The Actuarial Foundation - Emeritus Trustees

- The Actuarial Foundation - Emeritus Trustees - 2023 --- [BonkNote]

- Cecil Bykerk

- Sam Gutterman

- Anna M. Rappaport

- Charles E. Rohm

- Walter S. Rugland

- David K. Sandberg

- Thomas C. Sutton

- Mavis A. Walters

- Charles E. Rohm,

- This leads to the second attitude adjustment that is needed.

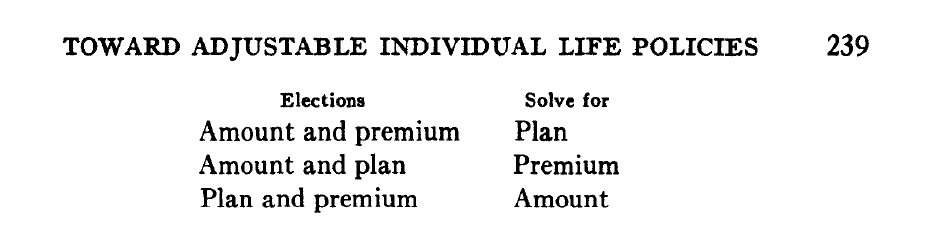

- The old distinction between term and permanent is usually not appropriate for an adjustable life policy.

- ⇒ In every sense an adjustable life policy should be a permanent policy regardless of what the current static plan may be.

1976 - SOA - Toward Adjustable Individual Life Products, by Walter L. Chapin, Society of Actuaries - 50p

- Until the buyer understands how the product works, attempts to compare price are essentially meaningless.

1972 - SOA - Life Insurance and the Buyer, by Anna Rappaport, Society of Actuaries - 2p-Article

- Everybody has been talking a lot about a paper by James Anderson on the so-called universal life insurance policy which was an annuity-term combination.

- So you have to bring the annuity into this.

- [Bonk: paper = 1975 (originally) - SOA - The Universal Life Insurance Policy, by James C.H. Anderson, Society of Actuaries - 10p]

1976 - SOA - Economic Role of Life Insurance, Society of Actuaries - 16p

- Tom Sutton, ACLI / Pacific Life - My personal opinion is that I would not have any problem with a kind of disclosure that could be communicated simply, but was based on extensive analysis by someone capable of making the appropriate analysis.

- I would not like a simplistic disclosure that could cause great dislocation because it did not recognize all of the factors in what is, in fact, a very complicated business. (p280)

1991 0227, 0507, 0509 and 0523 - GOV (House) - Insurance Company Solvency, (CSPAN) Insurance Company Insolvencies, Cardiss Collins (D-IL) --- [BonkNote]

- All of you have heard of the actuarial black box.

- This is a situation I will define as one in which actuarial analysis has not been adequately explained to its users.

- We can eliminate black boxes by more complete disclosure, more time spent with the user explaining what was done, and with better communication.

- Most actuaries I know can communicate well.

- However, they don't always give communications enough attention as an important part of any project.

- The more a user understands what we do, the more the end product will be valued and trusted, and the more times the actuary will become involved in significant issues.

- I hope that you join me in feeling confident in the value of the actuarial approach to problem-solving.

- If we can boost our users' confidence and trust in us, the better off we will all become.

-- Sam Gutterman, 1995-96 President of the Society of Actuaries

1996 - SOA - The Actuary, The Actuarial Black Box, by Sam Gutterman, Society of Actuaries - 2p

- The thrust of this development says the deal needs to be articulated.

- This deal has several components, and one is with respect to premiums.

- If they are not guaranteed or fixed, there needs to be an understanding of how they can vary.

-- Walter S. Rugland, Milliman & Robertson (M&R) and has been chairing the American Academy of Actuaries’ Working Group, which has presented the framework for this proposal to the NAIC

1996 - SOA - Nonforfeiture Law Developments, Society of Actuaries - 23p