Premium Benefit Pattern - Examples

- The complications begin with a very simple question:

- What's the premium for Universal Life?

- It could be almost anything.

- Then what's the cash value?

- That depends on the premium.

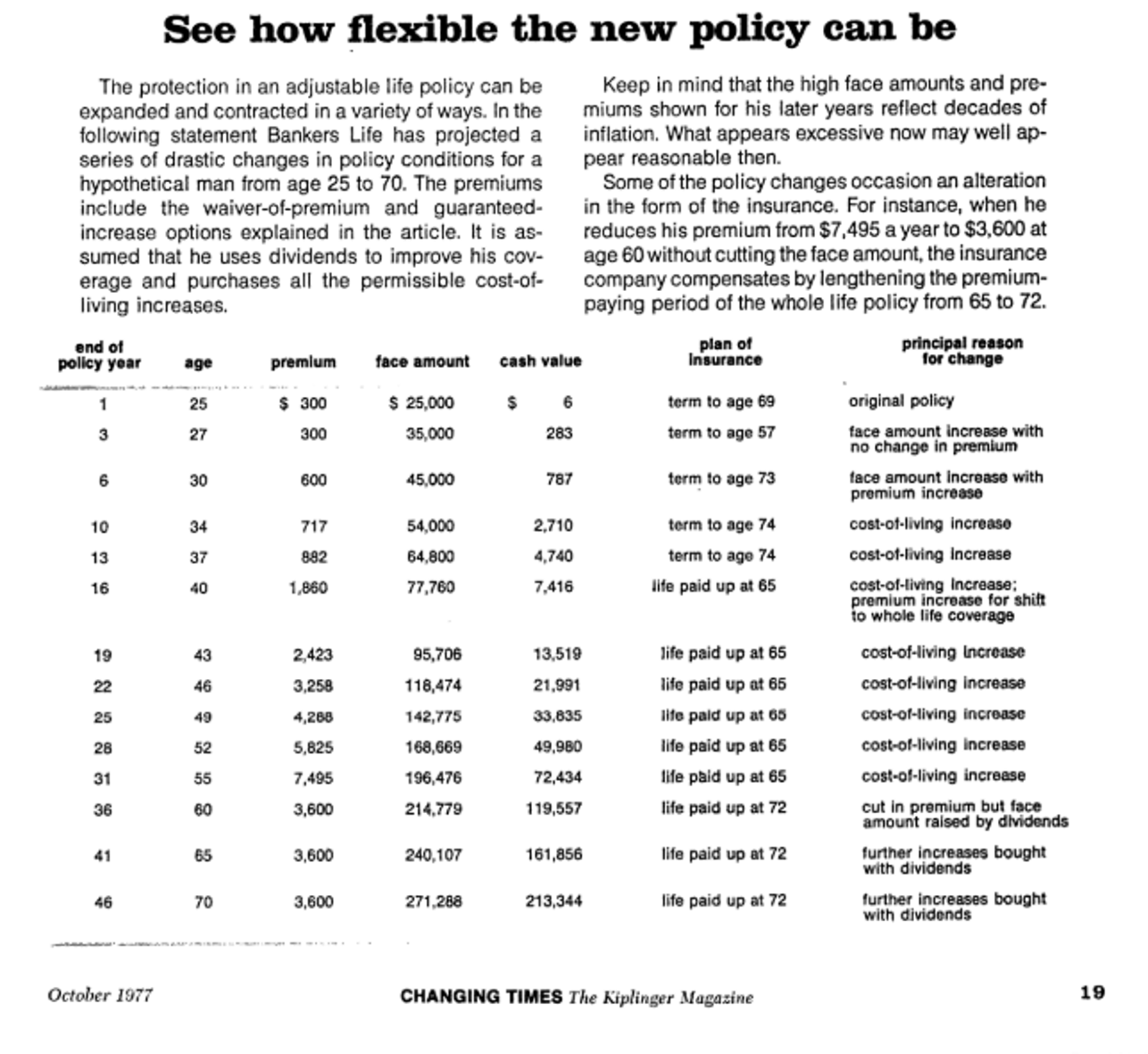

- It is the relationship between the premium and cash value that determines the product characteristics of Universal Life.

-- Ben H. Mitchell, [Bonk: a consulting actuary with Tillinghast in Atlanta - Years-?]

1981 - SOA - Universal Life (RSA81V7N412), Moderator: Samuel H. Turner, Society of Actuaries - 16p

- If that is the case, how does an agent program somebody?

- How does he tell a person what he needs to pay to keep his premiums level or to have paid-up insurance at age 65?"

-- Allan W. Sibigtroth

1979 - SOA - Future Trends and Current Developments in Individual Life Products (rsa79v5n44), Society of Actuaries - 24p

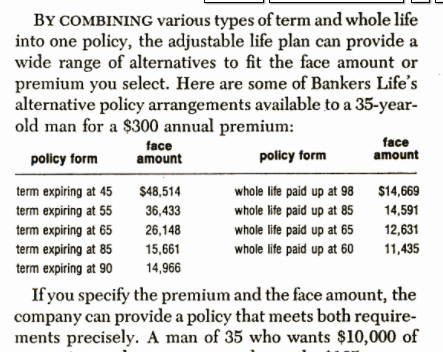

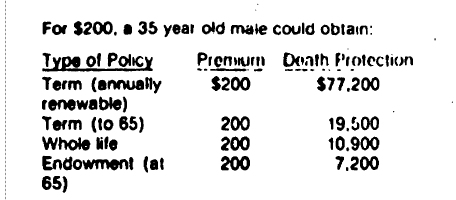

- "Completely Flexible" - The completely flexible life insurance plans are sometimes called "universal life insurance plans.

1980-2, NAIC Proceedings

- ...it is possible to produce any traditional plan of insurance from the generalized formulas underlying universal life.

-- Alan Richards, president and chief executive officer of E. F. Hutton Life Insurance Co.- (p448)

1983 0510, 0511 and 0728 - GOV (House) - Tax Treatment of Life Insurance - [PDF-991p-GooglePlay

,

- ... life insurance contracts such as universal life ...afford purchasers greater flexibility in designing their contracts so as to meet their individual needs.

-- 1981 0831 - Letter - ACLI to NAIC - Statement of the American Council of Life Insurance to the NASAA NAIC Joint Regulatory Insurance Products Study Committee - 10p

1982-1, NAIC Proceedings

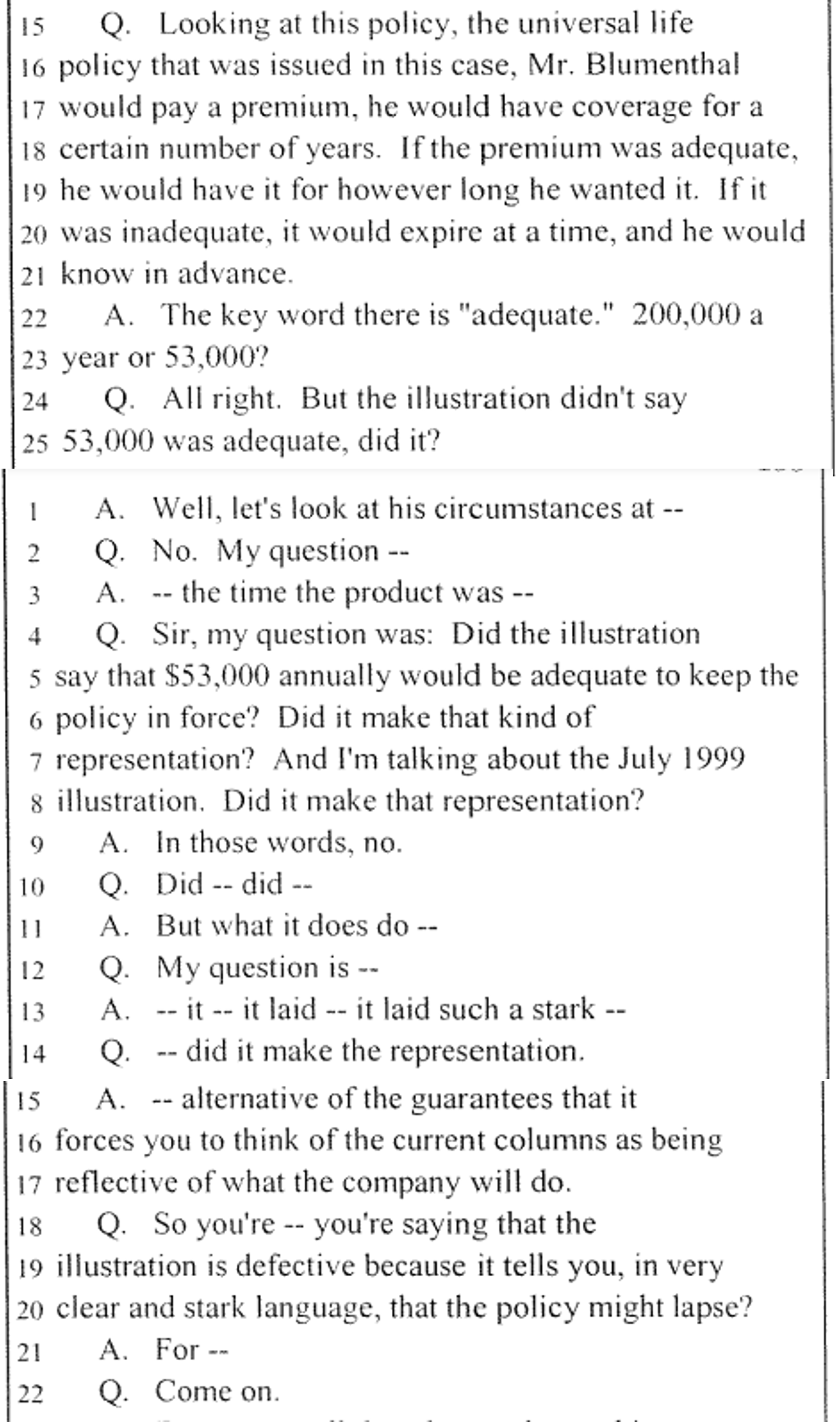

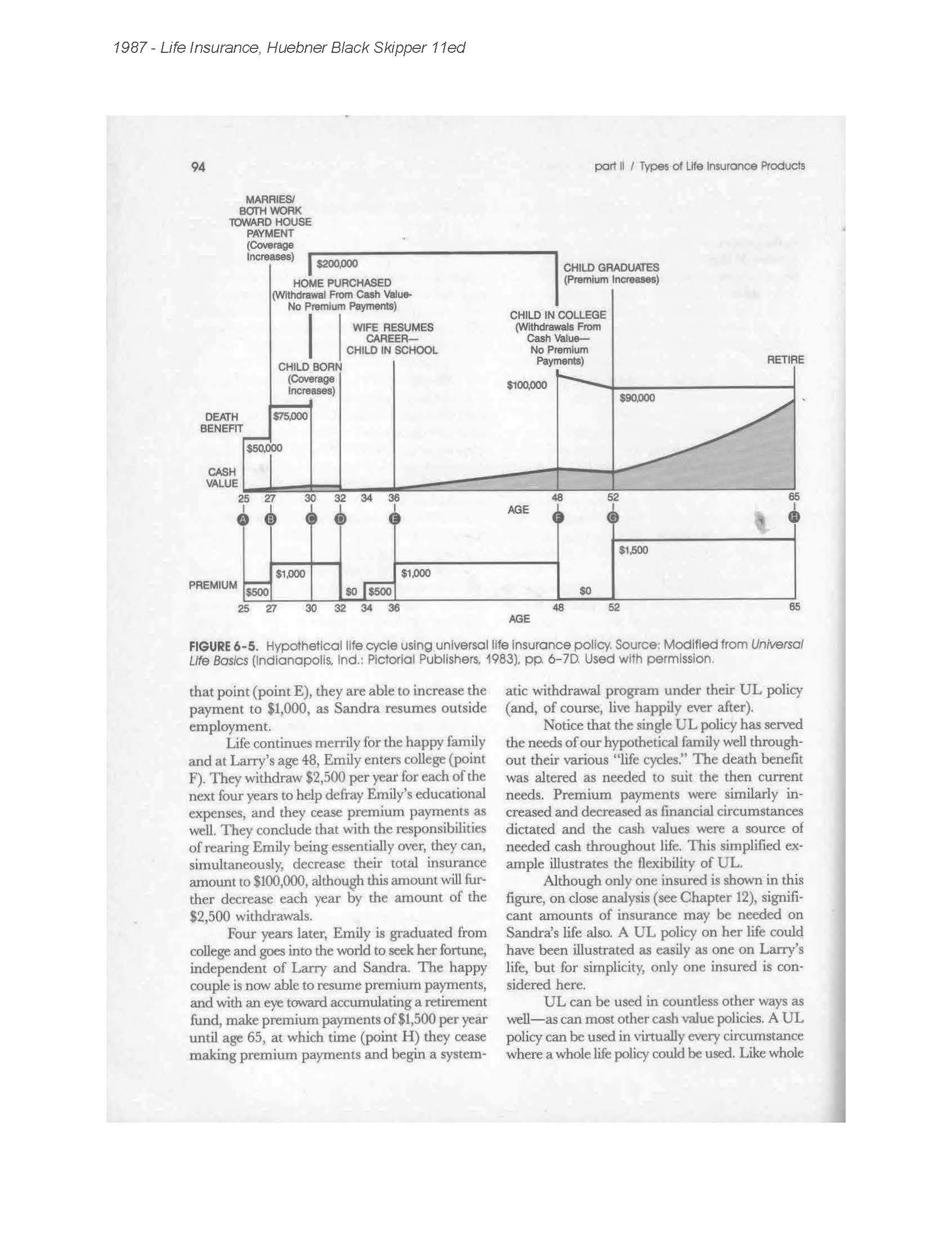

2010 - LegalCase - Blumenthal-v-New-York-Life-GLP-GMP-Min

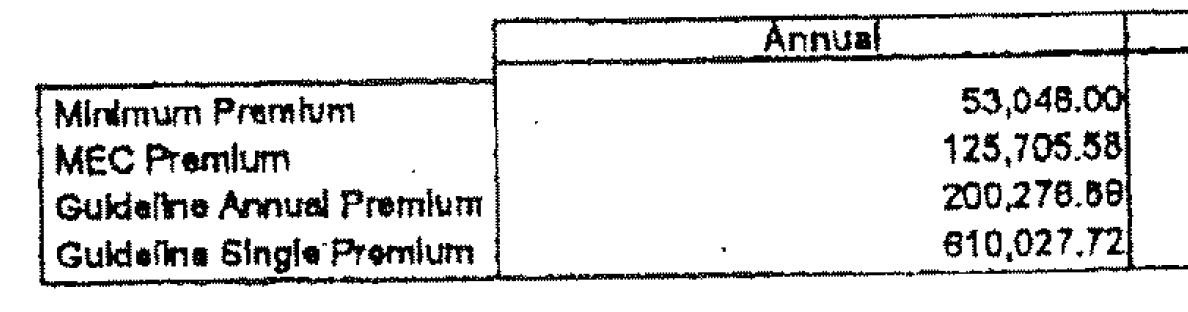

1987-Huebner-Black-Skipper-Life-Insurance-11ed-p94-UL-Flexible-Graph