EF Hutton

- Alan Richards

- Universal Life - First Policy - EF Hutton

- Total Life

- 1981 09 - Changing Times - Kiplinger's Personal Finance - Hutton Complete Life

- Such a product could be quite competitive and popular with stock brokerage houses who are used to low comnission structures.

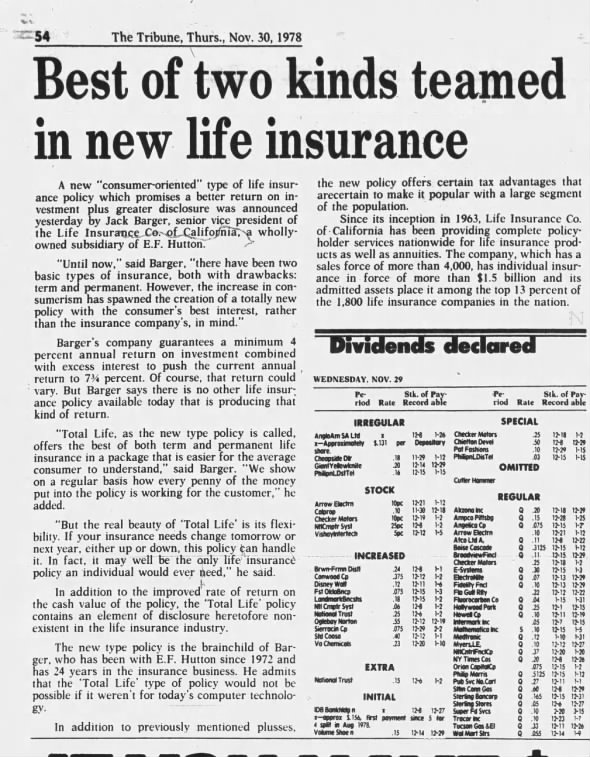

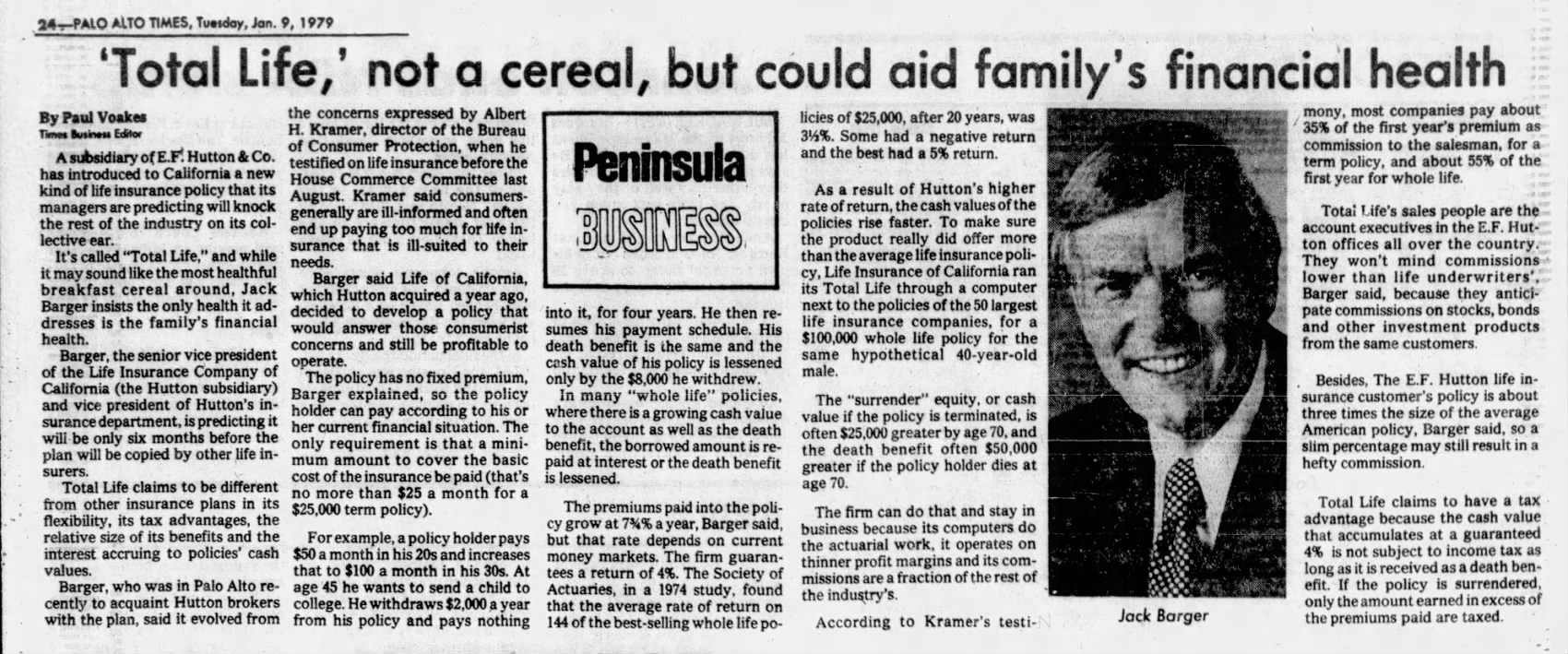

- E. F. Hutton's Life of California subsidiary is offering "Total Life", a primitive version of such a product, today.

- ...

- I would not expect Hutton's "Total Life" to be nearly as serious a threat in this environment.

-- Robert K. Dickson

1980 - SOA - The Future of Permanent Life Insurance (rsa80v6n19), Society of Actuaries - 28p

- 1981 0510 - NYT - Personal Finance; New, Improved Life Insurance, By Thomas C. Hayes - [link]

- 1981 1028 - Journal and Courier (Lafayette, Indiana) · Wed, Oct 28, 1981 - Page 36

- Hutton Life

- A ''Do It Yourself" - High Ca$h Yield pollcy. Find how. Hutton Life Insurance Company

- Year-? - LC - Frederick M. Binkley vs First Capital Life Insurance Company, formerly E. F. Hutton Life Insurance Company

- Petition for Rehearing - [GooglePlay-43p]

- 1987 0626 - UPI - E.F. Hutton executive under investigation steps aside - [link]

- A top executive at E.F. Hutton & Co., under investigation by the U.S. Attorney's office, stepped aside Friday while the brokerage firm examines his alleged involvement in a mob-run money-laundering scheme. -- re: Arnold Phelan

- 1988 0517 - The Washington Post - E.F. Hutton Is Fined $1 Million In Money-Laundering Case, By Brian Fuller - [link]

- E.F. Hutton & Co. was fined $1 million today after pleading guilty to charges stemming from a money-laundering scheme linked partly to the late New England mob boss Raymond Patriarca.

- 2022 0425 - InsuranceNewsNet Magazine - [link]

- Both could help put more life insurance products in the hands of ... company called EF Hutton Life, which was the pioneer of universal life.

- hinteractive.web.insurance.ca.gov/companyprofile/companyprofile?event=companyProfile&doFunction=getCompanyProfile&eid=3637

- LIFE INSURANCE COMPANY OF CALIFORNIA 08/01/1980

- E. F. HUTTON LIFE INSURANCE COMPANY 09/08/1987

- FIRST CAPITAL LIFE INSURANCE COMPANY

- NAIC Group #: 0004 Ameriprise Fin Grp

- nolhga.com/companies/public/main.cfm/NAICCode/65447/GAID/100

- On May 14, 1991, the Superior Court of the State of California for the County of Los Angeles (the "Court") entered an order placing First Capital Life Insurance Company ("First Capital") into conservatorship.

- On July 1, 1992, the Court approved a Rehabilitation Plan ("the Plan") for First Capital. The Plan called for Pacific Mutual to establish a subsidiary that would assume the policies of insureds who opted into the Plan, with First Capital retaining liability to opt-outs, general creditors and shareholders. Pacific Corinthian Life Insurance Company is still based in California. Their contact information can be found below.

- NAIC Number: 65447

- Rehabilitation Date: May 14, 1991

- Estate Closed: July 02, 2002

- Released from Oversight: June 05, 2003

- Pacific Corinthian Life Insurance Company

- Additional Information: Formed as a subsidiary by Pacific Mutual Life Insurance Company. Renamed Pacific Life Insurance Company.

- Life Insurance Company of California, Life of California - {Bonk: Same as California Life?]

- [BonkNote - Snippet: [EF Hutton / Life of California - 7p]

- First Capital - E.F. Hutton Life Insurance Co. announced that it has changed its name to First Capital Life Insurance Co

- 1983 0510, 0511 and 0728 - GOV (House) - Tax Treatment of Life Insurance, Pete Stark (D-CA) --- [BonkNote]

- 1985 0719 - GOV - EF Hutton Fraud Case - [VIDEO-CSPAN]

- E.F. Hutton Mail and Wire Fraud - [VIDEO-CSPAN]

- Fred Carr, Robert Bethoney, Alan Richards, Jerome C. Eppler, Robert M. Fomon

- 1993 - LC - Brown v. E.F. Hutton Group, Inc., 991 F.2d 1020, 1031 (2d Cir. 1993);

- The question that forms my title has often been asked since the first Universal Life product was introduced in 1979 by Life Insurance Company of California, now E. F. Hutton Life.

- I believe it's good for policyholders, is good for the industry, is here to stay, and will be a major force in life insurance future.

1981 09 - SOA - Is Universal Life Here to Stay?, by John F. Fritz - The Actuary, Society of Actuaries - 2p

- A cash value is therefore by definition a savings account whether we choose to call it that or not.

-- Alan Richards, EF Hutton

1980 - SOA - The Future of Permanent Life Insurance, Society of Actuaries - 28p

- Hutton Life Rulings

- 1980 - SOA - Product Innovation - Response to Consumer Needs in the 1980's, Society of Actuaries - 14p

- MR. RICHARD MURPHY - I will start off with the obvious question to Mr.

Richards. I believe that there have been some private letter rulings

requested by Life of California on several income tax issues and possibly

a question on par or non-par with respect to your product. Can you tell

us the status of those rulings? Have you had your conference, or are there

any letters forthcoming? - MR. RICHARDS - We believe that is a foregone conclusion because we can

demonstrate very easily a simple math_tical exercise that the cash values

according to this plan, are the same retrospectively and prospectively as

they are with any life insurance plan. We have requested a ruling to the

effect that this is llfe insurance under Section i01.

MR. HARRIS BAK - One thing that the Complete Life Product that Mr. Richards

described has in common with Adjustable Life and Traditional Life insurance

policies is that they are llfe insurance products. As life insurance they

must have a policy loan provision. Currently, we have the maximum policy

loan rate in all states at 8%, and we have prime rates at 20% interest.

Particularly since we are isolating the investment element, how can we use

this product to compete for the savings dollar when we can't pass on

effectively more than 8% interest?

- MR. RICHARD MURPHY - I will start off with the obvious question to Mr.

- The Hutton Life Rulings and Their Aftermath

- In August 1980, a term and annuity combination was found not to be eligible for life insurance treatment, as a single policy, all premiums were credited to premiums were deducted as partial withdrawals even though it was sold the annuity, and the term premiums were deducted as partial withdrawals.

- the Hutton Life rulings were issued, granting favorable tax treatment to the death proceeds of a universal life plan [4]. In February of 1981, a favorable ruling was

1988 - SOA - The Definition of Life Insurance Under Section 7702 of the Internal Revenue Code, by Christian J. Desrocher, Society of Actuaries - 56p

- Fred Buck is the president of First Capital Life and has held that position for about eight years, as far back as when it was called E. F. Hutton Life.

- Life Insurance Company of California

- Total Life, Complete Life

1992 - SOA - Companies on the Edge, Society of Actuaries - 20p

- Ardian Gill: I have a suggestion for Mr. Richards on his product and the scorekeeping of it. This comes from a paper by Mr. Maurice Levita, which is in the proceedings of the Conference of Actuaries. -- [Bonk: Alan Richards, EF Hutton]

- Maurice suggested some years ago that this type of product could be very simply administered by treating each premium as buying extended term insurance.

- And each succeeding premium, if there is one, extends the term or if the face amount is increased, it might reduce the term or otherwise adjust it.

1980 - SOA - Product Innovation - Response to Consumer Needs in the 1980's, The Society of Actuaries - 14p

<WishList: a paper by Mr. Maurice Levita, which is in the proceedings of the Conference of Actuaries>

1981-10-11-NP-Daily-Oklahoman-UL-Hutton