Robert E. Wilcox

- Actuary

- ?-1994-? - Utah Insurance Commissioner

- 1990s - NAIC - Chairman of the Life Disclosure Working Group

- Expert Witness - for Defense

- 2012 0313 - LC - Thao v Midland, United States District Court Eastern District of Wisconsin, 2:09-C-1158-LA

- *Robert E. Wilcox: What's the real problem then, Shane?

- Shane Chalke: I'll say before I answer that I don't have a good answer.

1995 - SOA - Current Developments Surrounding Regulations and Standards of Life and Annuity Products, Society of Actuaries - 18p

⇒ *Robert E. Wilcox, Utah Insurance Commissioner and Chairman of the Life Disclosure Working Group (NAIC)

- James D. ATKINS: The NAIC has proposed a life insurance illustration regulation. The draft I have is dated April 21, that's fairly recent. I hope you've had a chance to look it over.

- I'd like to start out by posing a question and that is, what is the impetus behind introducing this illustration regulation?

- Why are we doing this?

- I'd like to start out by posing a question and that is, what is the impetus behind introducing this illustration regulation?

- Robert Wilcox (Utah Insurance Commissioner and Chairman of the Life Disclosure Working Group - NAIC): Efforts began in the NAIC to look at the quality of the illustrations as the investment market turned steeply downhill and premiums that were supposed to vanish didn't.

- That put tremendous pressure on the companies and on the regulators of the companies to look at this particular issue.

- If you look at last week's copy of the National Underwriter, there was word of a lawsuit, actually two or three lawsuits, that had been filed over the issue of reappearing or nonvanishing premiums.

- That points out the initial problem.

- Whatever we did to illustrate those contracts when they were sold, the policyholders did not understand the contingent nature of that vanish.

- That's the underlying reason we got into this.

- James D. ATKINS: You mean just because they didn't understand the vanishing premium illustration we have all this regulation being imposed?

1995 - SOA - Current Developments Surrounding Regulations and Standards of Life and Annuity Products, Society of Actuaries - 18p

- It would be critical in that process to get on board with the idea of better disclosure to the consumer of what they're buying.

- We lack a great deal in terms of disclosure, but I'm convinced that many of the things we have regulated with a fairly heavy hand could be unregulated if we have some strict requirements on disclosure. It's a better form of regulation in my opinion.

-- Robert E. Wilcox, Utah Insurance Commissioner and Chairman of the Life Disclosure Working Group (NAIC)

1995 - SOA - Current Developments Surrounding Regulations and Standards of Life and Annuity Products, Society of Actuaries - 18p

- Commissioner Wilcox said that he admitted that the working group had gotten a little sloppy on its terminology, but it had been clear all along that the working group was focusing on sales.

-- Robert E. Wilcox, Utah Insurance Commissioner and Chairman of the Life Disclosure Working Group (NAIC)

1996-4V2, NAIC Proceedings

- There are those who would say that while cash value life insurance may not be dead, it is at least sick, if not dying, and I think that's a disservice to the people of this country.

-- Robert E. Wilcox, Utah Insurance Commissioner and Chairman of the Life Disclosure Working Group (NAIC)

1996 - SOA - A New Look at U.S. Nonforfeiture Regulation, Society of Actuaries - 16p

- Let's go back to the question of understandability.

- With no standardized format being utilized, many of the illustrations currently in use are far too complex for the average consumer or applicant to understand.

- In many cases the selling agent does not understand what he is presenting, and this needs to be addressed.

-- Robert E. Wilcox, Utah Insurance Commissioner and Chairman of the Life Disclosure Working Group (NAIC)

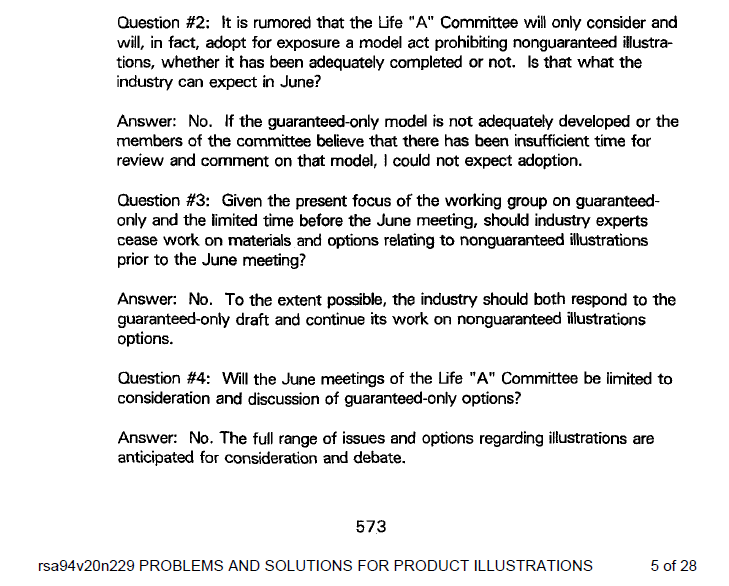

1994 - SOA - Problems and Solutions for Product Illustrations, Society of Actuaries - 28p

- Second, it was observed that ..... there is virtually no accountability for any of the participants in the sale,

- ..not for the company, not for the agent, and interestingly, the white paper discussed accountability on the part of the purchaser as well.

-- Robert E. Wilcox, Utah Insurance Commissioner and Chairman of the Life Disclosure Working Group (NAIC)

1994 - SOA - Problems and Solutions for Product Illustrations, Society of Actuaries - 28p

- p6 - A. The Black Box of Life Insurance

- 6. Life insurance contracts are circular, interrelated series of cash flows into, out of, and within a policy.

- There are innumerable ways to establish these cash flows...

- p7 - B. Basic Structure and Operation of Life Insurance Contracts

-- Declaration of Robert E. Wilcox in Opposition to Plaintiff's Motion for Class Certification -- Former Utah Insurance Commissioner and Chairman of the LDWG - Life Disclosure Working Group - (A) - NAIC

2011 0211 - LC - Thao v. Midland National - Document 34 - Declaration of Robert E. Wilcox in Opposition to Plaintiff’s Motion For Class Certification - 09-cv-1158 - 44p

- Q. Do you recall the vanishing premium litigation?

- A (Wilcox): Very well.

- Q. Would you agree that the sales practices that were used in the vanishing premium -- in selling those policies was problematic?

- MR. HIGGINS: Objection. Vague.

- THE WITNESS (Wilcox): In a limited number of cases, that was true. But again, that's a different question than you asked before.

- Problematic is not the same as unlawful.

- MR. PAUL: Q. Do you not believe that the sales practices used -- that were at issue in the vanishing premium issue were unlawful?

- MR. HIGGINS: Objection. Vague.

- THE WITNESS (Wilcox): There may have been a few instances where it was unlawful. In general, it was not vanishing premium issue were unlawful?

MR. HIGGINS: Objection. Vague.

THE WITNESS (Wilcox): There may have been a few instances where it was unlawful. In general, it was not.

-- Deposition of Robert E. Wilcox, Former Utah Insurance Commissioner and Chairman of the Life Disclosure Working Group (NAIC)

66-1 -2012 0313 - LC - Thao v. Midland National - Document 66-1 -Deposition of Robert E. Wilcox - 09-cv-1158 - 9p

- The working group did not come to a conclusion on whether to include the sensitivity analysis and decided that discussion at the next meeting would be helpful.

- Commissioner Wilcox said he was impressed** by the comments of those on the working group who were not actuaries that sensitivity adds more confusion than enlightenment.

- He said as an actuary, if he were buying a policy, he would want to see what 1% less interest produced.

- He said variations other than interest would be more difficult. (p674)

1994-4, NAIC Proceedings

-- Robert E. Wilcox, Utah Insurance Commissioner and Chairman of the Life Disclosure Working Group (NAIC)

**[Bonk: I was curious about use of the word "impressed." I looked it up on thesaurus.com and found that it is related to "affected" and "distressed" -- which would make sense in that sentence. Thoughts?]

- ...a great deal of our problem is caused because the people out there marketing our life insurance products are trying to market it against and like mutual funds.

- Until we start to market it as life insurance and describe it and teach the consumers about life insurance, they're not in any position to make those kinds of judgment calls

-- Robert E. Wilcox, Utah Insurance Commissioner and Chairman of the Life Disclosure Working Group (NAIC)

1995 - SOA - Current Developments Surrounding Regulations and Standards of Life and Annuity Products, Society of Actuaries - 18p

- Do not expect consistent answers from the panelists because we are still talking this through, and I can assure you that we are far from reconciling this issue in our own minds, let alone with each other.

-- Robert E. Wilcox, Utah Insurance Commissioner and Chairman of the Life Disclosure Working Group (NAIC)

1996 - SOA - Nonforfeiture Law Developments (rsa96v22n38pd), Society of Actuaries - 23p

- We have to get out of our mode of talking about these policies in language that can only be understood by the person who wrote the language.

- I find, after 30 years plus of experience in the life insurance business, that there is jargon used in illustrations that I don't understand.

- I can have difficulty in taking an illustration and figuring out what in the world the authors are trying to illustrate and how they are doing it.

-- Robert E. Wilcox, Utah Insurance Commissioner and Chairman of the Life Disclosure Working Group (NAIC)

1994 - SOA - Problems and Solutions for Product Illustrations, Society of Actuaries - 28p

- If we are going to have a group of consumers of our products who are satisfied with what they get, we have to meet their expectations.

- Obviously, there are two adjustment points whereby that can be accomplished.

- One is that you can change the outcome to match the expectations.

- The other is to change the expectation to match the outcome

-- Robert E. Wilcox, Utah Insurance Commissioner and Chairman of the Life Disclosure Working Group (NAIC)

1994 - SOA - Problems and Solutions for Product Illustrations, Society of Actuaries - 28p

- When I attended the first meeting, I very much wanted to repent and take a different course.

- I sensed that, even though this was a problem that I had observed over a long period of time through my consulting practice, the regulators and the industry were reaching for answers in a very difficult circumstance.

- It was important to observe that these nonactuary regulators, experienced, competent people, were seeing a different set of problems than we, as actuaries, were used to focusing on.

- It is important to understand that we as actuaries focus on the supportability issue.

- What I was hearing almost exclusively was understandability.

-- Robert E. Wilcox, Utah Insurance Commissioner and Chairman of the Life Disclosure Working Group (NAIC)

1994 - SOA - Problems and Solutions for Product Illustrations, Society of Actuaries - 28p

- Commissioner Wilcox also spoke favorably of a new provision in California where the illustration of non-guaranteed elements must show: the lesser of:

- the amount being currently paid,

- the amount the company is currently earning,

- or the amount the company can expect to earn.

- -- Robert E. Wilcox, Utah Insurance Commissioner and Chairman of the Life Disclosure Working Group (NAIC)

1994-3, NAIC Proceedings

- John Montgomery (Calif.) said that complicated products are not understood by the typical applicant.

- Commissioner Wilcox said that a "typical applicant" for a sophisticated policy should be a sophisticated applicant, and he acknowledged that the wording might need to be clarified in that instance.

- -- Robert E. Wilcox, Utah Insurance Commissioner and Chairman of the Life Disclosure Working Group (NAIC)

1994-3, NAIC Proceedings

- Commissioner Wilcox said that under Australian law a company is responsible for anything its agents say.

- He saw some value to that level of accountability.

- -- Robert E. Wilcox, Utah Insurance Commissioner and Chairman of the Life Disclosure Working Group (NAIC)

1994-3, NAIC Proceedings

- -- Robert E. Wilcox, Utah Insurance Commissioner and Chairman of the Life Disclosure Working Group (NAIC)

- .... said that since the NAIC had changed its policy on advisory groups, clarification had not been given to the technical resource advisors, and he intended to send them all a letter to explain the help that was being requested by the working group.

1994-4, NAIC Proc.

- Commissioner Wilcox said he had a concern about the inherent unfairness in a contract without rational charges for mortality, expenses, etc.

- He asked if it was the responsibility of this group to change that or just to require disclosure. (p492)

- -- Robert E. Wilcox, Utah Insurance Commissioner and Chairman of the Life Disclosure Working Group (NAIC)

1995-1, NAIC Proceedings

- ATTACHMENT ONE-A1

- TO: NAIC Members

- FROM: -- Robert E. Wilcox, Utah Insurance Commissioner and Chairman of the Life Disclosure Working Group (NAIC)

- DATE: January 21, 1996

- RE: Life Insurance Illustrations Model Regulation

- In December the NAIC membership adopted a new Life Insurance Illustrations Model Regulation to address some of the problems we have all been experiencing as consumers complain that their "vanishing" premiums haven't vanished and the high returns they expected haven't materialized.

1996-1, NAIC Proc.