Policy Mechanics / Cash flow / Works

- Until the buyer understands how the product works, attempts to compare price are essentially meaningless.

1972 - SOA - Life Insurance and the Buyer, by Anna Rappaport, Society of Actuaries - 2p-Article

- Buyers of life insurance are entitled to descriptions of their policies and how they work.

- But the computer-generated tables supplied by insurance agents often show results that are just not realistic.

- Walter Miller, vice president of the Prudential Insurance Company of America, said:

- Illustrations are not predictions. But they are better than no illustration at all in explaining how policies work."

1993 1030 - NYT - Insurance; Confusion Over Policies Leads to Talk of Change, Leonard Sloane - [link]

- Its fundamental "mechanics" are indistinguishable from those underlying traditional life insurance products.

- [Bonk: Its = Universal Life]

-- Samuel H. Turner, President - The Life Insurance Company of Virginia

1982 - Journal of Insurance Medicine - 1p

- The Mechanics of Universal Life Policies

- Once the policy is activated, the term policy and the accumulation account each operate independently.

- He or she may switch back and forth between whole life and term coverage, and may increase or decrease the amount of coverage as needed.

1985 - LR - TEFRA's Response to Short-Term Abuses of Insurance Annuity Policies - 20p

- First thing that I want to say is that there have been some references to Misleading Illustrations.

- I'm certainly not aware of the Regulators have not found that Illustrations are misleading.

- That seems to be just an allegation that is left hanging in the air, which is inaccurate.

- The Illustration is not misleading.

- » The policy is performing according to policy mechanics.

-- Scott Harrison

2019 1115 - IULWG, NAIC - Conference Call - [Bonk: Not in Proceedings]

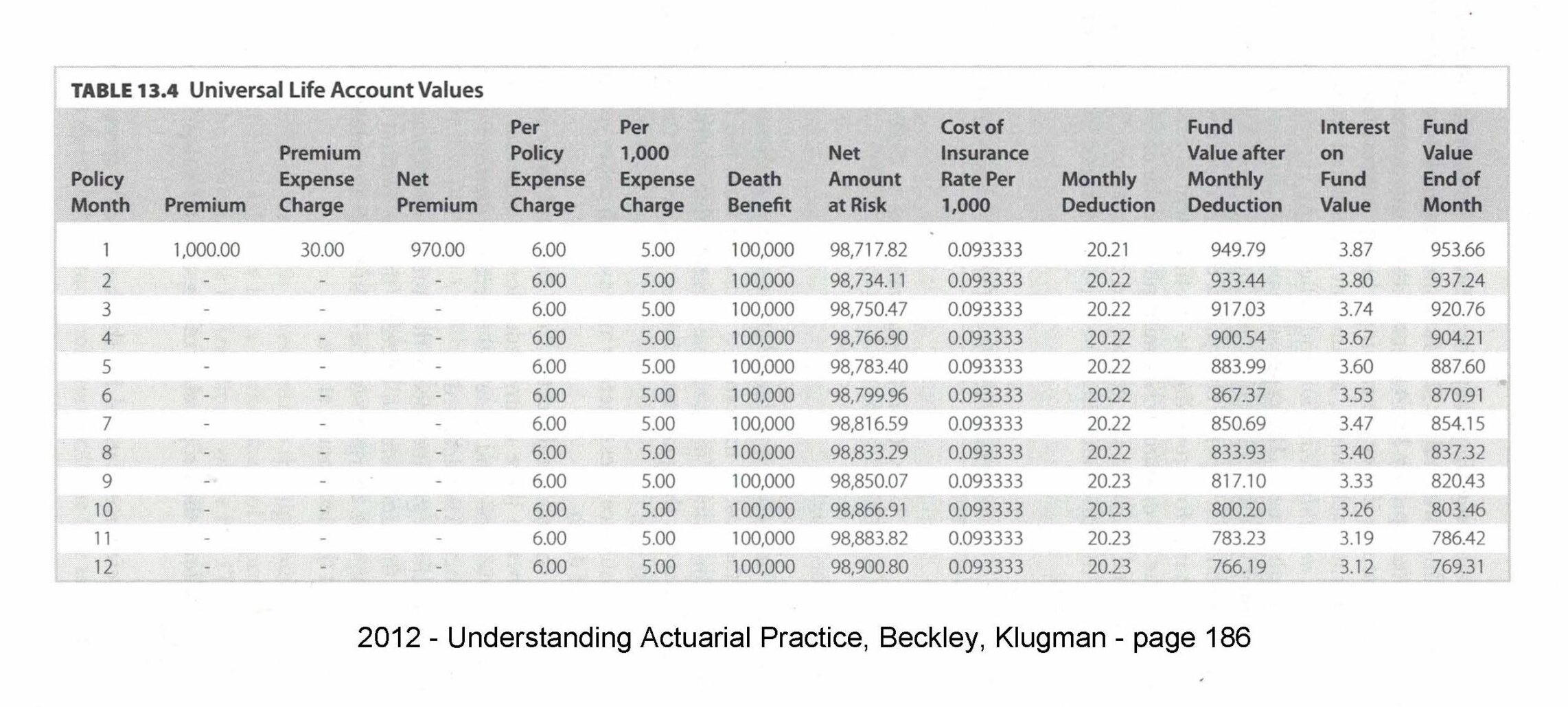

- Let's review the basic mechanics of Universal Life.

- The first thing that has to occur is a premium payment.

- A premium may be paid at any time and in any amount desired.

- Whenever a premium is paid, loads are deducted from that premium.

- The balance is added to a fund.

- On a monthly basis, cost of insurance charges are deducted from the fund.

- Expense charges may be deducted from the fund, especially in the early policy years, and interest is added to the fund on a monthly basis.

- The cash value changes each month based on the net impact of the income and deduction transactions.

- The policy does not lapse if a premium is not paid; rather, it lapses if the fund balance becomes too small to pay the next month's cost of insurance.

- The first thing that has to occur is a premium payment.

-- Ben H. Mitchell, [Bonk: Ben = a consulting actuary with Tillinghast in Atlanta - Years-?]

1981 - SOA - Universal Life (RSA81V7N412), Moderator: Samuel H. Turner, Society of Actuaries - 16p

- Roger Strauss (Iowa) said a fundamental issue was that the consumer realize that the premium is being paid from someplace.

- He said that was the most important issue to him and if it were to be included in the basic illustration then he would want to show the numbers with an asterisk beside them saying that they were being paid from other than the consumer's pocket.

1995-1, NAIC Proceedings

Understanding-Actuarial-Practice-page-186-

- Mr. Weber suggested that the illustration show ... how the policy values are paying the premium.

- Mr. Morgan said that this issue needs specific attention because many complaints were received in the state insurance departments on this issue.

* Richard Weber, Merrill Lynch Life

1994-3, NAIC Proceedings - (p521) - Life Disclosure Working Group – NAIC

- The premiums you pay (less expense charges) go into a policy account that earns interest, and charges for the insurance are deducted from the account.

- Here, insurance continues as long as there is enough money in the account to pay the insurance charges.

1983-1, NAIC Proc

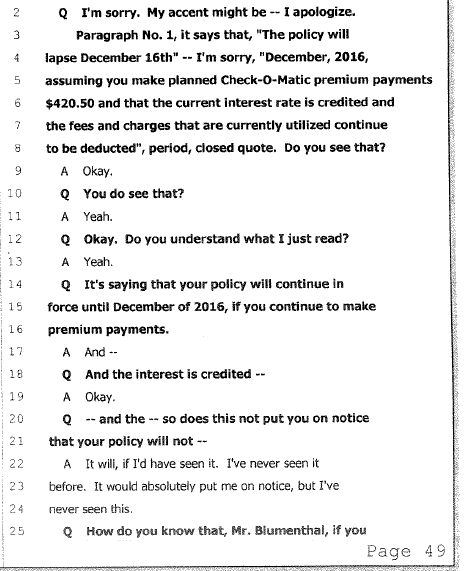

- According to the Illustration, "[c]ash value accumulation is important because it is used to pay insurance costs and other charges (monthly deductions) necessary to keep the policy in force and because it can also be withdrawn to help meet a policyowner's other financial needs. . . ." Id

Blumenthal v New York Life

PLAINTIFF'S RESPONSE TO DEFENDANT'S MOTION FOR SUMMARY JUDGMENT AND BRIEF IN SUPPORT

Case 5:08-cv-00456-F Document 85 Filed 06/01/10 Page 10 of 37

2001 Annual-Statement-Lapse-Put-on-Notice-Blumenthal

- There are some real advantages that flow from the flexibility inherent in the reserve and cash-value mechanics that Mr. Chapin has introduced into the adjustable life policy.

- These advantages deserve some discussion because many are not immediately apparent.

-- Charles E. Rohm

1976 - SOA - Toward Adjustable Individual Life Products, Society of Actuaries, Walter L. Chapin - 50p

- These previous comments remind me of a little story.

- It also relates to one of the comments Judy made, that agents sometimes do not understand the policies.

- My mother was thinking of buying an insurance policy on my father, and she asked me to speak to her agent.

- I spoke to him, and it was a Universal Life policy being proposed. I asked about the crediting rate, and then I said, "What kind of cost-of-insurance (COl) deductions are there?"

- He didn't understand what I was talking about.

- I said, "Well if you think of this Universal Life policy as a box, then you pour in premiums and your interest credited, and then pull out the cost of insurance.

- You could credit a high rate, but then at the same time be taking out a high COl, so you would be giving with one hand and taking with the other."

- And he said, "I didn't realize that out of this account you're actually pulling out an amount every month to pay for the insurance, and that could vary between companies.

- I'll have to talk to the company about that, because I never realized that before.

-- Alan L. Igielski

1992 - SOA - Life Insurance Sales Illustrations, Society of Actuaries - 16p

- Many years ago, when life insurance was born, a consumer knew what his annual premium bought; a guarantee that on his death his heirs would receive x amount of money.

- This money generally was to compensate heirs for the loss of incomedue to the breadwinner's death.

- As the years went on, insurance companies devised the level-premium method, which added a savings element to the insurance or death protection.

- The companies thought the idea would have consumer appeal, and would protect against the companies ending up with only the worst risks.

- And the facts seem to suggest the companies were right.

- Of the total 20 million new ordinary and industrial life policies bought in 1971, less than 1 in 10 was the old-fashioned term protection.

- But while the policies became a package of savings and protection, the premiums stayed a single unit.

- Thus, the vast majority of consumers today are putting a part into savings, and a part toward death protection when they deposit that premium.

- But no one is telling them how much goes into each category.

- Obviously, as the convening of these hearings shows, I have the feeling that it is time that perhaps someone did.

- And this is a philosophy shared apparently by a number of others that we will hear during this opening set of hearings. (p1)

-- Senator Philip Hart – (D-MI)

1973 0220 - GOV (Senate) - The Life Insurance Industry, Senator Hart (D-MI) - Part 1 of 4 - [PDF-815p-GooglePlay]

- In that case, there will remain at the end of the year the net premiums less the mortality charge, or cost of insurance, increased by the interest upon the premiums from the time they were invested.

1871 - NAIC Proceedings

- Many insurance companies even have a way to get a consumer's money without the consumer ever knowing about it.

- Most policies have a clause that allows the company, without telling the policyholder, to dip into the savings component of their life insurance policy.

- This can happen, for instance, when a consumer stops paying on a policy because he or she believes that the policy is paid up.

- Then, without even telling the policyholder, the company can raid the savings to pay itself more premium. (p3)

1992 0623 - GOV (Senate) - Consumer Disclosure of Insurance - [PDF-323p-GooglePlay,

- The role of the policy value, or account value, with its monthly algorithm and mortality, interest and expense guarantees, is part of the cost structure of the product.

- In a traditional product the inner workings are hidden.

- With this product <Universal Life>, the mechanic is "unbundled" and open.

- But events that are now observable may be misinterpreted.

-- Douglas Doll

1988-2, NAIC Proceedings

- As members of this Task Force, we think there are things that can be done to improve the situation.

- It is important to do so since our credibility as an industry is on the line.

- On the other hand, we have to be realistic.

- Many people in our society have a mental block when it comes to mathematics.

- By the same token, many people buy cars who do not know anything about how the engine is put together.

- But they still feel they have a reason to be dissatisfied when it konks out a couple of years later and they are told that the warranty doesn't cover it.

- Surely the situation can be improved without having to find a way to explain engine assembly to the average person.

- Thus, both common sense and history tell us that at some point regulators will intervene and take strong measures, if the industry itself does not institute sufficient

measures to deal with problems of this nature. - And we could well be dealing with federal as well as state authorities.

- Who can forget the Federal Trade Commission's foray into life insurance in the mid-1970s, when they pronounced that the average life insurance consumer was getting only a 1.3% return on his or her money.

- If the Feds were to become heavily involved in the illustration issue, we could again be forced to defend ourselves in public against simplistic and sensational statements like that.

- As Judy will tell you later, we may have already reached that stage, given Senator Metzenbaum's interest in this subject, culminating in the hearings.

-- Benjamin J. Bock, Transamerica Occidental

1992 - SOA - Life Insurance Sales Illustrations, Society of Actuaries - 16p

- Quoting first from Mr. Gilchrist's letter: "Universal Life and conventional participating plans are really quite different.

- Requirements for Universal Life are destroyed by critics from the participating point of view, and vice versa.

- Should not different requirements be set for each product type?

- There's also the interesting two-tier annuity, which may require a different approach.

- Two: It might be interesting... to consider precisely the very minimum disclosure requirements of interest to the consumer, or at least what we think would be of interest to the consumer.

- I would suggest the premium, the death benefit, the cash surrender value, and the term of each of the components.

- What is guaranteed would be the most important, and such numbers should be in the only boldface type in the illustration, and no smaller than any other material other than captions."

-- Benjamin J. Bock, TransamericaOccidental

1992 - SOA - Life Insurance Sales Illustrations, Society of Actuaries - 16p

- 135 -The 1974 Society of Actuaries report stressed that adequate information disclosure must consist of both a method for comparing costs of competing policies and a method for disclosing the cash flow elements and benefits of a particular life insurance contract as it relates to the individual purchaser.

- The cash flows of a policy are defined by the Society for this purpose as "the actual transfer of funds between the policyholder and the insurance company in either direction, and includes premiums, dividends, cash values and death benefits." Actuaries Report, supra n. 33, at 6.

1978 0807/0814/0815- GOV (House) - Life Insurance Marketing and Cost Disclosure - Congressman Moss - [PDF-826p-govinfo.gov]

- So what I am saying is that the Belth calculations cannot get out of a policy anything that isn't there already.

- The premiums and the dividends and the amounts of insurance and the cash value are all there is to a policy.

- You can fool around with them any way you like but mostly you can get at all the facts just by looking at basic things.

-- Julius Vogel, Prudential

1978 0807/0814/0815 - GOV (House) - Life Insurance Marketing and Cost Disclosure - Congressman Moss - [PDF-826p-govinfo.gov]

- ...some people view the UL fund mechanics as an opening of the dividend box...

1988 - SOA - Update on Universal Life Reserves and Non-Forfeiture Values, Society of Actuaries - 36p

- If the universal/variable life insurance premiums are not sufficient to cover the policy expenses and mortality costs the cash value is reduced to cover the deficit.

1986 - AP - A Comparison of Universal / Variable Life Insurance with Similar Unbundled Investment Strategies - [link-62p]

- As each premium is paid, it is added to the policyowner's accumulation account.

- An expense charge and a mortality charge to cover the policy's share of current death claims are deducted.

bbcontent.theamericancollege.edu/Course/BbC/01_HS/311/PDF/2011/HS311_TB08_11.pdf

- (p413) - The cash flows of a policy are defined by the Society for this purpose as "the actual transfer of funds between the policyholder and the insurance company in either direction, and includes premiums, dividends, cash values and death benefits." Actuaries Report, supra n. 33, at 6.

-

So what I am saying is that the Belth calculations cannot get out of a policy anything that isn't there already.

-

The premiums and the dividends and the amounts of insurance and the cash value8 are all there is to a policy.

-

You can fool around with them any way you like but mostly you can get at all the facts just by looking at basic things.

-

-- Julius Vogel, Prudential, on behalf of the American Council of Life Insurance, ACLI

1978 0807, 0814 and 0815 - GOV (House) - Life Insurance Marketing and Cost Disclosure, John Moss (D-CA) --- [BonkNote]

- 8. Flexible life: This policy permits the policyholder to vary the amount of his premiums, the frequency of his premiums, and the amount of his death benefit.

- With this policy, the policyholder pays a premium.

- From the premium, various expense charges are deducted.

- The remainder is added to the cash value that accrues at interest.

- Each month a mortality charge is deducted based on the net amount at risk, the attained age of the insured, and the mortality rate schedule.

1981 - SOA - Individual Life Insurance Cost Disclosure Issues, Society of Actuaries - 22p

- What UL does, among other things, is to let the policyowner or maybe the agent pick the point on the line between these two promises-- pick the point that best fits the situation that the agent or the policyowner is in.

- He can have a high premium policy with lots of dividends if experience does remain good

- or he can pay a very low premium but have a big risk of increasing the premium if experience does not turn out so well.

- One thing this ability does, it opens up the traditional 3-factor dividend formula, the black box, so that some of the workings are exposed.

- That is the good side, the opening up of the black box.

-- Bruce E. Booker

1988 - SOA - Update on Universal Life Reserves and Non-Forfeiture Values, Society of Actuaries - 36p