Vanishing Premium

- Robert Beck, Prudential, Chairman and Chief Executive Office

- RE: Vanishing Premium

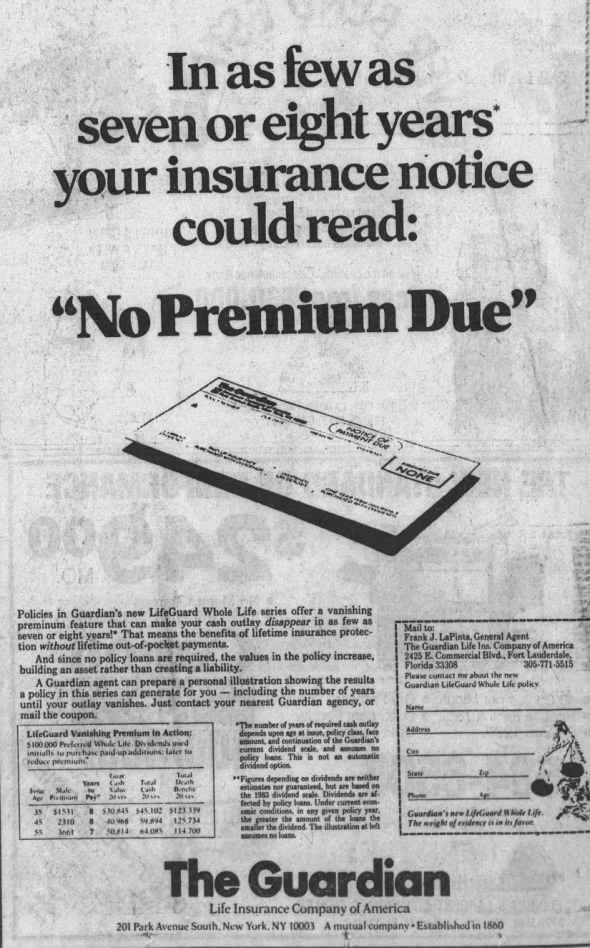

- (p6069) - Under some permanent insurance, contracts being sold today, the chances are you could stop paying after 7, 8, or 9 years and the insurance would remain in force for the rest of your life without further premium payments.

- (at approx. 2:27:00-2:27:30) - [VIDEO-CSPAN] - Impact of Tax Reform on Insurance Industry

1985 0719 Impact of Tax Reform on Insurance Industry, Pete Stark (D-CA) --- [BonkNote]

- If I bought a camera down the street and when I got back to my hotel room, the shop owner called me and said, "Oh, by the way, you owe me another $100 for that camera," I would feel exactly like many of the vanishing premium victims have felt.

- I understand the lawsuit.

- I think we could have avoided the problem through effective reillustration.

-- Christopher H. Hause

1995 - SOA - Current Developments Surrounding Regulations and Standards of Life and Annuity Products, Society of Actuaries - 18p

- (p51) - Gregory SERIO. NAIC / Superintendent, New York Department of Insurance - Price is a factor. Price should not be the leading factor on it. It should be a factor. I will go to this issue.

- Just a few years ago, we had this thing called vanishing premiums, where people were given a promise that their premiums were going to go away, and they were going to have this insurance coverage forever or for as long as they were told they were going to have it.

- That did not pan out, because those interest assumptions were wrong, because those other investment income assumptions were wrong over the duration of that policy.

- And we had to go back and rethink how it is that the companies are not only structuring these products but how they are selling them.

- And I think what has been happening is that this notion that the public is going to save money a little bit here, a little bit there is a hard thing to do when you are talking about a product that you need to have guaranteed at the end of the day

- Just a few years ago, we had this thing called vanishing premiums, where people were given a promise that their premiums were going to go away, and they were going to have this insurance coverage forever or for as long as they were told they were going to have it.

- (p68) - J. Robert Hunter (CFA) - Consumers, who over the last 30 years have been the victims of vanishing premiums....

2004 0922 - GOV (Senate) - Examination and Oversight of the Condition and Regulation of the Insurance Industry, Richard Shelby (R-AL) --- [BonkNote]

- Equitable Life Insurance was accused of misleading and cheating customers.

- This was a situation of the so-called vanishing premium cases in the 1980s.

- They sold policies when interest rates were high.

- They told customers as soon as the interest rates went down their premiums would be lower.

- That was not true.

- Class action lawsuits were filed in Pennsylvania and Arizona state courts, and Equitable settled the suits for $20 million helping over 130,000 people.

- However, because the insurance company was based in another state, under this legislation, the case would have been removed to federal court and these people harmed between 1984–1996 would still be waiting for justice. (S1150)

-- Senator Harry Reid (D-NV)

2005 0209 - Congressional Record - [PDF-70p]

- Vanishing premium whole life is often called irreplaceable life, with a premium almost equivalent to what an old fashioned, whole-life, nonparticipating policy had, but there's a direct crediting of interest and direct recognition of mortality.

- A policy like that with the current high interest rates could stop premiums after about five to eight years.

-- Ralph H. Goebel, Northwestern National Life Insurance through its various name changes. He retired in 1985 - Obituary - [link]

1985 - SOA - New Product Accounting Alternatives, Society of Actuaries - 18p

- 1984 - SOA - Deregulation of Financial Industries (rsa84v10n221), Society of Actuaries - 30p

- 1985 0719 Impact of Tax Reform on Insurance Industry, Pete Stark (D-CA) --- [BonkNote]

- 1985 - SOA - New Product Accounting Alternatives, Society of Actuaries - 18p

- 1985 - SOA - United States Life Insurance Tax Law, Society of Actuaries - 58p

- 1994 0613 - apnews - Life Insurance Buyers Allege Misleading Sales Tactics Were Used With PM-Vanishing Premiums-Illustrations, by Mark Dennis - [link]

- 1995 - SOA - Current Developments Surrounding Regulations and Standards of Life and Annuity Products, Society of Actuaries - 18p

- 1995 - SOA - Practical Illustrations and Nonforfeiture Values, Society of Actuaries - 14p

- 1995 - SOA - Sales Illustrations, Society of Actuaries - 14p

- 1996 - SOA - Legal Issues Affecting Nontraditional Products, Society of Actuaries - 14p

- 1997 - SOA - Vanishing Premium Illustrations Revisited, Arnold F. Shapiro, Society of Actuaries - 10p

- 1997 1024 - WSJ - MONY Wins Dismissal of Suit Over 'Vanishing Premium' Policies, by

- 1997 - LR - The Law and Economics of Vanishing Premium Insurance, by Daniel R. Fischel and Robert S. Stillman - 37p

- 2004 0922 - GOV (Senate) - Examination and Oversight of the Condition and Regulation of the Insurance Industry, Richard Shelby (R-AL) --- [BonkNote]

- 2018 03 - NCLC - Consumer Protection in the States: A 50-State Evaluation of Unfair and Deceptive Practices Laws, National Consumer Law Center - 76p

- Thus, we have universal life policies with a so-called low target premium where excess interest earnings can carry the policy for the whole of life with the payment of that low premium.

- We have the other extreme where the premium is higher but through the use of dividends or excess interest earnings, premiums are paid for only a few years. [Bonk: Vanishing Premium]

-- John L. Marcus, Prudential

1984 - SOA - Deregulation of Financial Industries (rsa84v10n221), Society of Actuaries - 30p

- Mr. Whittmore: You can illustrate a vanishing premium scenario as a supplemental illustration.

- It has to follow all the same rules as the base illustration, as far as supportability, not being lapse supported and the like, but for some reason they have actually banned the terminology, vanished premium, or anything along those lines.

- W. Keith Sloan: The vanishing-premium concept has been with us since the beginning of the century.

- I've seen illustrations of policies in companies that were formed about that time and had things that we sometimes call charter policies, and coupon policies, for example.

- One company I know routinely sold a coupon policy, 20-pay, with the coupons cancelled, which made it a 14-pay.

- That's a vanishing premium.

- This was brought out, I think, in 1914, so it's not a new concept...

- ....but I'd like to point out one other real problem, and that's that most of these illustrations are not made up in the home office--they're produced on laptops in the field.

- Regardless of how disciplined the scale is that you put into the agent's laptop, if he can change it or, as in one instance that I have seen, if he is trying to show a loan-supported policy and doesn't recognize that with a variable loan rate when the interest rate changes on the loan, it's also going to change on the dividends,

- ...somebody is in trouble.

- As a matter of fact, somebody was in trouble and they lost a lawsuit on that.

- [Bonk: 199x - LC - Ferguson v. Crown Life / Casteel - 91-11537 - ?]

- Regardless of how disciplined the scale is that you put into the agent's laptop, if he can change it or, as in one instance that I have seen, if he is trying to show a loan-supported policy and doesn't recognize that with a variable loan rate when the interest rate changes on the loan, it's also going to change on the dividends,

1995 - SOA - Practical Illustrations and Nonforfeiture Values, Society of Actuaries - 14p

- (p20) - Coverage of insurance

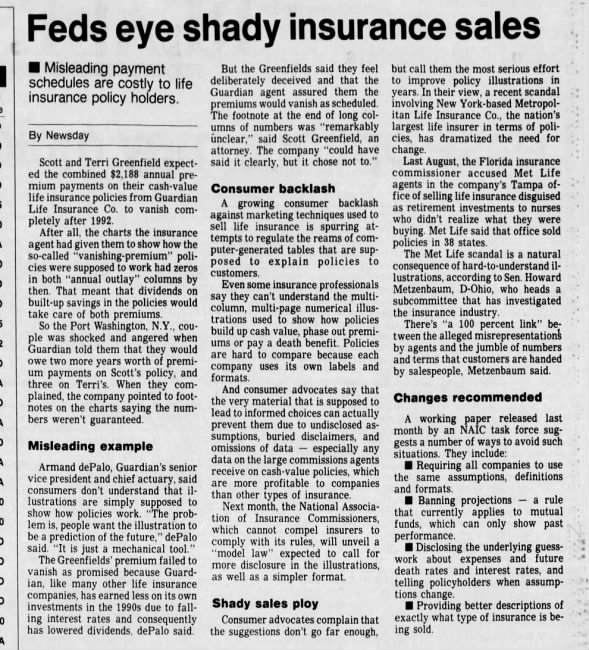

- Insurance policies are complicated financial instruments, making it difficult for consumers to detect deceptive sales pitches.

- For example, a common insurance sales pitch several years ago was that the interest earned on the premiums the consumer paid in the early years of a life insurance policy would build up so much that the consumer would be able to stop paying premiums after a certain number of years.

- The claim was based on the unfounded assumption that interest rates would stay high, but this assumption was never disclosed to consumers.

- Only when interest rates rose and the “vanishing premiums” failed to vanish did consumers realize they were defrauded.

- For example, a common insurance sales pitch several years ago was that the interest earned on the premiums the consumer paid in the early years of a life insurance policy would build up so much that the consumer would be able to stop paying premiums after a certain number of years.

2018 03 - NCLC - Consumer Protection in the States: A 50-State Evaluation of Unfair and Deceptive Practices Laws, National Consumer Law Center - 76p

- The standard product we are using is the most popular version of excess interest whole life, which is a high premium version--premium of $13.82 at age 35 (slide 17).

- This is a so-called vanishing premium model where if you pay the premiums for a certain number of years, like six or seven, the policy will in effect become paid up

-- Randall P. Mire

1985 - SOA - United States Life Insurance Tax Law, Society of Actuaries - 58p

- Universally omitted from the illustration language was any information about:

- the multiple significant assumptions upon which the illustrations depended,

- the highly leveraged nature and extreme volatility of the vanishing premium products,

- the rate of interest upon which the dividend factor depended, or

- the effect of even slight reductions in the dividend interest rate in causing the "vanished" premiums to "re-appear."

- My next comment relates to the vanishing premium "payback."

- I guess I'd have to say I'm disappointed that companies haven't defended themselves more vigorously in this whole situation.

- Maybe the reason is that their agents didn't do the proper job at the point of sale.

- But if the agent did, and if the agents have a good file, and they've been following up since the point of sale/issue and have communicated properly to their clients the impact of interest rate changes on at least an annual basis, I don't think we would have this problem.

- I found it fascinating that the agent in the Crown Life case got $40 million for mental anguish.

-- Kevin A. Marti

1995 - SOA - Sales Illustrations, Society of Actuaries - 14p

- The vanishing-premium concept has been with us since the beginning of the century.

- I've seen illustrations of policies in companies that were formed about that time and had things that we sometimes call charter policies, and coupon policies, for example.

- One company I know routinely sold a coupon policy, 20-pay, with the coupons cancelled, which made it a 14-pay.

- That's a vanishing premium.

- This was brought out, I think, in 1914, so it's not a new concept, but I'd like to point out one other real problem, and that's that most of these illustrations are not made up in the home office--they're produced on laptops in the field.

-- MR. SLOAN

1995 - SOA - Practical Illustrations and Nonforfeiture Values, Society of Actuaries - 14p