FTC - Federal Trade Commission

- ftc.gov/

- Life Insurance

- MLM - Multi-Level Marketing / Pyramid Schemes

- Michael P. Lynch

- Michael Pertschuk

- Robert J. Mackay

- 1919 - FTC - Report - Protecting the Public by Informing the Investor Betterment of Life Insurance Service, Federal Trade Commission - 10p

- - FTC- FEDERAL TRADE COMMISSION DECISIONS FINDINGS, OPINIONS, AND ORDERS JULY 1 , 1982 TO DECEMBER 31, 1982

PUBLISHED BY THE COMMISSION - VOLUME 100 -

1960s

- 1968 11 - FTC - National Consumer Protection Hearings, Federal Trade Commission - [PDF-398p -GooglePlay]

- 1969 - FTC - In The Matter of United National Life Insurance Company Consent Order, Etc.- In Regard to the Alleged Violation of The Federal Trade Commission Act - Docket C-1487 - 107p

- Starts at p200

- Complaint, Jan. 1969-Decision, Jan. 1969 - Consent order requiring a Birmingham, Ala., insurance company io cease misrepresenting that its policies are endorsed or recommended by the United States Armed Forces or any government agency, or that any policy has been issued with the knowledge or consent of the serviceman.

1970s

- 1976 1216 - NYT - F.T.C. Examining Data Given Buyers of Life Insurance - [link]

- 1977 - FTC - In the Matter of American General Insurance Company, et al, Order, Opinion, etc., In Regard to Alleged Violation of SEC 7 of the Clayton Act, Docket 8847. Complaint, June, 1971 - Final Order, June , 1977 - 94p

- American General Insurance Co. v. Federal Trade Commission, 496 F. 2d 197 (5th Cir. 1974).

- 1975 - GOV (Senate) - The Antitrust Improvements Act of 1975

- 1978 0919 - FTC - In The Matter of John Hancock Mutual Life Insurance Co., Et, Consent Order, Etc., In Regard to Alleged Violation of the Federal Trade Commission and Clayton Acts - Docket C-2930– Complaint Sept. 19, 1978 — Decision, Sept. 19, 1978 - 106p

- 1979 07 - FTC - Report - Life Insurance Cost Disclosure, Federal Trade Commission --- [BonkNote] --- [PDF-460p]

- 1979 01 - FTC - Report - Consumer Information Remedies: Policy Review Session, Federal Trade Commission - [385p-GooglePlay]

- 1979 04 - FTC - Report - Life Insurance Sold to the Poor: Industrial and Other Debit Insurance United States, Federal Trade Commission. Office of Policy Planning, by Elizabeth D. Laporte - [PDF-185p-GooglePlay]

- 1979 0710 and 1017 - GOV (Senate) - FTC Study of Life Insurance Cost Disclosure, Howard Cannon (D-NV) --- [BonkNote]

- [PDF-597p-GooglePlay], [PDF-592p]

- 1979 0710 - FTC - Michael Pertschuk, Chairman, Federal Trade Commission - 11p

- It was in the context of this interest among congressional, state and industry authorities that the Commission began its own inquiry into the problem of life insurance cost disclosure. In December, 1976, the Commission announced that it had authorized its staff to investigate four questions:

- (1) whether adequate cost information is being provided to prospective life insurance purchasers

- (2) what types of information would be most accurate and most likely to be useful to consumers;

- (3) the impact such disclosures would be likely to have upon the industry and

upon consumers; and - (4) what would be the most appropriate and feasible course of action for the Commission to take in this area to alleviate any problems found to exist.

- It was in the context of this interest among congressional, state and industry authorities that the Commission began its own inquiry into the problem of life insurance cost disclosure. In December, 1976, the Commission announced that it had authorized its staff to investigate four questions:

- Senate - Committee on Commerce, Science, and Transportation

- 1979 1025 - The Indianapolis News - The Great FTC / Insurance Battle, by John Cunniff --- [BonkNote]

- Life Insurers are furious about a recent government study of their industry that they call a "reckless misrepresentation" of the facts and a deliberate attempt to mislead insurance buyers.

- They seem to have a case too and they may have won sympathy for it at a congressional hearing last week in which they also called the report by the Federal Trade Commission "biased," "flawed," "distorted"

- The FTC has continued to stand by the report.

- 1979 1231 - Letter - President Jimmy Carter to State Governors re: Life Insurance Disclosure, Life Insurance Buyer's Guide - 4p

1980s

- 1980 01 - FTC - Report - Post-purchase Consumer Remedies: Briefing Book for Policy Review Session, Federal Trade Commission. Office of Policy Planning - [GooglePlay]

- 1980 0206 - Congressional Record - congress.gov/bound-congressional-record/1980/02/06/senate-section

- FTC - FEDERAL TRADE COMMISSION ACT OF 1979

- 1979 1120 - NYT - Rushing to Gut the F.T.C. - p2020

- More Media re: FTC

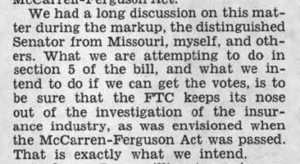

- (p2367-2368) - Senator Howard Cannon (D-NV) -

- What we are attempting to do in section 5 of the bill, and what we intend to do if we can get the votes, is to be sure that the FTC keeps its nose out of the investigation of the insurance industry, as was envisioned when the McCarren-Ferguson Act was passed.

- 1980 0207 - Congressional Record - Senators Howard Cannon (D-NV), Howard Metzenbaum (D-OH), John Durkin (D-NH), re: FTC, McCarran-Ferguson Act - p2368

-- Senator Howard Cannon - (D-NV): "...be sure that the FTC keeps its nose out of the investigation of the insurance industry..."

- 1980 - Congressional Record - Congress Votes FTC Life Insurance GPO-CRECB-1980-pt2-6-2

- 1983 11 - FTC - Resale Price Maintenance - Bureau of Economics Staff Report to the Federal Trade Commission - 216p

- Amway

- 1985 11 - FTC - Report - Life Insurance Products And Consumer Information, by Michael P. Lynch and Robert J. Mackay, Staff Report Bureau of Economics, Federal Trade Commission --- [BonkNote] --- [PDF-317p]

2000s

- 2003 - FTC - Report - The Origins or the FTC: Concentration, Cooperation, Control, and Competition Marc Winerman, Federal Trade Commission - 97p

- 2004 1116 - GOV (Senate) - Oversight Hearing on Insurance Brokerage Practices, including Potential Conflicts of Interest and the Adequacy of the Current Regulatory Framework, CSPAN (Insurance Brokerage and Regulation Practices) --- [BonkNote] --- [PDF-166p, VIDEO-CSPAN]

- J. Robert Hunter, Director of Insurance, Consumer Federation of America

- Complexity produces weak regulation, Unleash the FTC, Anti-trust, Cartel rating organizations, Spitzer report - Regulators have utterly failed,

- J. Robert Hunter, Director of Insurance, Consumer Federation of America

2010s

- 2019 1203 - FTC - The Alchemy of a Pyramid: Transmutating business opportunity into a negative sum wealth transfer, by Andrew Stivers, Federal Trade Commission - 33p

- MEDIA

- 1976 1216 - NYT - F.T.C. Examining Data Given Buyers of Life Insurance - [link]

- The Federal Trade Commission announced today an investigation into the $29‐billion‐a‐year life insurance industry to determine whether consumers are not being properly informed on the costs of coverage.

- 1979 1018 - Washington Post - Aetna Hits FTC Insurance Study As 'Reckless Misrepresentation', by Larry Kramer - [link]

- 1979 0720 - NYT - The Whole Truth About Life Insurance - [link]

- 1976 1216 - NYT - F.T.C. Examining Data Given Buyers of Life Insurance - [link]

Actuarial

- 1979 - SOA - Cost Disclosure (Moss Report), Society of Actuaries - 18p

- 1979 - SOA - EJM - 3-Part Series - Moss Report -1978 – GOV (House) - Life Insurance Marketing and Cost Disclosure

- Part 1 - 1979 02 - SOA - Permutations and Computation, by E. J. Moorhead, Society of Actuaries - 3p

- Part 2 - 1979 06 - SOA - The U.S. Government Cost Disclosure Report, by E. J. Moorhead, Society of Actuaries - 2p

- Part 3 - 1979 11 - SOA - The Oversight Subcommittee Report: Marketing and Cost Disclosure, by E. J. Moorhead - 2p

- 1980 - SOA - The Federal Trade Commission (FTC) Report, Society of Actuaries - 16p

- 1980 - SOA - The Federal Trade Commission (FTC) Report, Society of Actuaries- 8p

- 1987 - AAA Journal - Statement 1987-1, Comments of the Committee on Life Insurance, American Academ of Actuaries on the 1985 FTC Report on Life Insurance Cost Disclosure

- 1995 - SOA - Cash Value Life Insurance for the Twenty-First Century: Segregated Life and the Individual Death Benefit Account, Society of Actuaries - 50p

- Howard Metzenbaum - (D-OH):

1980 0207 - GOV - Federal Register - Senator Howard Cannon - (D-NV), Senator Howard Metzenbaum - (D-OH), Senator John Durkin - (D-NH), re: FTC, McCarran-Ferguson Act - p2382

- 1999 1019 - Letter - Company-? to FTC - Redacted: Reinsurance, Receivership, Ceding Company - 2p

-

Of the notification requirements under Hart-Scott-Rodino Antitrust Improvement Act of 1976 and the Federal Trade Commission's implementing regulations (collectively; (the Act")

-

- 2014 - LR - Transparently Opaque: Understanding the Lack of Transparency in Insurance Consumer Protection, By Daniel Schwarcz - 70p

- 2014 0502 - FTC - Letter - Are GICSs treated as Cash Equivalence for the HSR Act - 1p -- [link]

- magnuson moss ftc rulemaking "life insurance"

- "FTC Improvements Act of 1980"

- FTC disclosure evaluation research from the archives - [link]

- Commission Decision Volumes

- FEDERAL TRADE COMMISSION DECISIONS FINDINGS, OPINIONS, AND ORDERS

- Cases and Proceedings

- Rep Florio Introduces Bill to Give FTC Jurisdiction Over Insurance Practices H.R 2683

- On April 21 Rep James Florio introduced H.R 2683 which would amend the Federal Trade Commission Act and curb the restrictions placed on the FTC by the 1980 FTC Improvements Act.

- The bill was referred to the Committee on Energy and Commerce H.R 2683 would permit the FTC to study life insurance policies and the adequacy of information made available to consumers in regard to them private health insurance coverage the availability of information to consumers regarding automobile insurance and the practices of insurance companies in modifying or cancelling policies.

- The FTC would be mandated to complete its studies and to report to Congress no later than January 1987. (p2)

1983/84 - NAIC - Legislative Update - 407p

- 1957-2, NAIC Proceedings

- The complaint of the Federal Trade Commission, served on National Casualty Company on March 21, 1955, charged the company with false and deceptive advertising of its insurance policies during the preceding two years.

- National Casualty Company denied that its advertising was false or misleading, denied that the proceedings served any public interest, and affirmatively challenged the jurisdiction of the Federal Trade Commission under Public Law 15, the McCarran Act.

- Hearings were held before Frank Hier, and the Hearing Examiner in his initial decision, dated December 6, 1955, held that four of the five categories of advertising complained against were misleading and deceptive, and that the jurisdiction of the Commission was limited to direct mail advertising and to all advertising in those states which had no statute regulating insurance advertising.

- Upon appeal the Commission, by a three to two decision on May 21, 1956, held that all the advertising complained of was deceptive and that the Commission had full jurisdiction over all of the Company's advertising practices irrespective of the existence of state statutes regulating such practices.

- National Casualty Company, in its petition for review of the Order of the Commission by the U.S. Court of Appeals for the Sixth Circuit, reasserted its denial of the merits of the complaint as well as attacking the jurisdiction of the Commission.

- The Court of Appeals in a unanimous decision rendered June 6, 1957, found to unnecessary to decide the merits and disposed of the case by holding that, under the McCarran Act, the Federal Trade Commission is without jurisdiction to regulate the Company's insurance business in those states where such business is regulated by state law.

- The Order of the Commission was set aside on that basis.

- 1958 - LC - FTC v. National Casualty Co., 357 U.S. 560 (1958)

- supreme.justia.com/cases/federal/us/357/560/

- oyez.org/cases/1957/435

-

Oral Argument - April 09, 1958 Oral Argument - April 10, 1958

- I have read with interest the report on H.R. 12934 by our distinguished colleague from West Virginia and the subcommittee.

- I appreciate the $2,885,000 reduction from the administration's request.

- However, I note that the increase over the FTC's current year's spending still will be $4.1 million.

- The report reads:

- The committee views with alarm, the growing tendency of many agencies to invade the jurisdiction of other departments and agencies of the Government and act beyond the scope of the jurisdiction that the Congress intended.

- They slap the FTC for meddling in the life insurance industry-a role traditionally left to the 50 sovereign States of the Republic.

-- Hon. Theodore M. (Ted) Risenhoover. Of Oklahoma in the House of Representatives - Thursday, June 8, 1978

govinfo.gov/content/pkg/GPO-CRECB-1978-pt13/pdf/GPO-CRECB-1978-pt13-2-3.pdf

- 1977-1978 - H.R.12934 - Departments of State, Justice, and Commerce, the Judiciary, and Related Agencies Appropriation Act, 95th Congress

- Sponsor: Rep. Slack, John [D-WV-3] (Introduced 06/01/1978)

Committees: House - Appropriations | Senate - Appropriations Committee Reports: S.Rept 95-1043; H.Rept 95-1253; H.Rept 95-1565

Latest Action: 10/10/1978 Public Law 95-431. (TXT) (All Actions) - congress.gov/bill/95th-congress/house-bill/12934

- Sponsor: Rep. Slack, John [D-WV-3] (Introduced 06/01/1978)

- (p111) - The FTC commissioned three studies, two by Professor Jacoby of Purdue University and one by Professor Formisano of the University of Wisconsin.

- The results of these studies helped improve the FTC's recommended disclosure system.

- They were by no means suppressed, but rather were publicly released at the earliest possible date and have been disseminated widely.

- All the studies are, in fact, summarized in the cost-disclosure report

- the Formisano study on pages 150-163 of the text

- and the much more technical Jacoby studies in a 27 page appendix.

1979 0710 and 1017 - GOV (Senate) - FTC Study of Life Insurance Cost Disclosure, Senator Cannon - [PDF-592p]

- 1979 0711 - FTC GOV - Testimony of Michael Pertschuk, Chairman, Federal Trade Commission - 11p

- Senate - Committee on Commerce, Science, and Transportation

- I think it is very complicated, the idea of borrowing money, and I have talked to a lot of finance company people about it, and the best idea I can get is that the best way to borrow money is to call several companies and find out, not the interest rates and not the finance charges and not the insurance (which is too complicated for me, and I have an advanced degree)...

- ... but I have suggested in our little brochures that the people simply call up and say:

- "If I want to borrow $300, how much do I have to pay back over a two-year period," period.

- Maybe that is incredibly naive, but so far I am informed by the staff of the Commissioners on Uniform State Laws that this is a really good way to do things.

- I am even informed that our posters have been shown to some finance companies, and that they like it.

- ... but I have suggested in our little brochures that the people simply call up and say:

-- Statement of Michael D. Padnos, Director, Atlanta Legal Aid Society

1968 11 - FTC - National Consumer Protection Hearings, Federal Trade Commission - [PDF-398p -GooglePlay]