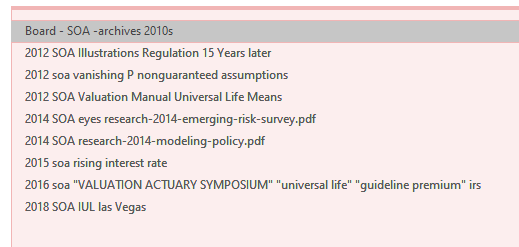

2010s - SOA - Society of Actuaries

- 2013 - SOA - A Qualitative History of Previous Challenging Environments for the Life Insurance Industry, By Evan Borisenko, Society of Actuaries - 4p

-

2013 - SOA - Life Insurance Regulatory Structures and Strategy: EU Compared with US - 92p

- 2014 - SOA - Modeling of Policyholder Behavior for Life Insurance and Annuity Products: A Survey and Literature Review, Society of Actuaries --- [BonkNote] --- 92p

- 2015 - SOA - Life Insurance Regulatory Structures and Strategy: EU Compared with US, Society of Actuaries - 92p

- 2015 - SOA - Transition to a High Interest Rate Environment Preparing for Uncertainty, Society of Actuaries - 105p

- 2015 - SOA - Update on Regulatory Development, By Francis de Regnaucourt, Society of Actuaries - 4p

- 2016 - SOA - Middle-Market Life Insurance Findings From Industry Thought Leaders, Society of Actuaries - 17p

- 2018 - SOA - Actuarial Review of Insurer Insolvencies and Future Preventions – Phase 1, Society of Actuaries - 74p

- 2018 /2019 - SOA - Why Indexed Universal Life Income Streams Need to Be Managed

- 2018 10 - SOA - Why Indexed Universal Life Income Streams Need to Be Managed—Part 1, By Ben H Wolzenski and John S. McSwaney - p28-31 - soa.org/4934ca/globalassets/assets/library/newsletters/product-development-news/2018/october/pro-2018-iss111.pdf

- WHAT’S THIS ABOUT AND A QUICK BO TTOM LINE

- Wolzenski: John, over the past decade working with producers, you’ve observed that most Indexed Universal Life (IUL) new premium comes from sales that illustrate policy loans or withdrawals, either for retirement income or to repay premium financing.

- WHAT’S THIS ABOUT AND A QUICK BO TTOM LINE

- 2018 10 - SOA - Why Indexed Universal Life Income Streams Need to Be Managed—Part 1, By Ben H Wolzenski and John S. McSwaney - p28-31 - soa.org/4934ca/globalassets/assets/library/newsletters/product-development-news/2018/october/pro-2018-iss111.pdf

- 2019 - SOA - Big Data and the Future Actuary How access to non-traditional data is unleashing innovation opportunities for the actuarial profession and insurance industry, Society of Actuaries - 27p

- 2019 - SOA - Insurance Regulatory Issues in the United States, Society of Actuaries - 37p

- 11- States do not typically regulate ratemaking in life insurance since competition leads to the proper adjustment of premiums.

- 11 - Premiums for life insurance and annuity products generally are not subject to regulatory approval, although regulators may seek to ensure that policy benefits are commensurate with the premiums charged.

- 12 - The Actuarial Standards Board recently issued Actuarial Standard of Practice (ASOP) No. 54, which provides guidance for the pricing of life insurance and annuity products.

- 12 - The American Academy of Actuaries (AAA) issued a long-term care credibility monograph that serves as a guide for the use of credibility in long-term care pricing.

- 22 - Even when companies are comfortable with their advanced models, there is a reputational concern about life insurance rates being determined by an advanced statistical model.

- 32 - A Public Policy Practice Note. 2017. Model Governance: Some Consideration for

Practicing Life Actuaries.

https://www.actuary.org/files/publications/Model_Governance_PN_042017.pdf - 33 - Deloitte. Predictive Modeling for Life Insurance. Ways Life Insurers Can Participate in the

Business Analytics Revolution.

https://www.soa.org/globalassets/assets/files/research/projects/research-pred-mod-lifebatty.pdf - 33 - New York Department of Financial Services. 2019. Use of External Consumer Data and

Information Sources in Underwriting for Life Insurance.

https://dfs.ny.gov/industry_guidance/circular_letters/cl2019_01

- 2019 - SOA - Why Indexed Universal Life Income Streams Need to Be Managed—Part 2, By Ben H Wolzenski and John S. McSwaney - 4p