Valuation Manual - NAIC

- Universal Life Plans (Other than Variable), issued without a Secondary Guarantee:

- 061 = Single premium universal life

- 062 = Universal life (decreasing risk amount)

- 063 = Universal life (level risk amount)

- 064 = Universal life – unknown whether code 062 or 063

- The term “net premium reserve” (NPR) means the amount determined in Section 3 of VM-20.

2021 - NAIC - Valuation Manual - 330p

- 2022 - NAIC - Valuation Manual - 338p

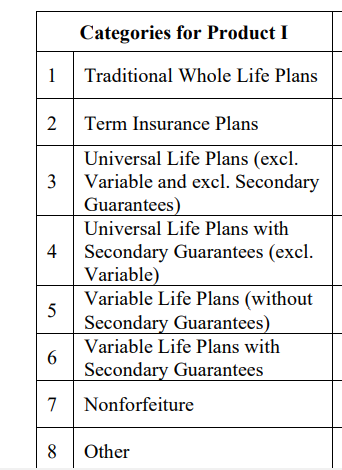

- Categories for Products - p51-12, p302

- 2012 02 - Report - Milliman for ACLI - VM-20 Impact Study Compendium - 148p

- Section 3: Interest

- A. The nonforfeiture interest rate for any life insurance policy issued in a particular calendar year beginning on and after the operative date of the Valuation Manual shall be equal to 125% of the calendar year statutory valuation interest rate defined for the NPR in the Valuation Manual for a life insurance policy with nonforfeiture values, whether or not such sections apply to such policy for valuation purposes, rounded to the nearer one-quarter of 1%, provided, however, that the nonforfeiture interest rate shall not be less than the applicable interest rate prescribed to meet the definition of life insurance in the Cash Value Accumulation Test under Section 7702 (Life Insurance Contract Defined) of the U.S. Internal Revenue Code.

Guidance Note: For flexible premium universal life insurance policies as defined in Section 3.D of the Universal Life Insurance Model Regulation (#585), this is not intended to prevent an interest rate guarantee less than the nonforfeiture interest rate.

- D. NPR Calculation and Cash Surrender Value Floor

- 1. For policies other than universal life policies, the NPR shall not be less than the greater of:

- a. The cost of insurance to the next paid to date.

- The cost of insurance for this purpose shall be based on the policy year in which the valuation date falls, using the mortality tables for the policy prescribed in Section 3.C

- b. The policy cash surrender value calculated as of the Valuation date and in a manner that is consistent with that used in calculating the NPR on the valuation date.

- a. The cost of insurance to the next paid to date.

- 2. For a universal life policy, the NPR shall not be less than the greater of:

- a. The amount needed to cover the cost of insurance to the next processing date on which cost of insurance charges are deducted with respect to the policy.

- The cost of insurance for this purpose shall be based on the policy year in which the valuation date falls, using the mortality tables for the policy prescribed in Section 3.C, and it shall be based upon the net amount at risk.

- “Cost of insurance,” as used here, refers to the valuation mortality rate, not the UL policy’s contractual cost of insurance or expense charges.

- b. The policy cash surrender value calculated as of the valuation date and in a manner that is consistent with that used in calculating the NPR on the valuation date.

- a. The amount needed to cover the cost of insurance to the next processing date on which cost of insurance charges are deducted with respect to the policy.

- The term “universal life insurance policy” means a life insurance policy where separately identified interest credits (other than in connection with dividend accumulations, premium deposit funds or other supplementary accounts) and mortality and expense charges are made to the policy.

- For purposes of determining the guaranteed gross premiums used in the demonstration in Section 6.B.2

- a. For universal life policies, the guaranteed gross premium shall be the premium specified in the contract, inclusive of any applicable policy fee, or if no premium is specified, then the level annual gross premium at issue that would keep the policy in force for the entire period coverage is to be provided based on the policy guarantees of mortality, interest and expenses; and

- b. For policies other than universal life policies, the guaranteed gross premium shall be the guaranteed premium specified in the contract, inclusive of any applicable policy fee.