LTTR - 2021

"The "unbundling" of services and other product differences between Universal Life and Ordinary Life cause current literature to be inapplicable, as well as insufficient, for Universal Life."

1984 - American Academy of Actuaries - Journal

ACLI

They <Universal Life Policy> merely afford purchasers greater flexibility in designing their contracts so as to meet their individual needs.

1982-1 STATEMENT OF THE AMERICAN COUNCIL OF LIFE INSURANCE BEFORE THE NASAA NAIC JOINT REGULATORY INSURANCE - 10p

Keep in mind that you may be able to make <ACLI Added> changes to <ACLI Added> your current policy to get the benefits or amount of coverage <ACLI Added> you want.

2018/03/19 - ACLI Letter: Comments on the “3-19-18 Draft Buyer’s Guide” exposure draft for the Life Insurance Buyers Guide

Binder 4 p209

...completely Dynamic services and policy opportunities for their customers to purchase and to elect a variety of options."

2019/11/09- LIIIWG CC - Michael Lovendusky, ACLI

Universal life insurance: A type of permanent life insurance that allows the insured, after the initial payment, to pay premiums at various times and in varying amounts, subject to certain minimums and maximums. To increase the death benefit, the insurance company usually requires the policyholder to furnish satisfactory evidence of continued good health. Also known as adjustable life insurance.

---

Adjustable life insurance: A type of life insurance that allows the policyholder to change the plan of insurance, raise or lower the policy’s face amount, increase or decrease the premium, and lengthen or shorten the protection period.

2017 - GLOSSARY OF INSURANCE-RELATED TERMS, ACLI FACT BOOK

Actuarial

The contract <Universal Life> is a lot like the Adjustable Life concepts of The Bankers and Minnesota Mutual, with the significant, additional flexibility that a plan change is not required each time there is a change in premium payments.

-- SPENCER KOPPEL

1979 - FUTURE TRENDS AND CURRENT DEVELOPMENTS IN INDIVIDUAL LIFE PRODUCTS, Society of Actuaries

2017/11/15, LIBGWG, American Academy of Actuaries, Letter

- Universal life also allows for flexibility in policy benefits, not just premium payments.

American Academy of Actuaries - "Because NGEs <Non-Guaranteed Elements> are likely to change, the ongoing performance of products with NGEs should be reviewed periodically after purchase to assess the impact of any NGE changes and consider actions that policyholders may wish to take (e.g., adjust premium payments or death benefits)."

Regulators

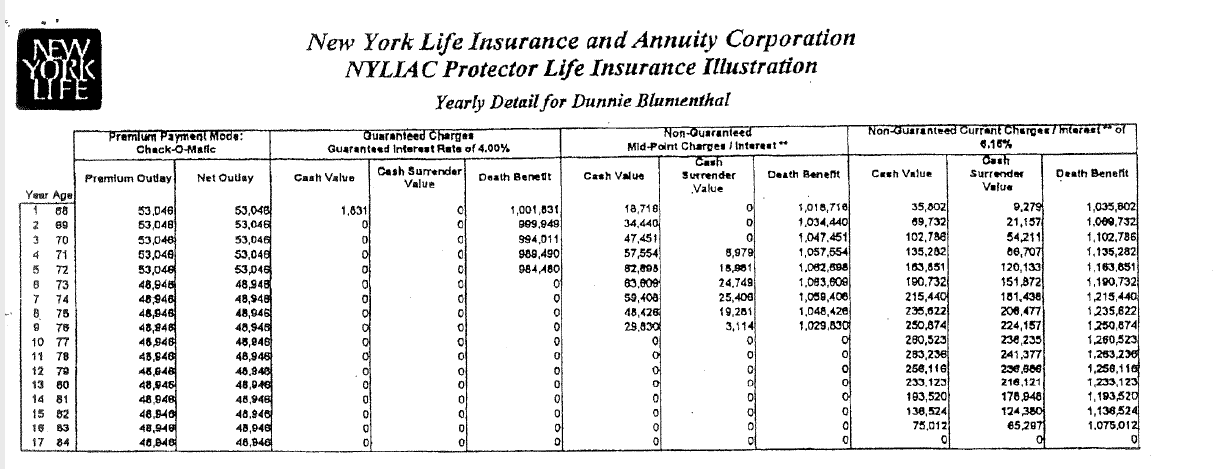

So, I think ... if you can refer to the eventual illustration and just show the cash value.

-- Teresa Winer (GA)

2019/9/17, NAIC Life Insurance Illustrations Working Group, <Bonk>

- Our sales illustrations are developed to comply with state laws and regulations.

- While the expiration date of the policy is not required by law, it is an important feature because it lets the customer know how long the policy will remain in-force, <Coverage Period> based on guaranteed factors and planned premiums (p187)

1991-1992 - FINAL REPORT* OF THE TASK FORCE FOR RESEARCH ON LIFE INSURANCE SALES ILLUSTRATIONS - 142p, Society of Actuaries