ELIC - Executive Life - California

- To bolster their statutory surplus and reported financial condition, the four insurers reduced policy reserves on their balance sheets through reinsurance transactions and received from their parent holding companies millions of dollars in surplus infusions and loans.

- Although reinsurance is a legitimate practice in the life insurance industry to reduce the strain on surplus of selling new policies, the Executive Life insurers and First Capital relied on questionable reinsurance transactions to artificially inflate their surplus.

- Without reinsurance and borrowed surplus, the Executive Life insurers would have been insolvent as early as 1983.

1992 0218 - GAO - Insurance Regulation: The Failures of Four Large Life Insurers, Statement of Richard L. Fogel, Assistant Comptroller General, General Government Programs - 21p

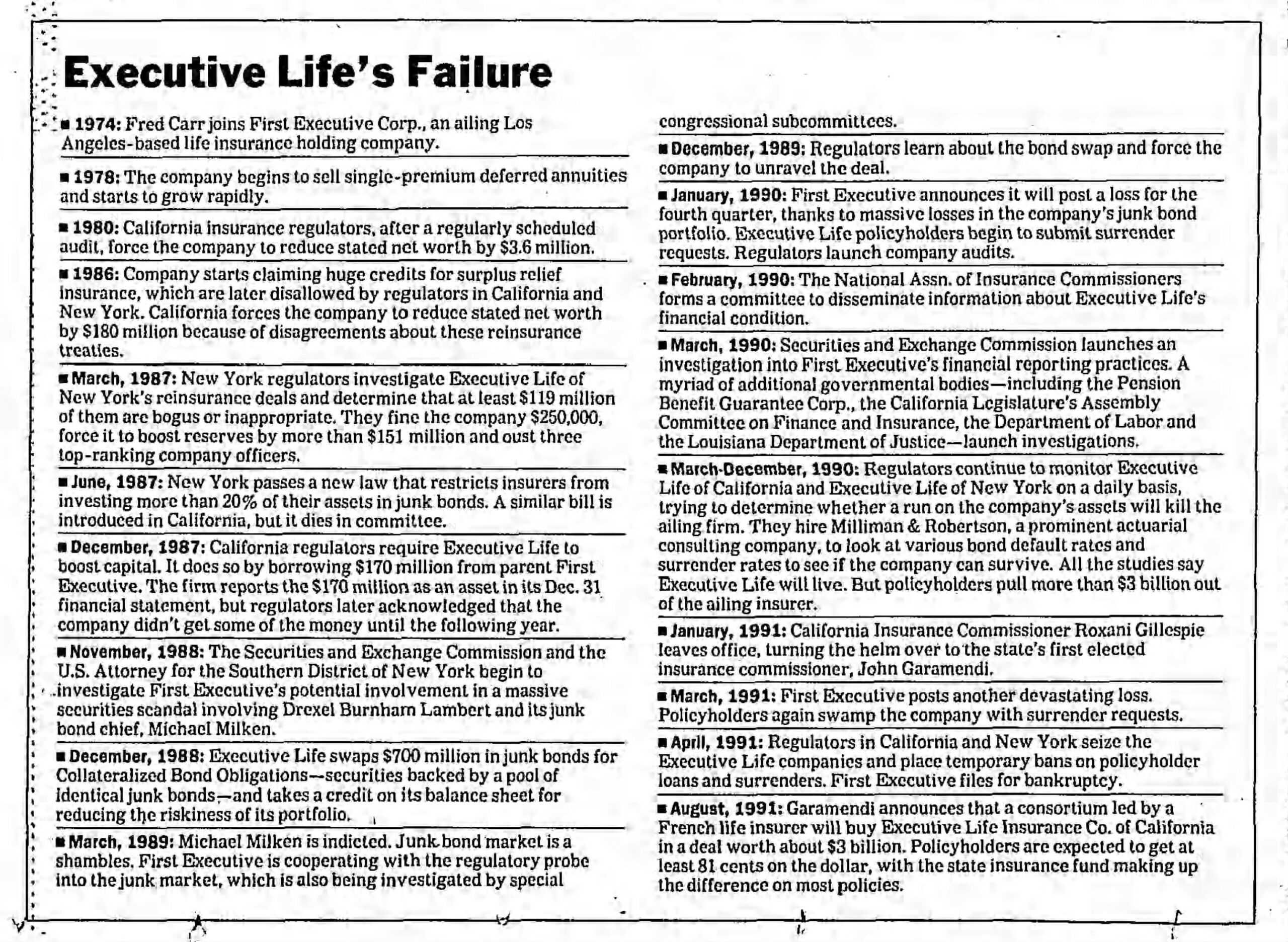

- Executive Life Timeline - s2kmblog.typepad.com/rethinking_structured_set/fred-carr/

- Explorer+Plus, Single Premium Life Insurance Policy

- 1988 0315 - GOV (House) - Investment Uses of Life Insurance - [PDF-257p-GooglePlay,

- 1988 0325 - GOV (Senate) - Tax Treatment of Single-Premium Life Insurance, aka Single Premium Life Insurance - [PDF-199p,

- California Conservation and Liquidation Office - Executive Life - [link]

Executive Life Insurance Failure - [PDF-145p-GooglePlay, VIDEO-CSPAN] - John Garamendi - California Insurance Commissioner

- We have many problems with what is perceived rather than what is actual, and I think there are companies that have been creating those problems for the rest of us.

- Executive Life was doing some very strange illustrations as well as strange investment policies, and we have to do anything we can to stop that.

-- Linda M. Lankowski

1995 - SOA - Practical Illustrations and Nonforfeiture Values, Society of Actuaries - 14p

- Regarding Executive Life, it was obvious that the sale of assets lost value for the policyholders.

- I think I remember reading that it was about $1.5 billion that was given up from the sale of assets quite quickly.

- Garamendi was the Insurance Commissioner for the state of California; he was a novice, and he didn't really understand the insurance industry. He had worked for a bank. I met him once or twice.

- He just had a different outlook on what was going on than somebody who was inside the insurance industry.

- He also was a political animal, so I think he gave up a lot of value to policyholders by selling out so quickly, and he sold to Leon Black.

- He was the one who created a lot of stuff in the first place. He knew what the value of it was. Why would you sell it? It's like selling to the shark. you're going to get bitten. I think it was mishandled.

-- Keven Maloney, Vice President and Senior Analyst of Moody's Investors Service

1999 - SOA - Insurance Company Failures of the Early 1990s-Have We Learned Anything?, Society of Actuaries - 25p

- When I invested my hard-earned money 10 years ago, Executive Life was a health[y] company, rated tops in security in the industry.

- Well, we know what happened in the meantime.

- The management of Executive Life took a lot of risks.

- They invested in things I would never have touched, they gambled, effectively, with my money.

- I would have just as soon as taken it to Las Vegas myself.

- Meanwhile, nobody let me know what they were doing.

- I trusted, perhaps foolishly, the manager of that company, and even worse, I trusted my Government to watch over their actions for me, expecting them to be mindful of those who abuse their power over ordinary citizens.

- No one told me a thing until April 2, 1991. On April 11, 11:30 a.m., the State took over Executive Life and stopped all annuity checks.

- Mine included. . . . I now stand to lose everything.

-- Donn C. Sigerson (p212-13)

c-span.org/video/?17925-1/insurance-company-insolvencies

<Bonk: Donn C. Siegerson also in 1957 - GOV - Tax Problems of Small Business Tax>

- Fred Carr

- Allan L. Chapman

- First Executive - Parent Company

- Credit Lyonnais

- LC - BEFORE THE BOARD OF GOVERNORS OF THE FEDERAL RESERVE SYSTEM - 35p

- California / ELIC

- New York / ELNY

- MetLife

- Trevor Langkamp

- Trevor Langkamp v The United States No. 15-764C filed March 20, 2017, the Court of Federal Claims

- Garamendi

- Guaranty Association Benefits Company

- nolhga.com/

- gabenefitsco.com - Providing Benefits for ELNY Payees

- worldcat.org/identities/lccn-no91019297/

- edwardstonelaw.com/elny/class-action-lawsuit/

- 1992 - Book - Broken Promises: The Inside Story of the Failure of Executive Life, Vic Modugno

- Finally, I have mentioned the NOLHGA.

- Quite frankly, I still don't know what to make about this, but there's no question that they have had a substantial impact on the Executive Life Insurance Company transaction.

- I have no idea how that's going to play out, but the talking process in Executive Life has been significantly impacted by NOLHGA.

- And the last I heard, they are to be considered a serious buyer.

- So in rehabilitation situations, they are a force to be reckoned with.

-- Patrick S. Baird, Vice President and Chief Tax Officer of Aegon U.S.A., Inc.

1991 - SOA - What is a Life Company Worth? Society of Actuaries - 24p

- 2. Discussion of Executive Life

- Commissioner Garamendi noted that he had tentatively approved the National Organization of Life and Health Guaranty Association's (NOLHGA) bid to acquire Executive Life, subject to conditions relating to the guaranty fund's ability to perform.

- He stated that it is essential that enhancement proposals be approved because of the length of the plan and that the commitment must be long-term to assure that it cannot be changed.

- Commissioner Haase inquired if the municipal guaranteed investment contract holders would be taken care of by the NOLHGA plan ...

- and Commissioner Garamendi responded that NOLHGA is working on the proposal but that it must be kept in mind that the more responsibility NOLHGA assumes, the more assessments it must make.

- He stated that this may cause legal problems for the guaranty association.

- He stated that it was his desire to see the matter taken care of prior to year-end.

- Commissioner Garamendi then responded to several additional questions concerning the Executive Life rehabilitation.

- Considerable discussion ensued regarding the NOLHGA bid for Executive Life of California. The officers agreed to stay in communication with Commissioner Garamendi regarding the bidding process. (p152)

- Commissioner Garamendi noted that he had tentatively approved the National Organization of Life and Health Guaranty Association's (NOLHGA) bid to acquire Executive Life, subject to conditions relating to the guaranty fund's ability to perform.

1991-1A, NAIC Proceedings

- 1987 - SOA - Risk is Your Enemy Speaker: Fred Carr*, Society of Actuaries - 20p

- 1991-2A, NAIC Proc. - 12. Heard a report on Executive Life.

- 1992 , Winter - The California Regulatory Law Reporter Vol. 12, No. 1 - 10p

- On November 6, the Commissioner rejected a bid by the National Organization of Life and Health Guaranty Associations, a group which coordinates guaranty funds in 47 states, because it was unable to meet necessary financial conditions.

- This rejection left Executive Life with only two suitors, Altus and a partnership headed by investment banker Hellman & Friedman; each group boosted its offer 3-4% prior to the deadline for bids.

- On November 14, the Commissioner announced that he would recommend to Judge Lewin that Altus be permitted to purchase and rehabilitate Executive Life.

- The decision was based primarily on the bidders' respective treatment of the junk bond portfolio; Altus proposed to immediately rid the insurer of nearly all the bonds, while the Hellman group would have sold off the bonds gradually.

- The Commissioner viewed retention of the bonds as unnecessarily risky to the company.

- 1992 - SOA - Is there Life After Executive Life? Retirement Plan Participants and the Guarantees of Insurance Companies, Society of Actuaries - 22p

- 1993 - LC - Garamendi v. Executive Life Ins. Co

- 1993 - LC - Texas Commerce Bank v John Garamendi, Insurance Commissioner of the State of California; and Executive Life Insurance Company, Defendants and Appellants, and National Organization of Life and Health Insurance Guaranty Associations (NOLHGA), Interveners and Appellants - [PDF-211p-GooglePlay]

- 2002 0130 - GOV (CA) - Attorney General Lockyer Expands Lawsuit Alleging Conspiracy to Raid Executive Life - [link]

- 2005 - LC - State v. Altus Finance, S.A

- scocal.stanford.edu/opinion/state-v-altus-finance-sa-33565

- 36 Cal. 4th 1284, 116 P.3d 1175, 32 Cal. Rptr. 3d 498

- 2008 01 - California. Bureau of State Audits - Former Executive Life Insurance Company Policyholders Have Incurred Significant Economic Losses, and Distributions of Funds Have Been Inconsistently Monitored and Reported - 116p

- 2020 0114 - Belth - No. 349: Executive Life of New York and Its Structured Settlement Annuities Are Back in the News, Joseph Belth - [link]

- 2015 - Book - The Insurance Forum: A Memoir - Joseph Belth - Chapter 7

- November 1986, Executive Life's Bermuda Reinsurance

- March 1987, More on Executive Life's Bermuda Reinsurance

- April 1987, An Interesting Letter from Executive Life

- May 1987, The Reinsurance Disaster at Executive Life

- June 1987, More on the Reinsurance Disaster at Executive Life

- September 1987, Still More on the Reinsurance Disaster at Executive Life

- June 1988, New Questions about Executive Life's Financial Condition

- August 1988, More about Executive Life's Financial Condition

- October 1988, Excerpts from Examination Report on Executive Life

- November 1988, Executive Life, Moody's Investors Service, and Duff & Phelps

- January 1990, Executive Life's Junk Bonds—A Case Study in the Manipulation of Investments to Improve Their Apparent Quality and Provide Surplus Relief

- June 1991, The Collapse of Executive Life

- July 1991, A New and Dangerous Era for the Life Insurance Industry

- December 1991, A Disappointing Book about Executive Life

- An interesting question arising in third-party guaranteed defaults is what happens when the guarantor collapses

- When the letter-of-credit bank or insurance company goes under, or the corporate guarantor goes bankrupt, there is no more credit enhancement or guarantee on the bond issue.

- In these instances bondholders usually lose.

- Such was the case with the $1.6 billion of munis backed by Executive Life and the $600 million of housing issues backed by Mutual Benefit Life Insurance Company. (p150)

-- C. Richard Lehmann, President - Bond Investors Association From 1994 "The Handbook of Municipal Bonds" CHAPTER 33: Municipal Bond Defaults

1995 0726 and 0727 - GOV (House) - Debt Issuance and Investment Practices of State and Local Governments - [PDF-968p-archive.org

- We have learned that an affiliate of Executive Life, Executive Life of New York, went through similar problems.

- However, the policyholders of Executive Life of New York were made whole.

-- Dan Burton (Chairman of the Committee)

------------------------------------------

- The only delay that occurred, there was a 10-day delay between the seizure of the parent company in California and the New York company.

- There was a run on the bank, quite extensive run of the bank in that 10-day period in New York, but the company was able to withstand that.

- Ultimately, the company was taken over by MetLife and the policyholders in New York were made whole. (p48)

-- Statements of James P. Corcoran, Former Insurance Commissioner, State of New York

2002 1010 - GOV (House) - The Collapse of Executive Life Insurance Co. and Its Impact on Policyholders - [PDF-277p,

- The quote said that a few years ago Executive Life had the best guarantees in the business.

1994 - SOA - Problems and Solutions for Product Illustrations, Society of Actuaries - 28p

GOV

-

Insurance Company Insolvencies - CSPAN

-

1991 0522 - Executive Life Insurance Failure - CSPAN

-

1991 0430 - GOV (House) - Pension Annunity [sic] Protection in Light of the Executive Life Insurance Company Failure

- 1992 12 - GAO - Weak Oversight Allowed Executive Life to Report Inflated Bond Values - GGD-93-35 - 44p

- 1993 0802 - GOV (Senate) - Recent Court Decisions Affecting ERISA and Executive Life Annuities - [PDF-53p-GooglePlay

- 2002 1010 - GOV (House) - The Collapse of Executive Life Insurance Co. and Its Impact on Policyholders - [PDF-277p

-

NOV - Book Review - Executive Life:History of Company's Collapse - [link]

https://www.congress.gov/bill/102nd-congress/senate-bill/1644

https://www.actuary.org/files/publications/November%201991%20Actuarial%20Update.pdf

metzenbaum , Mccaran Ferguson

apparent to him that while there was the appearance of lending adequate state regulation, it "was really a mirage. . . . Once you looked through the veil, you could see it was not adequate."

The 1980s, he noted, brought radical changes in the industry, but the regulators didn't keep up.

Citing the example of Executive Life's 1985 clean bill of health, Metzenbaum criticized state commissioners for allowing "gimmicks that mask financial problems ." The state regulation system lacks muscle because "many of the regulators come from the insurance industry, and certainly [many] are expecting to return to the industry . . . when they leave the position of commissioner." As a consequence, "they don't intervene quickly enough.

These issues and others are behind Metzenbaum's recent introduction of S. 1644. This legislationwould establish the independent insurance Regulatory Commission (IRC),

https://www.actuary.org/rmfr/More-RMFR-Issues?page=0%2C115

https://library.unt.edu/gpo/acir/Reports/policy/A-123.pdf

S. 1644: PROPOSAL OF SENATOR METZENBAUM In August 1991, Senator Metzenbaum introduced S. 1644, known as the “Insurance Protection Act of 1991.” The bill would create a federal insurance regulatory commission made up of five members appointed by the President. The commission would have authority to certify state insurance departments. Without such federal certification, a state could not issue a license to engage in insurance in interstate commerce. In order to become certified or accredited, a state insurance department would have to adopt certain uniform minimum federal standards in several areas, including the following: capital and surplus, accounting practices and procedures, investment regulations, liabilities and reserves, independent CPA audits, qualified actuarial analysis, restrictions ownership and transfer of owners of insurers, restrictions on transfer of policies, consumer disclosure, consumer protection, and maintenance of adequate resources by state departments of insurance, such. as a federally mandated minimum number of examiners and actuaries. The commission would periodically examine state in- surance departments to assure their enforcement of and compliance with the federal standards. States that failed to comply could lose their accreditation, forcing insurers in the state to lose their licenses to do business in inter- state commerce. In addition to the insurance regulatory commission, the Metzenbaum bill would create several new entities. A

- 2. Insolvencies among insurance companies have risen in recent years.

- The amount of money assessed by state guaranty funds to pay for insolvencies has increased as well.

Historically, life company failures and guaranty fund assessments have been low. For example, from 1975 to 1982, those assessments averaged $6.2 million a year. Recently, however, life company failures have increased significantly. For example, life guaranty fund assessments tripled from $154.8 million in 1990 to $469.7 million in 1991. The problem of insolvency of life companies is not limited to small companies. In April 1991, the California Department of Insurance seized Executive Life Insurance Company of California. Assessments for Executive Life of California could reach $400 million per year over five years. (p1) - The effect of treating the federal government as a “super creditor’’ is, of course, to reduce the amount of the insolvent insurer’s estate that is available to pay policyholders. The reduction can be dramatic.z1 Recently, IRS pIaced a $643 million lien against the insolvent Executive Life Insurance Company of California. (p39)

- In contrast to the aggregate investment figures listed above, some companies have a far greater percentage of their assets in low quality bonds and risky real estate ventures. For example, investments in junk bonds were a significant factor in the recent failure of the Executive Life Company of California. According to California regulators, approximately $6.4 billion of the company’s $10.4 billion of assets was invested in junk bonds? In 1991, NAIC issued a model regulation restricting insurer investments in ‘%elow investment-grade bonds.” Only eight states have adopted the model regulation. (p63)

- Executive Life of California. As the recent experience with Executive Life of California illustrates, serious problems remain with interaffiliate transactions in insurance holding company systems. In its investigation of the company just prior to the failure, the California insurance department uncovered deceptive transactions among company affiliates.

- For example, in one series of transactions, Executive Life transferred over $700 million of junk bonds in exchange for the securities of six newly formed affiliated partnerships. After this transaction, Executive Life reduced its mandatory securities valuation reserves and increased its surplus by $120 million.2g On completion of its examination two years after the transaction, the California department ordered Executive Life to recalculate its MSVR and to disclose the substance of the junk bond transactions in its Annual Statement. (p65)

- In 1991, Executive Life had over $1.8 billion of muni-GICs outstanding.

- The typical Executive Life muni-GIC worked as follows: (p68)

- In addition to the shortcomings noted by GAO, NAIC’s accreditation program suffers from other problems in connection with the required model laws. For example, the model laws on reinsurance do not address many of the serious problems with reinsurance described in this report. Equally serious, as described in Chapter 3, the required model law on holding company systems contains several loopholes that could allow a parent holding company to shift assets among its subsidiaries, obscuring the true net worth of insurer subsidiaries in a manner similar to the abusive interaffiliate transactions that were implicated in the downfall of Baldwin-United and Executive Life of California. Moreover, NAIC’s proposal for improving state guaranty funds does not address any of the market and regulatory disincentives in the current system. The latter issue is describrf in the following sections. (p76-77)

1992 - GOV (California) - State Solvency Regulation of Property-Casualty and Life Insurance Companies - 144p