Dynamic

- Products

- NGEs - Non-Guaranteed Elements

- Policyholder Behavior

- NAIC Working Groups - Current / Recent

- ACLI Letter

- 2016 0517 - LIIIWG - Assurity Resources - Consumer Issues Associated with Guaranteed Universal Life - NAIC - 11p

- 2017 1115 - Letter - AAA tp NAIC - (American Academy of Actuaries) - Re: Life Insurance Buyer’s Guide Q&A Draft 8/1/17 - 2p

- Universal life also allows for flexibility in policy benefits, not just premium payments.

- (p288) - "Dynamic Products" are products with premiums and benefits that can fluctuate from month to month, depending on the

- ...premiums the policyholder pays,

- ...the withdrawals the policyholder makes,

- ...the investment returns credited to the policy,

- ...and the mortality and expense charges deducted from the policy."

- Some common names for dynamic products include universal life, variable universal life, unit-linked life, and adjustable life.

2000 - Book - Life Insurance Products and Finance, by D.B. Atkinson and J.W. Dallas

- Dynamic policyholder behavior assumptions include lapses, annuitization, partial withdrawals, loans and funding persistency.

- For all these types of assumptions, it is difficult to obtain experience data.

2003 - SOA - Applied Modeling Concepts, Society of Actuaries - 21p

- ...completely Dynamic services and policy opportunities for their customers to purchase and to elect a variety of options.

-- Michael Lovendusky, ACLI

2019 1109 - NAIC - LIIIWG - Life Insurance Illustrations Working Group Conference Call - [Bonk: Not in Proceedings]

- (p19) - With a dynamic product, continuation of a policy is tied to having enough funds available in the account value to cover the monthly deductions for expenses and mortality.

- This contrasts with pre-scheduled policies, where continuation is tied to the payment of a pre-scheduled premium.

2000 - Book - Life Insurance Products and Finance, by D.B. Atkinson and J.W. Dallas

- I think you really have to make sure that people understand volatility, whether you solve for a policy blowing up or values being halved.

- I think you have to catch people's attention, and that is all to the good.

-- George Coleman, Prudential, ACLI, TRG-Technical Resource Group for the NAIC (Industry Advisory Group - Illustrations)

1994 - SOA - Problems and Solutions for Product Illustrations, Society of Actuaries - 28p

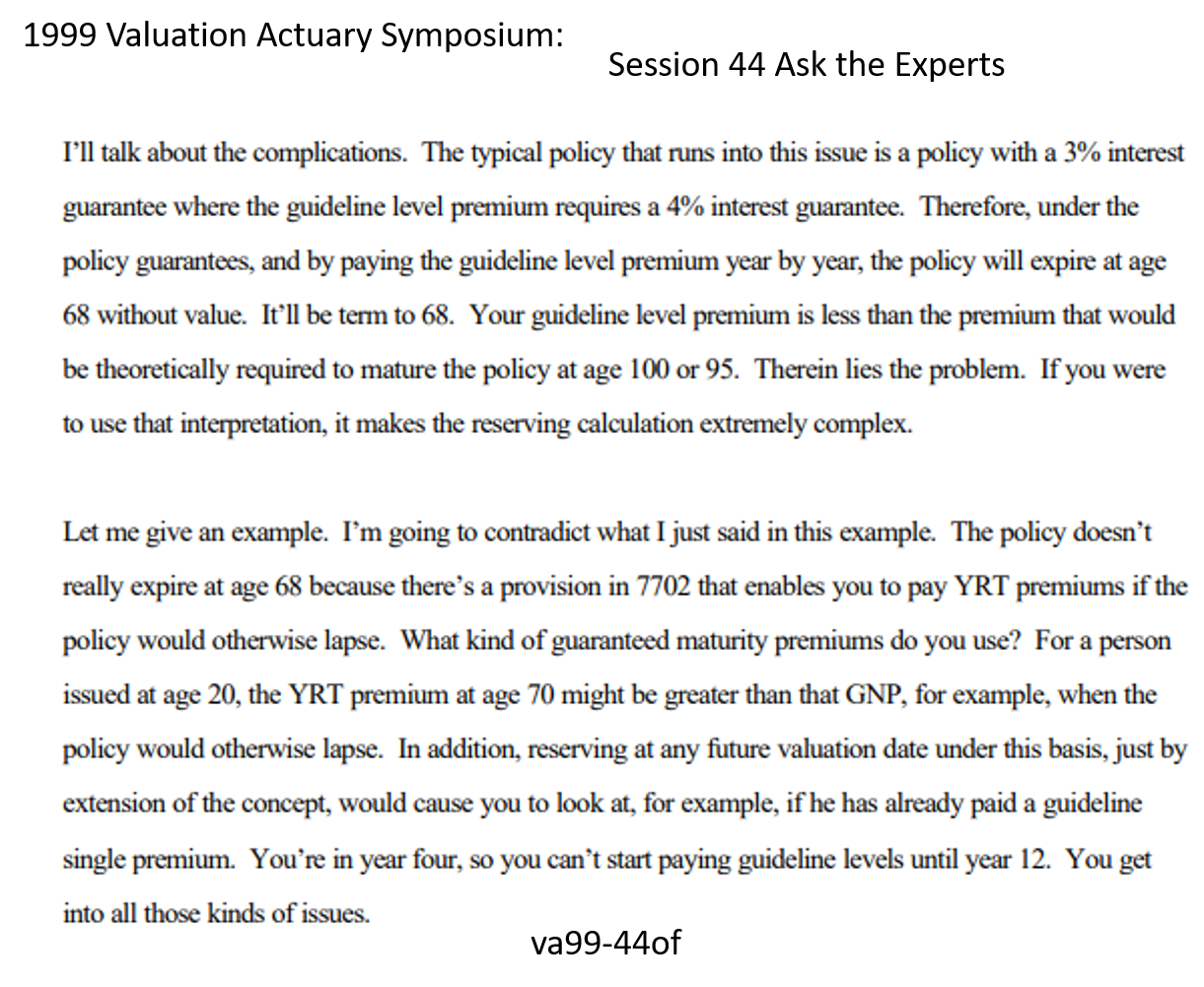

- A regulator had told them that in that case they should not treat their universal life as though it was a whole life policy matured by paying the GMP.

- Rather, you should assume that people will pay the guideline level premium, and that will give you a policy that provides guaranteed coverage for something less than the whole of life.

- [Bonk: GMP = Guaranteed Maturity Premium]

-- Daniel J. McCarthy

1999 - SOA - 1999 Valuation Actuary Symposium, (va99-44of), Edward L. Robbins, Society of Actuaries - 28p

- This paper develops a model which can be used to help life insurance consumers decide how much insurance to purchase.

- The original dynamic programming model developed by Belth is updated and revised to obtain results relevant in today's environment. Sample results of the model are provided and sensitivity analysis is performed with respect to four key variables.

- Many students, as well as members of the public at large, are understandably wary of relying on life insurance agents for the answer.

- Belth' s dynamic programming model has had very little popular acceptance to date.

1980 - AP - Using the Dynamic Life Insurance Programming Model, by Sandra Gustavson - 22p

⇒ 1964 - AP - Dynamic Life Insurance Programing, by Joseph M. Belth, The Journal of Risk and Insurance, Vol. 31, No. 4 (Dec., 1964), pp. 539-556 (18 pages), Published By: American Risk and Insurance Association - JSTOR

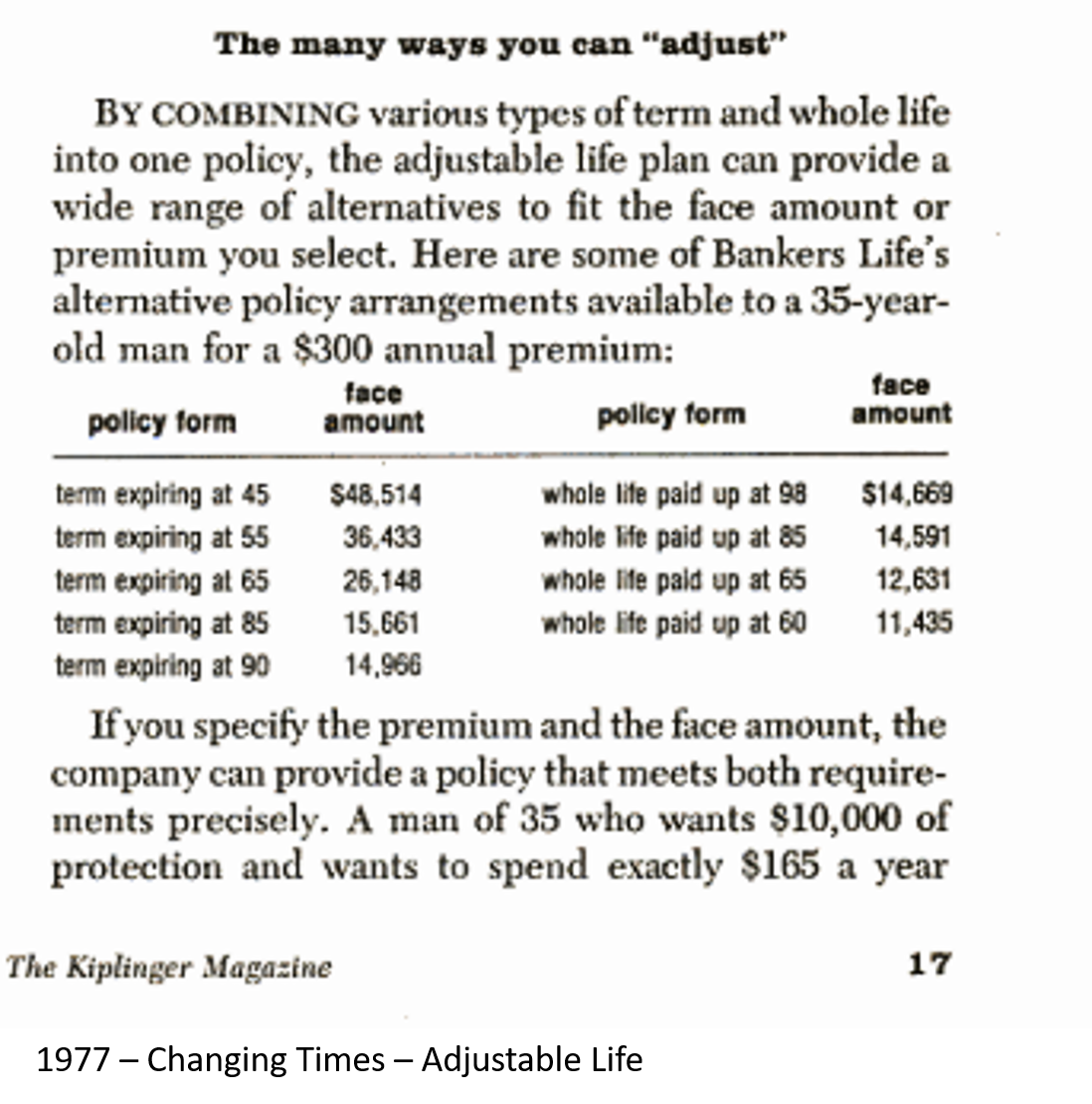

- They merely afford purchasers greater flexibility in designing their contracts so as to meet their individual needs.

- [Bonk: They = Universal Life Insurance Policy]

1982-1, NAIC Proceedings - ACLI - Statement of the American Council of Life Insurance Before the NASAA NAIC Joint Regulatory Insurance - 10p

- As a result of the declining interest rates during the first ten years, the amount accumulated in the deposit fund after ten years is less than anticipated when the contract was issued, and less than necessary to keep the contract in force for the long term if the original "target premium" assumptions were continued.

- Industry experience indicates that policyholders will increase their renewal premium payments in order to maintain their valuable insurance and minimum deposit interest rights."

2004 - ACLI / IAA - Renewal Premiums and Discretionary Participation Features of a Life Insurance, A Joint Research Project - 52p

- Universal Life

- Unlike Adjustable Life, where a current plan is defined, but is subject to change, a Universal Life policy at any time has only a "minimum" and a "maximum" plan, based on the current cash value, and minimum and maximum allowable premiums.

1989-1, NAIC Proceedings

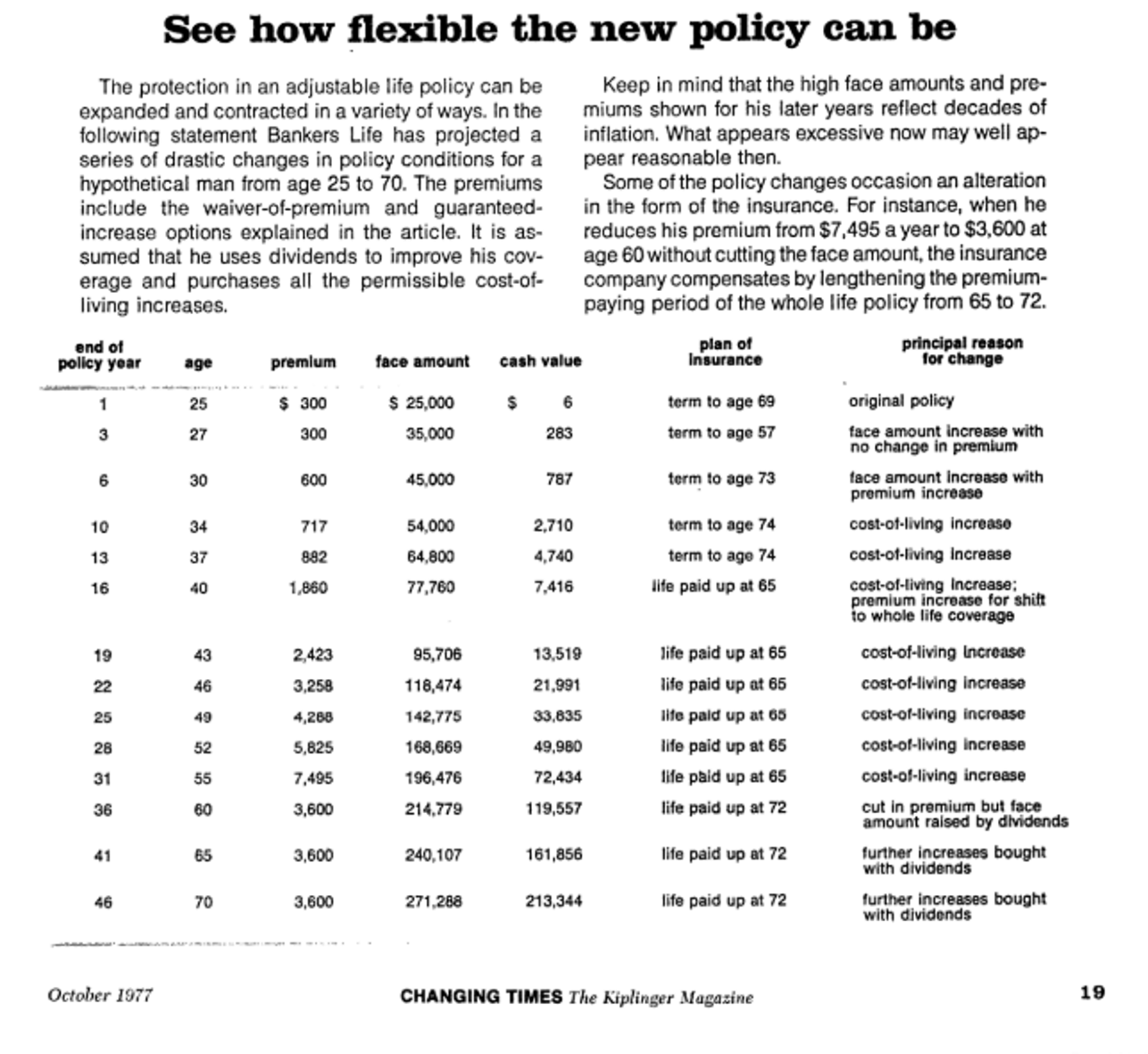

- This leads to the second attitude adjustment that is needed.

- The old distinction between term and permanent is usually not appropriate for an adjustable life policy.

- In every sense an adjustable life policy should be a permanent policy regardless of what the current static plan may be.

- Its flexibility means that it can be the only policy a person ever

owns even if the initial version corresponds to a ten-year term plan. - An adjustable life policy can be adjusted upward or downward in amount and/or premium to accommodate the needs and premium capabilities of the insured.

- It seems better to look at it in terms of what it can adjust to in the future rather than to concentrate on whatever plan today's premium/face amount relationship requires for defining values and dividends.

- The emphasis should be on the basic permanent result that flows from the adjustability.

1976 - SOA - Toward Adjustable Individual Life Products, Society of Actuaries, by Walter L. Chapin - 50p

- Keep in mind that you may be able to make <ACLI Added> changes to <ACLI Added> your current policy to get the benefits or amount of coverage <ACLI Added> you want.

2018 0404 - Letter - ACLI to NAIC LIBGWG - Comments on the “3-19-18 Draft Buyer’s Guide” exposure draft for the Life Insurance Buyers Guide, Binder 4 p209

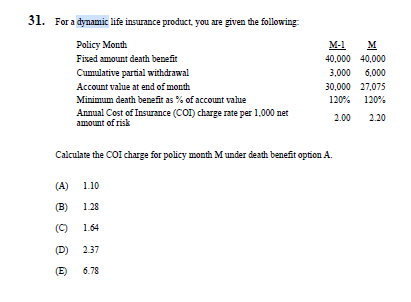

- Let's review the basic mechanics of Universal Life.

- The first thing that has to occur is a premium payment.

- A premium may be paid at any time and in any amount desired.

- Whenever a premium is paid, loads are deducted from that premium.

- The balance is added to a fund.

- On a monthly basis, cost of insurance charges are deducted from the fund.

- Expense charges may be deducted from the fund, especially in the early policy years, and interest is added to the fund on a monthly basis.

- The cash value changes each month based on the net impact of the income and deduction transactions.

- The policy does not lapse if a premium is not paid; rather, it lapses if the fund balance becomes too small to pay the next month's cost of insurance.

- The first thing that has to occur is a premium payment.

-- Ben H. Mitchell, [Bonk: a consulting actuary with Tillinghast in Atlanta - Years-?]

1981 - SOA - Universal Life (RSA81V7N412), Moderator: Samuel H. Turner, Society of Actuaries - 16p

- George Coleman said he hoped this is a dynamic document.

-- George Coleman, Prudential, ACLI, TRG-Technical Resource Group for the NAIC (Industry Advisory Group - Illustrations)

1994-, NAIC Proceedings

- The contract is a lot like the Adjustable Life concepts of The Bankers and Minnesota Mutual, with the significant, additional flexibility that a plan change is not required each time there is a change in premium payments.

- [Bonk: The contract = Universal Life]

-- Spencer Koppel

1979 - SOA - Future Trends and Current Developments in Individual Life Products (rsa79v5n44), Society of Actuaries - 24p

- It's very possible to have a 25-year term with zero cash value, using a UL product.

-- Lawrence Silkes

1990 - SOA - Life Product Development Update (rsa90v16n4b6), Society of Actuaries - 20p

Wisconsin Center of Actuarial Excellence

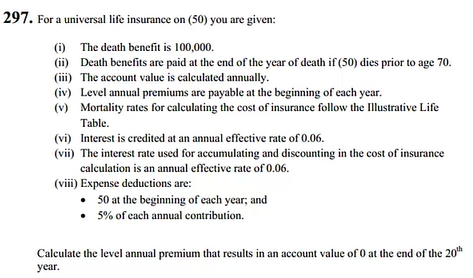

- Learning Objective: Universal Life

- Dynamic

- X - 1980s acli - design your own

- X - Actuarial -

-

"Dynamic Products" are products with premiums and benefits that can fluctuate from month to month, depending on the premiums the policyholder pays, the withdrawals the policyholder makes, the investment returns credited to the policy, and the mortality and expense charges deducted from the policy."

"Some common names for dynamic products include universal life, variable universal life, unit-linked life, and adjustable life."

2000, Life Insurance Products and Finance, page 288, D.B. Atkinson and J.W. Dallas

-

- X - UW - Madison - UL as 2x year term policy

- Legal Case

- Chalke - bga / bgf

- AL - 1, 2 , 3

- X - ULMR - r-ratio / r-factor, Guertin - one ratio

- LIBG - Do the premiums or benefits change?

- Cude - Markup - What are Benefits?

- Is she asking because she doesn't know? or does she want to make it clearer in the LIBG?

- Cude - Markup - What are Benefits?

- 198x - NAIC Update?

- X - 198x - Universal Life

- The Premium can be anything, the Benefit can be anything

- 20XX - NAIC Working Groups

- LIIIWG - How do people explain Universal Life?

- bonknote.com/universal-life-descriptions/

-

NAIC WORKING GROUP PARTICIPANTS

ACLI: 1) Dynamic, Conference Call

2) "Permanent (cash value) insurance ", ACLI Brochure "What You Should Know About Buying Life Insurance." page 2Birney Birnbaum: Permanent,

Brenda Cude: Whole

2018 Life Insurance Buyer's Guide - "cash value insurance"

- LIIIWG - How do people explain Universal Life?

- R-Ratio

- Annual Report to Consumer

- FTC - Table $200

- Adjustable Life

- : marked by usually continuous and productive activity or change