Robert I. Mehr

- 1961 - Book - Modern Life Insurance, by Robert I. Mehr

- 1975 - AP - The Concept of the Level-Premium Whole Life Policy Reexamined, by Robert I. Mehr - 14p

- 1984 - Book - Life Insurance: Theory and Practice, by Robert I. Mehr

- 1994 - Book - Insurance, Risk Management, and Public Policy: Essays in Memory of Robert I. Mehr (Huebner International Series on Risk, Insurance and Economic Security, 18), by Sandra G. Gustavson (Editor), Scott E. Harrington (Editor) - <WishList>

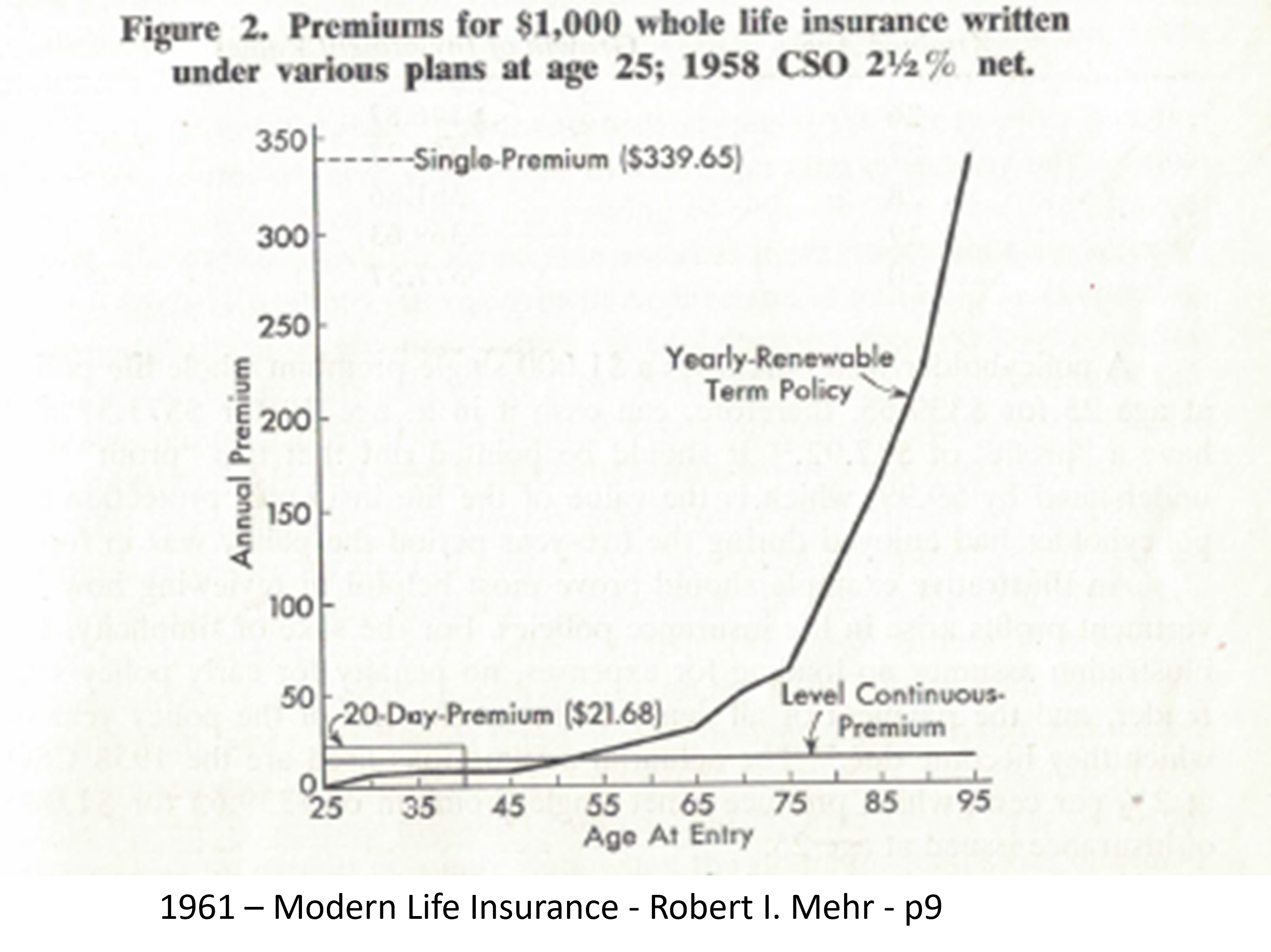

- Persons seeking life insurance for the Whole of Life have several choices: they may:

- buy a one-year renewable term contract and renew it annually, paying the full cost of insurance for each year

- buy coverage for the insured's life with a single premium payment, or

- buy coverage for the whole of life under some type of installment arrangement. (p47)

1984 - Book - Life Insurance: Theory and Practice, by Robert I. Mehr

... in gaining a life insurance education, one problem does present itself... the basic question is where to begin. (p1)

1961 - Book - Modern Life Insurance, by Robert I. Mehr

- (p1) - INTERDEPENDENCE OF SUBJECT MATTER

- The Subject of Life Insurance is one that everyone will discuss sooner or later.

- Fortunately, nearly everybody knows something about it, but unfortunately many who buy it and some who sell it have only a superficial knowledge.

- Even those who legislate controls or propose reforms for the business are not always sufficiently informed.

- What does one need to know to become adequately informed about life insurance?

- It is essential that he know a few basic principles of law, mathematics, accounting, economics, marketing, finance, business management, statistics, history, and government—all as they apply to life insurance.

- This seems a rather large order, but actually it is not, because everything is logical, and the pattern as a whole fits quite neatly.

- However, in gaining a life insurance education, one problem does present itself.

- Although the pieces fit together snugly, it is not easy to determine the order in which the pieces should be developed.

- For example, to understand types of policies thoroughly one should know something about methods of premium computation.

- But to comprehend premium computations adequately, one must know something about types of policies.

- This interdependence applies with equal force to other aspects of knowledge about the field.

- ⇒ Thus, since it is necessary to know something of the whole to understand and appreciate the parts, the basic question is where to begin.