P1P2 - Actuarial

- 1873 - Book - Politics and Mysteries of Life Insurance, Elizur Wright - 265p - [GooglePlay-link]

- (p12) - (SIV - "Self Insurance Value") - Consequently, the insurance done by ...the company is ... 972.34, and the balance, $27.66, is the self-insurance, reserve, or "value of the policy,” at the end of the second year.

- It would be better, always, to call this the self insurance value of the policy,

- (p12) - (SIV - "Self Insurance Value") - Consequently, the insurance done by ...the company is ... 972.34, and the balance, $27.66, is the self-insurance, reserve, or "value of the policy,” at the end of the second year.

- 1981 - SOA - Universal Life (RSA81V7N412), Society of Actuaries - 16p

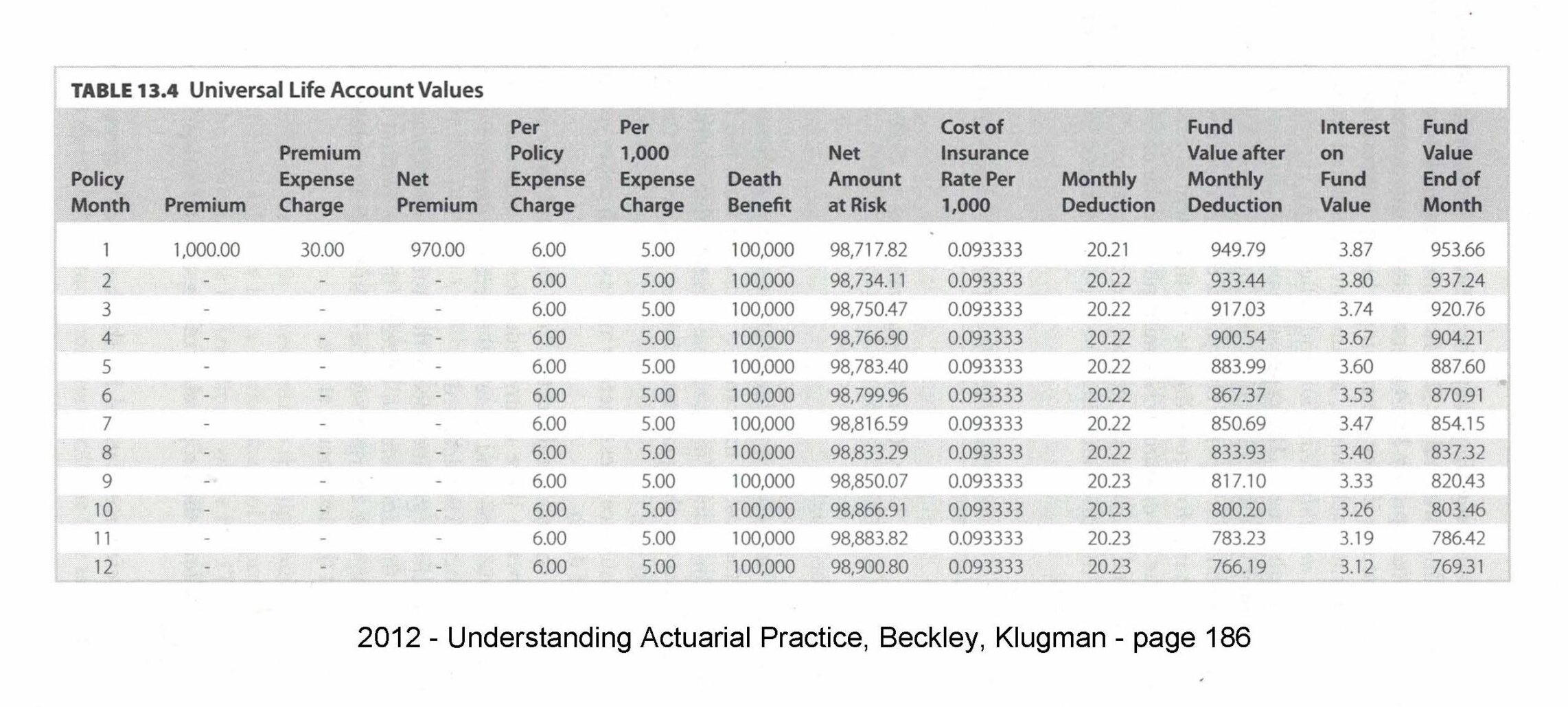

- 2012 - Book - Understanding Actuarial Practice, Stuart A. Klugman - 509p

- 2018 - Book - Statutory Valuation of Individual Life and Annuity Contracts | 5th Edition -- Claire, Lombardi and Summers

|

Bonk |

P1 |

E1 |

SIV |

i |

CIV |

P2 |

E2 |

DB-A |

DB-CP |

|

Generic |

|

|

|

|

|

|

|

|

|

- Let's review the basic mechanics of Universal Life.

- The first thing that has to occur is a premium paymentP1.

- A premiumP1 may be paid at any time and in any amount desired.

- Whenever a premiumP1 is paid, loadsE1 are deducted from that premiumP1.

- The balance is added to a fundSIV.

- On a monthly basis, cost of insurance chargesP2 are deducted from the fundSIV.

- Expense chargesE2may be deducted from the fundSIV, especially in the early policy years, and interesti is added to the fundSIV on a monthly basis.

- The cash valueSIV changes each month based on the net impact of the incomeP1andi and deduction transactionsP2andE2.

- The policy does not lapseDB-CP if a premiumP1 is not paid; rather, it lapsesDB-CP if the fund balanceSIV becomes too small to pay the next month's cost of insuranceP2.

-- Ben H. Mitchell, [Bonk: a consulting actuary with Tillinghast in Atlanta - Years-?]

1981 - SOA - Universal Life (RSA81V7N412), Moderator: Samuel H. Turner, Society of Actuaries - 16p

- Let's review the basic mechanics of Universal Life.

- The first thing that has to occur is a premium payment.a

- A premiumb may be paid at any time and in any amount desired.

- Whenever a premiumc is paid, loadsd are deducted from that premium.e

- The balance is added to a fund.f

- On a monthly basis, cost of insurance chargesg are deducted from the fund.h

- Expense chargesj may be deducted from the fundk, especially in the early policy years, and interestL is added to the fundm on a monthly basis.

- The cash valuen changes each month based on the net impact of the incomeo2 and deduction transactions.q2

- The policy does not lapser if a premium is not paids; rather, it lapsest if the fund balanceu becomes too small to pay the next month's cost of insurance.v

-- Ben H. Mitchell, [Bonk: a consulting actuary with Tillinghast in Atlanta - Years-?]

1981 - SOA - Universal Life (RSA81V7N412), Moderator: Samuel H. Turner, Society of Actuaries - 16p

- Let's review the basic mechanics of Universal Life.

- The first thing that has to occur is a premium payment.

- A premium may be paid at any time and in any amount desired.

- Whenever a premium is paid, loads are deducted from that premium.

- The balance is added to a fund.

- On a monthly basis, cost of insurance charges are deducted from the fund.

- Expense charges may be deducted from the fund, especially in the early policy years, and interest is added to the fund on a monthly basis.

- The cash value changes each month based on the net impact of the income and deduction transactions.

- The policy does not lapse if a premium is not paid; rather, it lapses if the fund balance becomes too small to pay the next month's cost of insurance.

- The first thing that has to occur is a premium payment.

-- Ben H. Mitchell, [Bonk: a consulting actuary with Tillinghast in Atlanta - Years-?]

1981 - SOA - Universal Life (RSA81V7N412), Moderator: Samuel H. Turner, Society of Actuaries - 16p