Premiums, Costs, Values and Benefits - Expert Witnesses

- Q. Do you recall the vanishing premium litigation?

- A (Wilcox): Very well.

- Q. Would you agree that the sales practices that were used in the vanishing premium -- in selling those policies was problematic?

- MR. HIGGINS: Objection. Vague.

- THE WITNESS (Wilcox): In a limited number of cases, that was true. But again, that's a different question than you asked before. Problematic is not the same as unlawful.

- MR. PAUL: Q. Do you not believe that the sales practices used -- that were at issue in the vanishing premium issue were unlawful?

- MR. HIGGINS: Objection. Vague.

- THE WITNESS (Wilcox): There may have been a few instances where it was unlawful. In general, it was not vanishing premium issue were unlawful?

MR. HIGGINS: Objection. Vague.

THE WITNESS (Wilcox): There may have been a few instances where it was unlawful. In general, it was not.

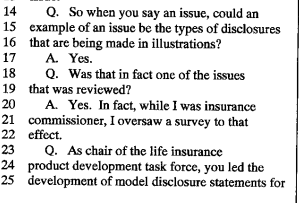

-- Deposition of Robert E. Wilcox, Former Utah Insurance Commissioner and Chairman of the Life Disclosure Working Group (NAIC)

2012 0313 - Thao v Midland, United States District Court Eastern District of Wisconsin, 2:09-C-1158-LA

- Universal life is considered "permanent insurance" in the industry.

- For example, a governmental website for seniors, maintained by the Social Security Administration, has the following definition "Permanent Insurance -- including whole, ordinary, universal, adjustable and variable life -- is protection that can be kept in force for as long as you live."8

2003 - Rebuttal Of Mr. Affleck's Report, By Donna R Claire, RE: William L. Fay, Sr. et al. v. Aetna Life Insurance and Annuity Company

- 85-3 - Deposition of David Sanderford - Plaintiff Expert Witness - 65p

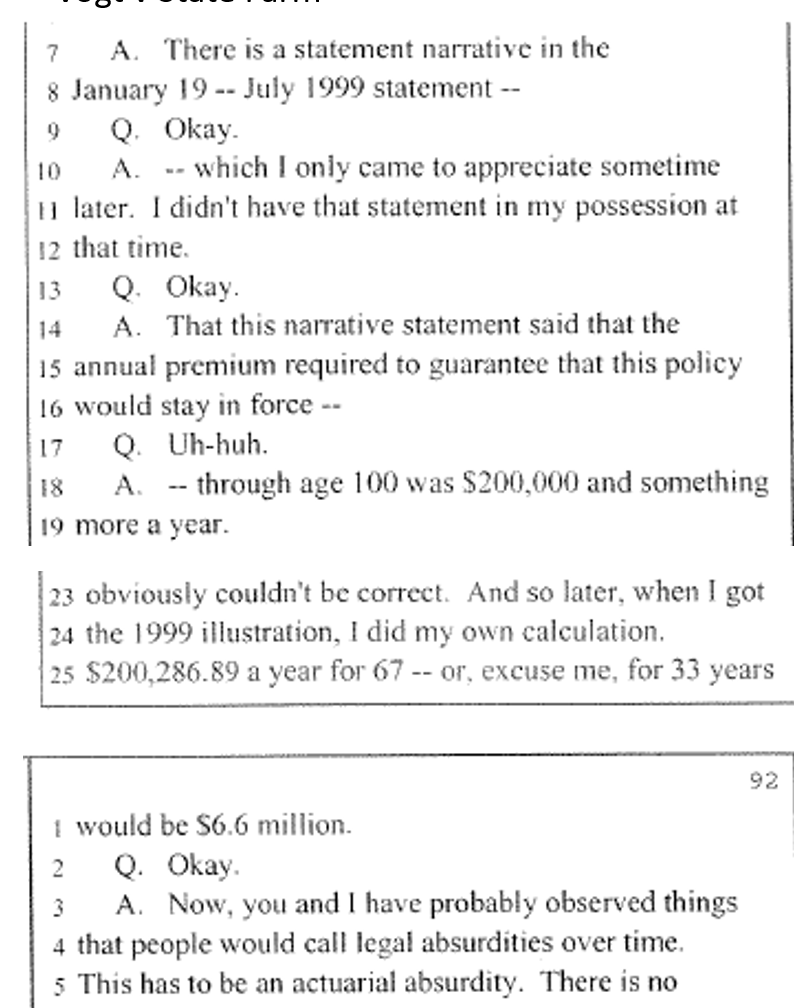

- Blumenthal v New York Life - Sanderford (Expert Witness for Blumenthal) - Guaranteed Maturity Premium

Fay-v-Aetna-William-Hager-Deposition

Case 1:01-cv-10846-RGS Document 65 Filed 06/02/03 Page 27 of 32