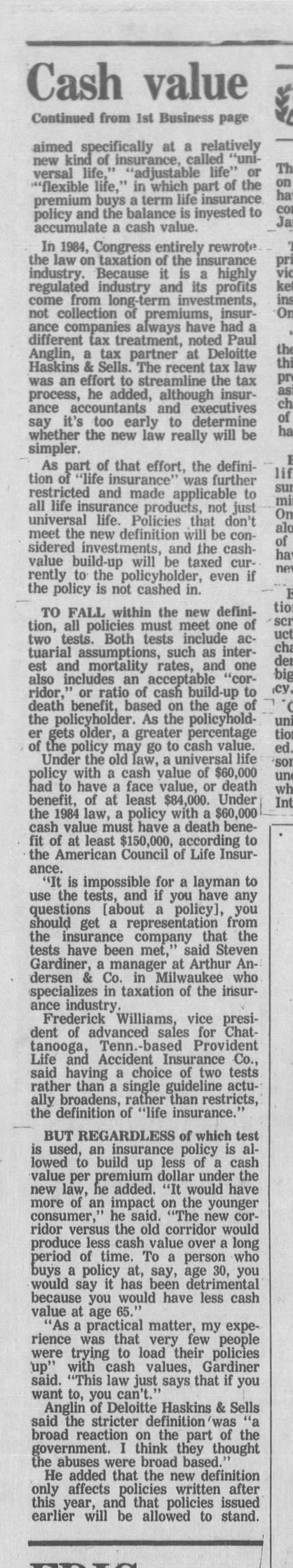

- This creature called universal life has evolved from a combination of term insurance and a flexible premium annuity to a range of differing products with various design features.

- Common to any of these variations is the fact that future cash values cannot be determined completely at issue.

- Cash values (and other benefits) are produced by a formula that is specified in advance. Some of the various elements used in the formula, however, can be adjusted after issue by the insurer.

- 6. THE CONCEPT OF THE BENEFIT GENERATING ACCOUNT

- We have mentioned several times that the function of the account value is to determine future benefits.

1983 - SOA - Universal Life Valuation and Nonforfeiture: A Generalized Model, by Shane A. Chalke and Michael F. Davlin, Society of Actuaries - 72p

- The primary purpose of the policy's Cash Value is to fund the Cost of Insurance.

1999 - Dearborn Continuing Education - Suitability

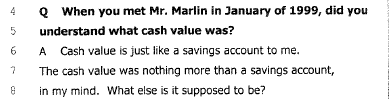

- A cash value is therefore by definition a savings account whether we choose to call it that or not.

-- Alan Richards, EF Hutton

1980 - SOA - The Future of Permanent Life Insurance, Society of Actuaries - 28p

- Additionally, the insurer usually guarantees the cash value will not fall below a minimum value.

- The cash value of the policy can also be used to pay the term insurance portion of the policy

2013 - NAIC - State of the Life Insurance Industry: Implications of Industry Trends - 220p

- (p317) - Statement of the National Association of Life Underwriters [NALU, Current Name is NAIFA]

- The Historical Treatment of Cash Values was Soundly Conceived

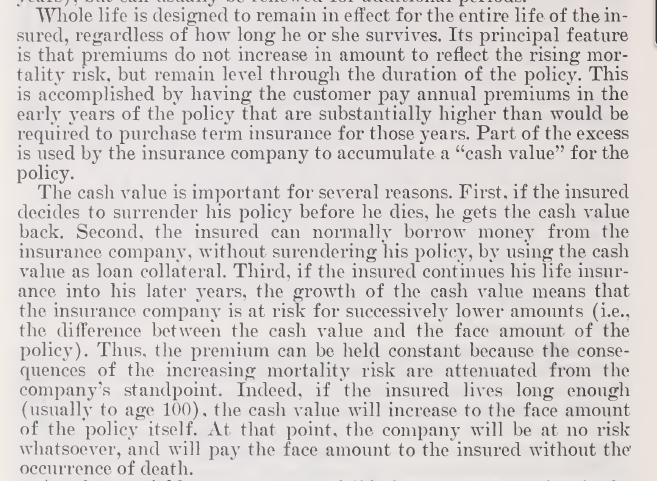

- Cash value life insurance developed out of the desirability if not the necessity of providing a level premium for the duration of a life insurance contract. The vitality of the level premium has been described as follows:

- "The chief significance of the level premium concept lies in the fact that the redundant premiums in the early years of cash value contracts create a fund which is held by the insurer for the benefit and to the the credit of the policyowners.

- Earnings (principally interest) are produced by investing the fund.

- The accumulated fund, improved by earnings, is used to pay out the benefit amounts provided for under the contract.

- Thus, the level premium is the only arrangement under which it is possible to provide insurance protection to the uppermost limits of the human life-span without the premium per unit of face amount increasing as age advances and eventually becoming prohibitive for most individuals." [Life and Health Insurance Handbook, 1973]

- Cash value life insurance developed out of the desirability if not the necessity of providing a level premium for the duration of a life insurance contract. The vitality of the level premium has been described as follows:

- The Historical Treatment of Cash Values was Soundly Conceived

1983 0510, 0511 and 0728 - GOV (House) - Tax Treatment of Life Insurance, Pete Stark (D-CA) --- [BonkNote]

- Account Value

- Benefit-Generating Account

- Reserve

- SIV-Self Insurance Value

- Robert H. Dreyer: Over the past few decades, cash values in life insurance policies have become so routine that many people have lost sight of their original purpose.

- Instead of being viewed in the context of a policyholder's equity in case of lapse, they are being treated as policy benefits which may be an integral part of the sales presentation.

- RALPH E. EDWARDS: I do not think that the consumer "advocate" will look at the cash value except cursorily.

- He will try to analyze the premium. For example, he may see a $20.00 premium in the tenth policy year as splitting into $1.74 for claims, $14.75 to increase the cash value, $2.61 for the dividend, and the remainder of 90 cents for expenses.

- This arithmetic may appear to be correct, but, if it is mathematically correct, this product should be freely available to all comers in the marketplace.

- To the contrary, it is not; this $20.00 price is indivisibly linked to the requirement that the nine previous premiums must have been paid.

- Thus, buried somewhere in the prior premiums was a charge for guaranteeing the right to keep the policy in force at the same premium rate. Since the eleventh-year premium has a similar status, the tenth-year premium must have in itself a similar charge. This cost will surely be overlooked by the consumer "advocate," even as I believe we have disregarded it in determining prices by the interest-adjusted method.

- He will try to analyze the premium. For example, he may see a $20.00 premium in the tenth policy year as splitting into $1.74 for claims, $14.75 to increase the cash value, $2.61 for the dividend, and the remainder of 90 cents for expenses.

1972 - SOA - Transactions, Society of Actuaries - 360p

- We must understand that we no longer have any reasonable basis for making any assumptions whatever about the range within which interest rates will fluctuate.

- Financing the squeeze by issuing commercial paper is just about the most dangerous thing a life company can do.

-- Ernest J. Moorhead (Jack) - EJM

1981 01 - SOA - Financial Hazards of the Cash Value Life Insurance Business, by EJM The Actuary, Society of Actuaries - 2p

- There are those who would say that while cash value life insurance may not be dead, it is at least sick, if not dying, and I think that's a disservice to the people of this country.

-- Robert E. Wilcox, Insurance Commissioner for the State of Utah, and Chairman of the Life Disclosure Working Group (NAIC)

1996 - SOA - A New Look at U.S. Nonforfeiture Regulation - 16p

- According to the Illustration, "[c]ash value accumulation is important because it is used to pay insurance costs and other charges (monthly deductions) necessary to keep the policy in force and because it can also be withdrawn to help meet a policyowner's other financial needs. . . ." Id

2008 - Legal Case - Blumenthal v New York Life - Plaintiff's Response To Defendant's Motion For Summary Judgment And Brief In Support - Case 5:08-cv-00456-F - Document 85 - Filed 06/01/10 - Page 10 of 37

- Despite the fact that there are cash values in the thirty‐year term contract, from a consumer's viewpoint it has no savings element.

- All of the premium is required to provide the thirty years of protection.

- The savings element in the thirty‐year endowment is the difference in the premiums of the two contracts. (p26)

-- Paul Overberg

1973 - SOA - Price Disclosure and Cost Comparison, Society of Actuaries - 186p

- Cash value policies differ from term insurance in three important ways.

- First, the premiums for a cash value policy are initially much higher than for term insurance for the same amount of insurance protection.

- Second, unlike the premiums for term insurance, cash value premiums do not go up with age, but remain the same throughout the payment period.

- Third, these insurance policies develop cash values which increase each year. (p3)

-- David Fix, Lead Attorney, Insurance Matters, Bureau of Consumer Protection, FTC

1979 1011/1022 - GOV (House) - Small Business Problems with Insurance - Part 1 - 1979 1011/22 - [PDF-337-GooglePlay]

- So often in the past eight or ten years, the purpose of a cash value has been to give an agent another first-year commission.

-- W. Keith Sloan

1995 - SOA - Practical Illustrations and Nonforfeiture Values, Society of Actuaries - 14p

- Cash values, which are the residual amounts of prefunding reserves returned to policyholders if the contracts are terminated, are secondary benefits.

-- TRG - Technical Resource Group, Industry, ACLI

1994-1, NAIC Proceedings

- And, despite the stellar performance of variable funds, in reality policyholders often allocate a large percentage of their premium to the fixed account.

-- Anne M. Katcher, Equitable

1992 - SOA - Product Management, Society of Actuaries - 28p

- 1981 01 - SOA - Financial Hazards of the Cash Value Life Insurance Business, by EJM - Ernest J. Moorhead (Jack) - The Actuary, Society of Actuaries - 2p

- 1989 - SOA - Cash Value Structures of the Future, Society of Actuaries - 16p

- 2004 - AP - Universal Life Insurance - Aspects of the Cash Value Development, Martin Birkenheier - 146p

Government Hearings

1978 - GOV - Life Insurance Marketing and Cost Disclosure Report - Moss - 106p

- 1983 0510, 0511 and 0728 - GOV (House) - Tax Treatment of Life Insurance, Pete Stark (D-CA) --- [BonkNote]

- p314 - Statement of Thomas Gregg, NALU, National Association of Life Underwriters (cka NAIFA)