AIG - Life Insurance Companies - FRB

- 2008 0914 - FRB - FRBNY Alejandro LaTorre e-mail to Timothy Geithner re Pros and Cons on AIG lending - 21p

- 2008 0914 - FRB (Adam Ashcraft) - FCIC-AIG0021165 - 2p

- The Citi research piece suggests the could raise $20 billion by selling subs, but this is much less than their true value given distressed markets.

- Citi also notes that the firm could also hedge COO risk with little effect on capital as these positions have been written down to fair value.

- A capital raise now would be highly dilutive given market prices, but I don't think we can justify access to the window based on the fact that shareholders don't want diluiton.

- 2008 0913 - FCIC - FRBNY Email re AIG-Board Call - SB-AIG-35647 - 2p

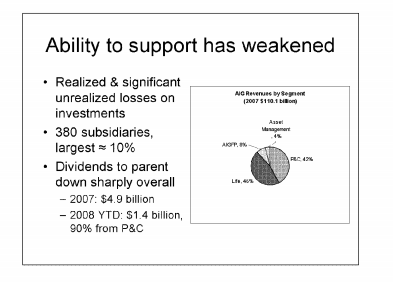

- Medium term plan is to sell approximate $40 billion of high quality assets, largely life insurance subsidiaries in the US and abroad to raise capital/cash needed to fill the hole.

- Such a sale of assets would amount to AIG selling approximately 35 to 40% of the company.

-

(AIG believes that they can make the point that because of the value in the insurance companies, this is truly a liquidity problem overall, not a solvency one.)