Informed Consumer

|

2016/4/3 - Life Insurance Illustrations Working Group Conference Call - NAIC Proceedings

|

2016 |

vs

| 1982 |

1982 Proc. II 359-360 - Universal Life Model Regulation - Citations

|

- The working group's concern was how to bring about a change without damage to the marketplace.

1993-4, NAIC Proceedings

We are seeing a real crisis in confidence:

- That, in my mind, is probably the worst thing that could happen.

- There is not a company in the country that can stand runs that

Commissioner Weaver was talking about, where people ask for $1

billion in policy loans and surrenders in a 2-week period.

- Some thing like that happened with Executive Life and Mutual Benefit.

- Even the strongest cannot respond to those claims. <page 13>

--- William McCartney, William, Director of Insurance, State of Nebraska and Vice President, National Association of Insurance Commissioners

1991 - GOV - REGULATION OF INSURANCE COMPANIES AND THE ROLE OF THE NATIONAL ASSOCIATION OF INSURANCE COMMISSIONERS - 286p

2020/7/24 - NAIC Life Insurance Illustrations Working Group Conference Call - ACLI - Pat Reeder

-Idea of the Informed Consumer

3 Broad Recommendations:

1) Consumer Testing -Fundamental Question: Will this form enhance the customer experience?

2) Enhance the NAIC Electronic Consumer's Guide - NAIC Life Insurance Information - Example: SEC Summary Prospectus

3) Have a larger discussion about the disclosure and buying process... backed with data driven studies to understand when consumers need what information in the buying process. Consider the information available at each point in time.

Complaints and inquiries related to life insurance and annuity products were less frequent, and generally concerned consumer dissatisfaction with, or confusion regarding Universal Life insurance policies.

2018 - Wisconsin Insurance Report, page 90

Monitoring of litigation may alert regulators to issues that the regulatory system has not yet addressed.

2008-3, NAIC Proc.

More NAIC Proceedings

Proceeding Citations

Section 8. Disclosure Requirements

The main concern was that an unsophisticated buyer purchased a policy and did not know what the coverages, benefits and limitations were. 1988 Proc. II 566.

- Also, because most people presume that if you pay your premium continuously, your policy will remain in effect, quite a few people had a hard time understanding how or why the policy would terminate in policy year 31.

- This was simply foreign to their way of thinking.

1990 - 1A NAIC Proceedings - NAIC LIMRA - Universal Life Disclosure Form Test Market Results - 10p - Consumer Testing

......identified which should be disclosed: (2) adequate disclosure of the fact that a premium quoted will not support the contract for the whole life if the policy is a universal life policy;

1988 Proc. II 566.

Universal Life Model Regulation - Citations (ULMR) (MDL-585)

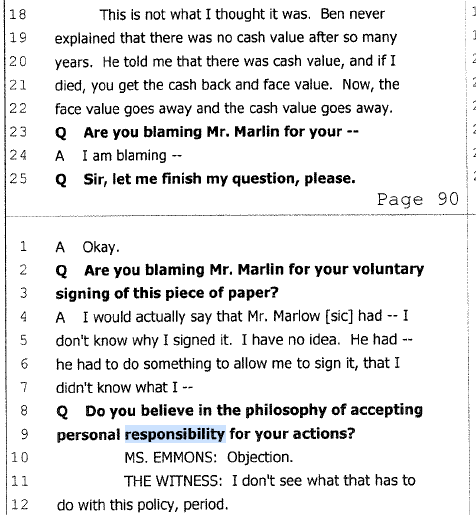

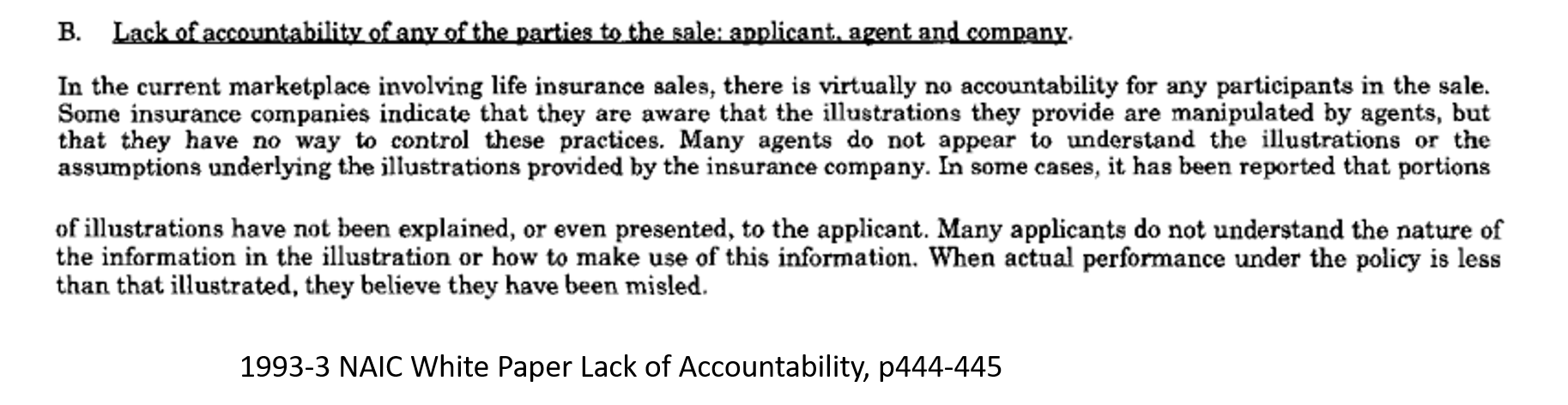

.....there is virtually no accountability for any of the participants in the sale, not for the company, not for the agent, and interestingly, the white paper discussed accountability on the part of the purchaser as well. Accountability is a major issue."

-- ROBERT E. WILCOX - Chairman of the Life Insurance Disclosure Working Group (NAIC)

1994 - PROBLEMS AND SOLUTIONS FOR PRODUCT ILLUSTRATIONS, Society of Actuaries

- ......need to take a Broader Look at how all products are explained to consumers........ Universal Life

COMMON / PARADIGM

Permanent / Whole / Cash Value

NAIC - Brenda Cude

|

Comment [BJC2]: Permanent insurance is a We would prefer – Life insurance comes No Date, Assuming approximately 11/15/2017 |

Universal life insurance is permanent life insurance combining term insurance with a cash account earning tax-deferred interest.

https://content.naic.org/cipr_topics/topic_life_insurance.htm

EXPLORE

"Completely Flexible," "Dynamic Products," "ratebook and more," "Design Your Own," "Innovative"

The words "whole life" or "ordinary life" don't tell anyone anything, and yet we use them as though they were second nature to the rest of the world simply because we have used them. -- BARBARA J. LAUTZENHEISER

1981 -THE LIFE INSURANCE BUSINESS---THE VIEW OF CONSUMERISTS, Society of Actuaries

The foregoing is only one approach to the design of a contract with the desired characteristics.

There is ample scope for variations in the form of the term life insurance, the loading pattern, the accumulation process, the

availability of optional benefits and other features.

It should be noted that the suggested design can provide any conceivable pattern of premium payment and coverage and thus can replace all other products.

Hence, the Universal Life Insurance Policy.

-- James C. H. Anderson

1975 - The Universal Life Insurance Policy, Society of Actuaries

<RE: Universal Life> In order to obtain a certain pattern of guaranteed benefits, how much does the policyholder have to put in his account value? -- MICHAEL F. DAVLIN

1983 - Universal Life, Society of Actuaries - 22p - rsa83v9n32

RE: Universal Life

"If that is the case, how does an agent program somebody? How does he tell a person what he needs to pay to keep his premiums level or to have paid-up insurance at age 65?" -- ALLAN W. SIBIGTROTH

1979 - FUTURE TRENDS AND CURRENT DEVELOPMENTS IN INDIVIDUAL LIFE PRODUCTS, Society of Actuaries - 24p - rsa79v5n44

If appropriate, the paragraph might add something like "The amount of premium you have elected to pay, $300 per year, is however insufficient to keep the policy in force to age 95 at the guaranteed minimum interest rate of 4%; the policy would terminate at age 66.

To be sure that the policy continues to age 95, even at the minimum interest rate of 4%, you would have to pay $644.30 per year for the entire life of the policy."

1990-1A NAIC Proceedings - NAIC LIMRA - Universal Life Disclosure Form Test Market Results - 10p - Consumer Testing

DICTIONARY - Universal

PREMIUM

NAIC

Be Sure You Can Afford the Premium

Before you buy a life insurance policy, be

sure you can pay the premiums. Can you

afford the initial premium? If the premium

increases later, will you still be able to afford

it?

NAIC - Life Insurance Buyer's Guide

https://www.naic.org/documents/prod_serv_consumer_lig_lp.pdf

MEDIA

It <Universal Life> can cover you for the duration of your life, as long as the premiums are paid. -- Understanding Universal Life Insurance

https://www.forbes.com/advisor/life-insurance/universal-life-insurance/

The policy <Universal Life> stays in effect for as long as you remain alive and pay the premiums.

https://www.usnews.com/360-reviews/life-insurance/universal-life-insurance

PROBLEM?

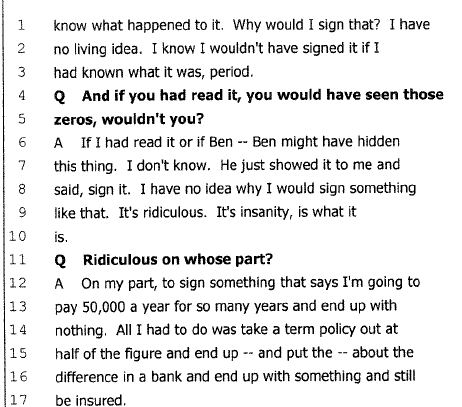

LEGAL CASES

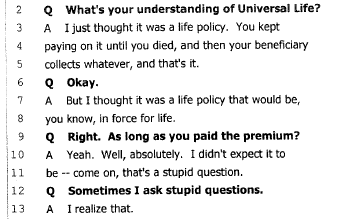

"John <Plaintiff - Policyowner> contacted Glasgow <Agent>, who had retired in 2000, to inquire why his policies <Universal Life> would be terminating, even though he had timely paid the premiums on the policies for approximately 18 years."

2010 - Maloof v John Hancock Alabama Supreme Court Opinion - 39p

EXPLORE

- Section I

- Finally, almost nobody understood the difference between a flexible premium and fixed premium policy.

- As indicated previously, this confusion was enhanced by the fact that the charts showed a level premium which they interpreted as being a fixed premium.

1990-1A NAIC Proceedings - NAIC LIMRA - Universal Life Disclosure Form Test Market Results - 10p

Guaranteed Maturity Premium, Guideline Premiums, Target Premium, Planned Premium

2017/11/15, LIBGWG, ACLI Redlined Draft

Unlike a term policy, which can end after a specified number of years, permanent life insurance will continue to the policy’s maturity age so long as premiums are paid.

(Note that this isn’t exactly accurate for UL, where policies can continue as long as the cash value is sufficient to pay the policy charges. We may want to make that distinction.) <<< ----BonkNote: ACLI Wording>>>

2016/4/3 LIIIWG CC, NAIC Proceedings

- ......consumers being better able to understand the product performance......

PERFORMANCE

??????

PROBLEM?

|

1997, The Next Generation Universal Life, |

"The actual-versus-expected performance for some UL policies led to class-action lawsuits that have caused a substantial amount of negative attention to be focused on cash-value life insurance in the illustration of projected values." |

EXPLORE

DURATION / LENGTH OF COVERAGE/ PLAN OF INSURANCE

DYNAMIC

Section V

- Also, because most people presume that if you pay your premium continuously, your policy will remain in effect, quite a few people had a hard time understanding how or why the policy would terminate in policy year 31.

- This was simply foreign to their way of thinking.

1990-1A NAIC Proceedings - NAIC LIMRA - Universal Life Disclosure Form Test Market Results - 10p

2019/9/17, NAIC LIIIWG Teresa Winer

I think if you can refer to the eventual Illustration and just show the cash value.

ACCOUNTABILITY - Snippets

NAIC - White Paper

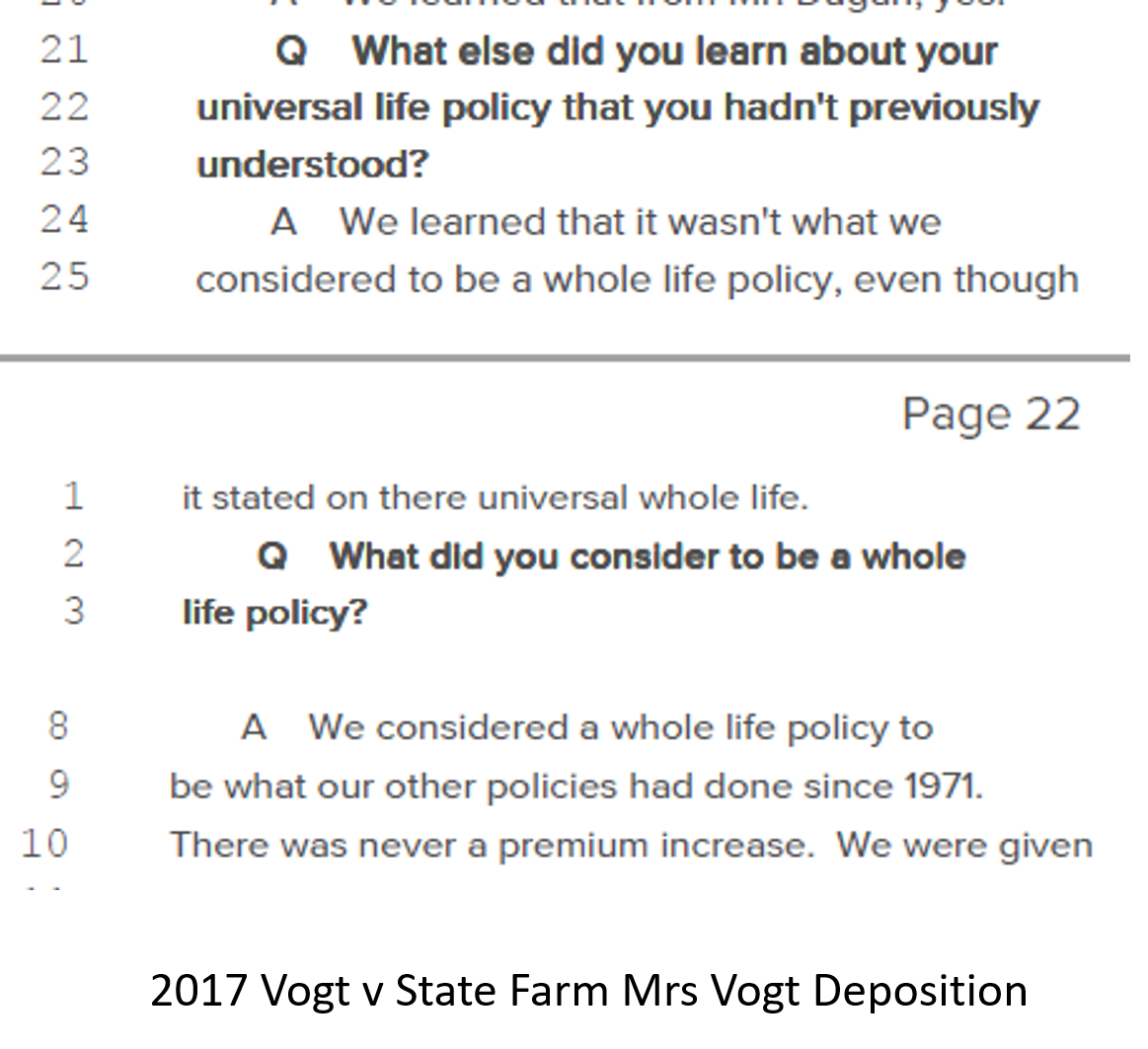

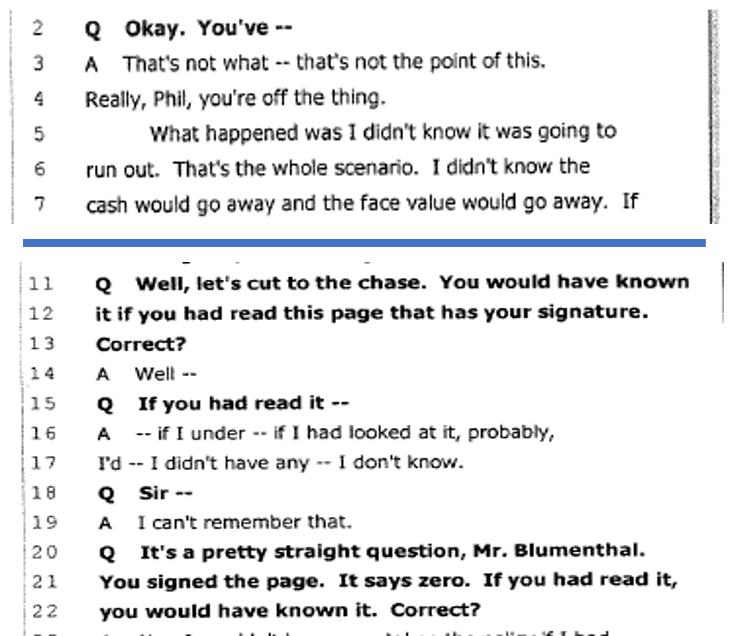

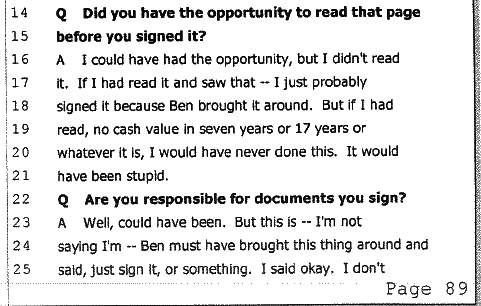

LEGAL CASE - 2010 - Blumenthal v New York Life

INDUSTRY

I sincerely believe we have a flawed instrument in today's sales illustrations.

It is neither a reason to condemn our industry nor pretend our industry should have been immune to change, especially with the economic realities of the past few years.

But we did not communicate the impact of change as well as we should have, especially the impact of change on the numbers we used in our sales illustrations.

So our challenge is to learn and to respond. I sincerely believe it's a shared responsibility by all of us - agents, the actuarial profession, company leadership, regulators and even the consumer.

Our biggest mistake would be to delay. I don't believe the consumer will tolerate or forgive us, let alone the regulators, if we do nothing.

-- Robert Nelson (NALU / NAIFA)

1993 - SALES ILLUSTRATIONS - WE CAN'T LIVE WITH THEM, BUT WE CAN'T LIVE WITHOUT THEM!, Society of Actuaries

2018/11/09 - ACLI - ML <Bonk>

"Neither model was intended to generate Buying Guides or to relieve consumers of their own individual responsibilities to understand the product that they are spending their hard-earned money to buy after all.

NONGUARANTEED ELEMENTS

- Brenda Cude (University of Georgia) said the issue of NGEs <Non-Guaranteed Elements> is interesting, but not something the average consumer would understand.

2017-3V1, Life Insurance Buyer’s Guide (A) Working Group - NAIC

- Brenda Cude (Cooperative Extension Service) opined that the target audience does not care about assumptions."

1996-3V2, Report of the Cost Indices Subgroup of the Life Disclosure (A) Working Group - NAIC

American Academy of Actuaries - "Because NGEs <Non-Guaranteed Elements> are likely to change, the ongoing performance of products with NGEs should be reviewed periodically after purchase to assess the impact of any NGE changes and consider actions that policyholders may wish to take (e.g., adjust premium payments or death benefits)."

2017-3V1, Life Insurance Buyer’s Guide (A) Working Group

The educational task is huge, and it's not just with the customers; it's with our agents also.

I would say to all of you that if you think that you don't have any customers or any agents who fail to understand what a nonguaranteed illustration really means, you're kidding yourself. -- Walter Miller

1991 - Illustrations, Society of Actuaries

They are complaints about things that we can’t do anything about because the contract might be a Universal Life type product with Nonguaranteed Elements, and there is no regulatory framework to deal with those issues.

Those complaints just fall by the wayside because there is nothing that can be done. “Mr. Gorski <Regulator>

1996 - Nonforfeiture Law Development, Society of Actuaries - 23p