GMP - Guaranteed Maturity Premium

- p3 - The guaranteed maturity premium for flexible premium universal life insurance policies shall be that level gross premium, paid at issue and periodically thereafter over the period during which premiums are allowed to be paid, which will mature the policy on the latest maturity date, if any, permitted under the policy (otherwise at the highest age in the valuation mortality table), for an amount which is in accordance with the policy structure.1 The guaranteed maturity premium is calculated at issue based on all policy guarantees at issue (excluding guarantees linked to an external referent). The guaranteed maturity premium for fixed premium universal life insurance policies shall be the premium defined in the policy which at issue provides the minimum policy guarantees.2

ULMR - Universal Life Insurance Model Regulation - MDL-585 - NAIC --- [BonkNote] --- 22p

- A regulator had told them that in that case they should not treat their universal life as though it was a whole life policy matured by paying the GMP. --- [Guaranteed Maturity Premium]

- Rather, you should assume that people will pay the guideline level premium, and that will give you a policy that provides guaranteed coverage for something less than the whole of life.

-- Daniel J. McCarthy

1999 - SOA - Valuation Actuary Symposium - Session 44, Society of Actuaries - 28p

- The Guaranteed Maturity Premium is that gross annual premium which will mature the policy based on the guaranteed factors set forth in the policy.

1993-2, NAIC Proc.

- The Model Regulation assumes that future premiums will be paid at the whole life level, and calls this premium the GMP [the guaranteed maturity premium].

- [Bonk: Universal Life Model Regulation - NAIC]

-- Shane Chalke

1984 - SOA - NAIC Update, Society of Actuaries - 24p

- 1999 10 - AAA - Report of the American Academy of Actuaries' Equity Indexed Universal Life Work Group to the Life and Health Actuarial Task Force of the NAIC - 19p

- NAIC - Universal Life Insurance Model Regulation (#585): - 22p

- Universal Life Insurance Model Regulation - Citations - (MDL-585) - NAIC - [BonkNote]

- GMP - Guaranteed Maturity Premium

- "Every universal life insurance policy of which the drafters are aware has a “net level premium” that could be computed which would guarantee permanent protection."

- As a result, it is expected that most universal life insurance policies will be sold as permanent plans."

- "Every universal life insurance policy of which the drafters are aware has a “net level premium” that could be computed which would guarantee permanent protection."

- GMF - Guaranteed Maturity Fund

- The guaranteed maturity fund at any duration is that amount which, together with future guaranteed maturity premiums, will mature the policy based on all policy guarantees at issue.

- r-ratio

- "The letter “r” is equal to one, unless the policy is a flexible premium policy and the policy value is less than the guaranteed maturity fund, in which case “r” is the ratio of the policy value to the guaranteed maturity fund."

For the UL Model Reg, you start by calculating a guaranteed maturity premium (GMP).

- This is calculated at issue, so once the policy is issued, unless you have a policy change of some sort, it is fixed.

- It’s the level premium that will mature the policy for the specified amount. In other words, if you have a $100,000 specified amount policy, it’s the premium that you have to pay every year so that the maturity value when your policy matures is $100,000. It’s based on the guarantees in the contract: guaranteed mortality, guaranteed interest and guaranteed expense charges.

- From this, you then calculate a guaranteed maturity fund (GMF).

- The GMF is...

2005 - Statutory Financial Reporting for Universal Life, Jeffrey A. Beckley, Society of Actuaries - 15p

- The Model Regulation assumes that future premiums will be paid at the whole life level, and calls this premium the GMP [the guaranteed maturity premium].

- [Bonk: Universal Life Model Regulation - NAIC]

- The GMP is analogous to the guideline level premium (GLP) from TEFRA, the only differences being in the area of assumptions.

- The GMP is calculated using plan guarantees, regardless of their level, and with no restrictions on plan form (20 year endowment, 10 pay life, etc.).

- For most plans, however, the GMP should be equal to the GLP from TEFRA.

-- Shane Chalke

1984 - SOA - NAIC Update, Society of Actuaries - 24p

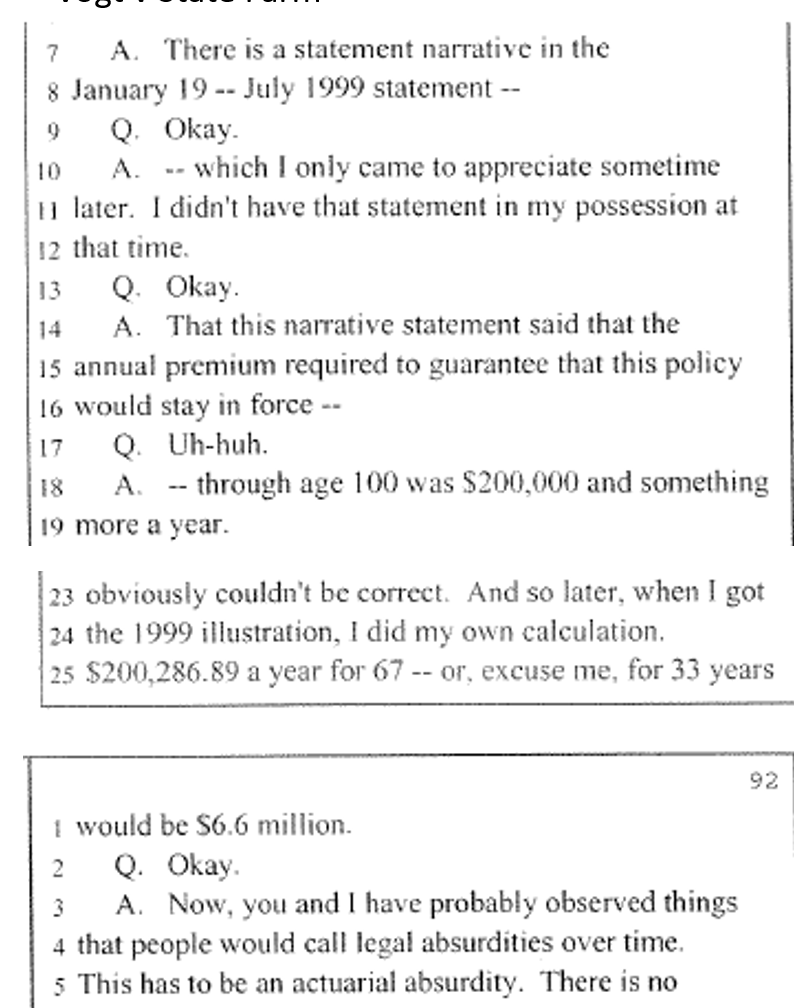

- Blumenthal v New York Life - Sanderford (Expert Witness for Blumenthal) - Guaranteed Maturity Premium

- 85-3 - Deposition of David Sanderford - Plaintiff Expert Witness - 65p

- 1999 10 - AAA - Report of the American Academy of Actuaries' Equity Indexed Universal Life Work Group to the Life and Health Actuarial Task Force of the NAIC - 19p

- The Task Force also believes that manipulative patterns of COl deductions will be weeded out by their GMP test.

- Examples have been given to the regulators that a whole life product filed in their state today that offered cash values that were equal to 1941 CSO 2.5% values would probably be approved, as long as the paid-up values were on the more current non-forfeiture basis, but a similar UL product would not be approved.

-- Philip K. Polkinghorn

1988 - SOA - Update on Universal Life Reserves and Non-Forfeiture Values, Society of Actuaries - 36p

- I’ll talk about the complications.

- The typical policy that runs into this issue is a policy with a 3% interest guarantee where the guideline level premium requires a 4% interest guarantee.

- Therefore, under the policy guarantees, and by paying the guideline level premium year by year, the policy will expire at age 68 without value. It’ll be term to 68.

- Your guideline level premium is less than the premium that would be theoretically required to mature the policy at age 100 or 95.

- Therein lies the problem.

- If you were to use that interpretation, it makes the reserving calculation extremely complex.

- Let me give an example. I’m going to contradict what I just said in this example.

- The policy doesn’t really expire at age 68 because there’s a provision in 7702 that enables you to pay YRT premiums if the policy would otherwise lapse.

- What kind of guaranteed maturity premiums do you use?

-- Edward L. Robbins

1999 - SOA - Valuation Actuary Symposium - Session 44 (va99-44of), Society of Actuaries - 28p

- Life and Health Actuarial Task Force - Conference Call - August 22, 2000

- 2. What is the projection interest rate to be used to calculate the guaranteed maturity premium and the guaranteed maturity fund for variable universal life policies?

2000-, NAIC Proceedings

- MR. ROBBINS: The actual wording is, “the guaranteed maturity premium shall be that level gross premium paid at issue, and periodically, thereafter, over the period during which premiums are allowed to be paid, which will mature the policy on the latest maturity date, if any, permitted under the policy.”

- So it has two things that are sort of in conflict: “Allowed to be paid” and “which will mature the policy".

- MR. RAYMOND: It’s hard to tell whether “permitted under the policy” only refers to the latest maturity date or if it refers to the premiums also.]

- MR. MCCARTHY: As Ed pointed out, this happened before 7702.

- MR. RAYMOND: Nobody thought of these things back then.

- FROM THE FLOOR: I just wanted to mention that some of us, a few years ago, quit including any difference between current and guaranteed expense charges into our guideline premium calculations, I believe on your advice.

- MR. MCCARTHY: I didn’t know she was going to do that.

- FROM THE FLOOR: For recent issues that means that guideline premiums are always going to be less than guaranteed maturity premiums.

1999 - SOA - Valuation Actuary Symposium - Session 44 (va99-44of), Society of Actuaries - 28p

- 1994 - Letter - NALU to NAIC (LDWG) - NALU [Currently NAIFA] National Association of Life Underwriters to the NAIC Life Disclosure Working Group - 1994-1, NAIC Proc.

- GMP - Guaranteed Maturity Premium

- 1994 NALU Cover Page GMP ATTACHMENT FOUR-C

- Statement of the National Association of Life Underwriters (NALU) to the NAIC Life Disclosure Working Group of the Life Insurance (A) Committee on Life Insurance Illustrations January 31, 1994

- 13. The Cover Page for any illustration should contain the annual premium necessary to maintain the policy to maturity based solely upon the guarantees in the policy.

- This will assist the policyowner in understanding the differences between guaranteed and non-guaranteed policy features.

- 1990 - LC - USAA Life Ins. Co. v. Commissioner 60 united States Tax court Mar 26, 1990 94 T.C. 499

- ...conceptually similar to the NLP, the GMP differs in some notable respects.

- The GMP is calculated using universal life fund mechanics; the NLP uses commutation functions.

- The GMP is based on policy guarantees of interest and mortality; the NLP is based on valuation assumptions of interest and mortality.

- Flexible Premium Universal Life-Type Contracts

- Alternative minimum reserves shall be required, if applicable, for flexible premium universal life-type contracts if the guaranteed maturity premium is less than the valuation net premium.

1998 - Statutory Issue Paper No. 56 - Universal Life-Type Contracts, Policyholder Dividends, and Coupons STATUS - Finalized March 16, 1998, Original SSAP: SSAP No. 51; Current Authoritative Guidance: SSAP No. 51R- 12p