TO DO

- [Documents]

- Concepts

- History

- 1980 - SOA - Product Innovation - Response to Consumer Needs in the 1980's, Society of Actuaries - 14p

- Charles W. McMahon - Whenever you are working on something new and innovating, it is always a good idea to look back and see what the ancients called it.

- 1980 - SOA - Product Innovation - Response to Consumer Needs in the 1980's, Society of Actuaries - 14p

- Language / Terms of Art

- 1993-4, NAIC Proceedings

- William Koenig (Northwestern Mutual) suggested that the parties all needed a common understanding of the terms used in their discussion.

- 1996-3v2, NAIC Proceedings - CONSUMER PARTICIPATION BOARD OF TRUSTEES

- Brenda Cude - Letter on Readability of the Life Insurance Buyers Guide - (Attachment One) - p1268

- Brenda Cude said that her main focus is consumer information and education.

- She has worked extensively on the Life Insurance Buyers Guide and the model consumer information report.

- Ms. Cude expressed concern about the NAIC process of developing consumer guides and other documents.

- She suggested that the group drafting process used to develop these documents does not result in a document that is easily readable for most consumers.

- 1981 - SOA - The Life Insurance Business---The View of Consumerists (rsa81v7n17), Daphne Bartlett- Moderator, Society of Actuaries - 16p

- Craig W. Lewis - I look at it a little differently.

- The panel is saying that we should bring the level of language in the contract down to the present public comprehension.

- That is fine, but we are missing the point: the public doesn't understand what it is getting.

- So instead of bringing the language down to the public, should we not educate the public up to our standard, or at least somewhere between the two existing levels.

- Craig W. Lewis - I look at it a little differently.

- 1984 - Journal - AAA - American Academy of Actuaries - 271p

- (p217) - The "unbundling" of services and other product differences between Universal Life and Ordinary Life cause current literature to be inapplicable, as well as insufficient, for Universal Life.

- Example - Universal Life "Premium"

- (A) - 2005 - When is a Premium Not a Premium?, by Richard Weber - 4p

- The dilemma is in the very use of the word “premium.”

- You probably first think of what you pay for car insurance or disability insurance: you get a quote – and if “shopping” – often choose policies on the basis of the best price.

- You then pay that “premium,” and you’ve got your coverage.

- But many of today’s life insurance policies don’t actually have a “premium!”

- 2019 0830 - Letter - CEJ / Birny Birnbaum to LIIIWG, Life Insurance Illustrations Issues Working Group - (A) - NAIC - 12p

- (p4) - Mr. Lovendusky [ACLI] stakes his claim on the premise that the Policy Overview has “personalized information” that can somehow only be provided after the life insurer has issued a policy. In fact, the Policy Overview, has very limited items personalized to the consumer.

- The personalized information in the Policy Overview is the premium for the policy – based on information known to the producer or insurer at the time and subject to change based on additional or revised information – and that information can be provided prior to purchase.

- If an insurer can produce an illustration for a complex, investment type life insurance product prior to the consumer purchase, it is clearly possible for an insurer to provide the premium for a policy prior to purchase.

- (A) - 2005 - When is a Premium Not a Premium?, by Richard Weber - 4p

- 1993-4, NAIC Proceedings

- Universal Life

- Works / Elements / Cash Flow / P1P2 - Cash Value vs. Reserves - Surrender Charge - NGEs - Non-Guaranteed Elements - Cah Value / Reserves

- 1993 - SOA - Sales Illustrations - We Can't Life With Them, But We Can't Live Without Them!, Society of Actuaries - 20p

- Bruce E. Booker, Life of Virginia, a member of the American Council of Life Insurance (ACLI) Task Force on Cost Disclosure and the National Association of Insurance Commissioners (NAIC) Advisory Group on Illustration - Actuaries can do lots of things.

- We can provide the field with a clear description of the policy and how it works.

- Bruce E. Booker, Life of Virginia, a member of the American Council of Life Insurance (ACLI) Task Force on Cost Disclosure and the National Association of Insurance Commissioners (NAIC) Advisory Group on Illustration - Actuaries can do lots of things.

- P1P2 - Which one is Correct or does it depend on the policy?

- (A) - 2024 0306 - Yahoo - 'How is this legal?': A 72-year-old's life insurance policy is being terminated — despite all her premiums being paid, TikToker says. Fewer Americans are buying life insurance. Is it smart?, by Bethan Moorcraft - [link]

- Premiums first cover the COI, which is the minimum you must pay to get coverage. Anything on top of that goes toward the cash value and is invested so it can grow.

- (B) - 1981 - SOA - Universal Life (RSA81V7N412), Moderator: Samuel H. Turner, Society of Actuaries - 16p

- Ben H. Mitchell, [Bonk: Ben = a consulting actuary with Tillinghast in Atlanta - Years-?]

- Let's review the basic mechanics of Universal Life.

- The first thing that has to occur is a premium payment.

- A premium may be paid at any time and in any amount desired.

- Whenever a premium is paid, loads are deducted from that premium.

- The balance is added to a fund.

- On a monthly basis, cost of insurance charges are deducted from the fund.

- Expense charges may be deducted from the fund, especially in the early policy years, and interest is added to the fund on a monthly basis.

- The cash value changes each month based on the net impact of the income and deduction transactions.

- The policy does not lapse if a premium is not paid; rather, it lapses if the fund balance becomes too small to pay the next month's cost of insurance.

- The first thing that has to occur is a premium payment.

- Let's review the basic mechanics of Universal Life.

- Ben H. Mitchell, [Bonk: Ben = a consulting actuary with Tillinghast in Atlanta - Years-?]

- (A) - 2024 0306 - Yahoo - 'How is this legal?': A 72-year-old's life insurance policy is being terminated — despite all her premiums being paid, TikToker says. Fewer Americans are buying life insurance. Is it smart?, by Bethan Moorcraft - [link]

- libg - cude

- 1993 - SOA - Sales Illustrations - We Can't Life With Them, But We Can't Live Without Them!, Society of Actuaries - 20p

- Premium / Cost / Price

- 1972 - SOA - Life Insurance and the Buyer, by Anna Rappaport, Society of Actuaries - 2p-Article

- 1994-3, NAIC Proceedings - Life Disclosure Working Group – NAIC

- Richard Weber, Merrill Lynch Life ... suggested that the illustration show ... how the policy values are paying the premium.

- Mr. Morgan said that this issue needs specific attention because many complaints were received in the state insurance departments on this issue. (p521)

- 2014 0425 – DOC 813 – Trial Transcript – Day 12 – Walker v LSW – 224p

- Closing Argument by Mr. Martens, Defendant Attorney - LSW, Life Insurance Company of the Southwest

- The fact that we charge people fees that we have disclosed and that fees reduce the value of your policy, and if your policy keeps reducing in value, it will lapse, is not a fraud.

- That's common sense.

- That's how life insurance works. (p171)

- The fact that we charge people fees that we have disclosed and that fees reduce the value of your policy, and if your policy keeps reducing in value, it will lapse, is not a fraud.

- Closing Argument by Mr. Martens, Defendant Attorney - LSW, Life Insurance Company of the Southwest

- 2019 0917 - LIIIWG - Life Insurance Illustrations Issues Working Group - (A) - NAIC --- [BonkNote]

- LC -

- Social Media

- History

- 1970s

- Binder Adjustable Life Powerpoint - 3p

- GOV - FTC

- 1980s

- ULMR

- EF Hutton - Organized Crime - garrett / doug andrew

- 1990s

- 1990-1A, NAIC Proceedings - NAIC / LIMRA - Universal Life Disclosure Form - Focus Group Summary --- [BonkNote] --- 10p

- 1993 - NAIC - Policy Information for Applicant - Universal Life Policy - 3p

- Life Insurance Disclosure Model Regulation - Appendix D

- Located in: 1993 0525 - GOV (Senate) - When Will Policyholders Be Given The Truth About Life Insurance?, Senator Howard Metzenbaum (D-OH) - p63-65 --- [BonkNote]

- Bulletin on Illustrated Interest Projections – NAIC

- 1994-1A - Bulletin on Illustrated Interest Projections Amended Exposure Draft (Attachment Eight-A) .......... 561

- Binder - LDWG - 1993-1996

- 1996-3v2, NAIC Proc. - 1996 0917 - Consumer Participation Board of Trustees - re: Readability of NAIC Publications Consumer Disclosures - Brenda Cude - p1268-1269 - 2p

- 2000s

- 2010s

- blumenthal -

- 2015 – LC - Walker vs Life Insurance Company of the Southwest - TRIAL DAY 11 - JEFFREY STEMLER, Agent

- market conduct - ChatBox - Jules [Bonk] - are we talking about the same thing

- Benefits

- aaa

- 1982 - SOA - Universal Life (rsa82v8n111), Society of Actuaries - 14p

- Gary P. Monnin, Senior Vice President, Chief Actuary of American Founders Life Insurance Company - Maybe he is not getting all the disclosure he needs, as far as the continuing benefit is concerned, when the interest rates change from that illustrated.

- The interest assumption is one that we really struggled with.

- Gary P. Monnin, Senior Vice President, Chief Actuary of American Founders Life Insurance Company - Maybe he is not getting all the disclosure he needs, as far as the continuing benefit is concerned, when the interest rates change from that illustrated.

- 2009 - LC - Blumenthal v. New York Life --- [BonkNote]

- 82-1 - Defendant Expert Witness Report - Michael LaBoeuf - 23p

- 2017 1115 - Letter - AAA to LIBGWG - Re: Life Insurance Buyer’s Guide Q&A - Draft 8/1/17, American Academy of Actuaries, Life Insurance Buyer's Guide Working Group (A) - NAIC - 2p

- Universal life also allows for flexibility in policy benefits, not just premium payments.

- 2018 0918 - LIBGWG - Life Insurance Buyer's Guide Working Group - (A) - NAIC - Brenda Cude Letter / Markup Life Insurance Buyer's Guide - Revised 2-9-18 for discussion on conference call 2-22-18

-

Life Insurance Buyer's Guide - Draft 2-9-18: How much do the benefits build up in the policy?

-

Brenda Cude - Comment [BJC4]: What benefits?

-

-

Life Insurance Buyer's Guide - Draft 2-9-18: How will the timing of money paid and received affect interest?

-

Brenda Cude - Comment [BJC5]: What interest? Not mentioned anywhere else.

-

-

- COI - Cost of Insurance / Coverage Period

- 2019 0917 - LIIIWG - Life Insurance Illustrations Issues Working Group - (A) - NAIC --- [BonkNote]

- Richard Wicka (WI-Chair): This is probably more for the Universal Life Products, but how do we want to capture the concepts like Cost of Insurance and other fees in this document?

- (A) - Birny Birnbaum (CEJ) said there is no need to get too caught up in the details; he said just include enough information that a consumer could compare one policy to another and say, for example: The cost of insurance is between 1% of cash value up to 3% of cash value.

- g. Clarifying “Coverage Period Description"

- 1984 / 1993 - NAIC / ACLI Life Insurance Buyers Guide - 5p

- Other policies may have special features which allow flexibility as to premiums and coverage. Some let you choose the death benefit you want and the premium amount you can pay. The kind of Insurance and coverage period are determined by these choices.

- One kind of flexible premium Policy, often called universal life, lets you vary your premium payments every year and even skip a payment if you wish. The premiums you pay (less expense charges) go into policy account that earns interest and charges for the insurance are deducted from the account. Here, insurance continues as long as there is enough money in the account to pay the insurance charges.

- Richard Wicka (WI-Chair): This is probably more for the Universal Life Products, but how do we want to capture the concepts like Cost of Insurance and other fees in this document?

- 2019 0917 - LIIIWG - Life Insurance Illustrations Issues Working Group - (A) - NAIC --- [BonkNote]

- Benefits

-

1976 - SOA - Toward Adjustable Individual Life Products, Society of Actuaries, by Walter L. Chapin - 50p

-

-

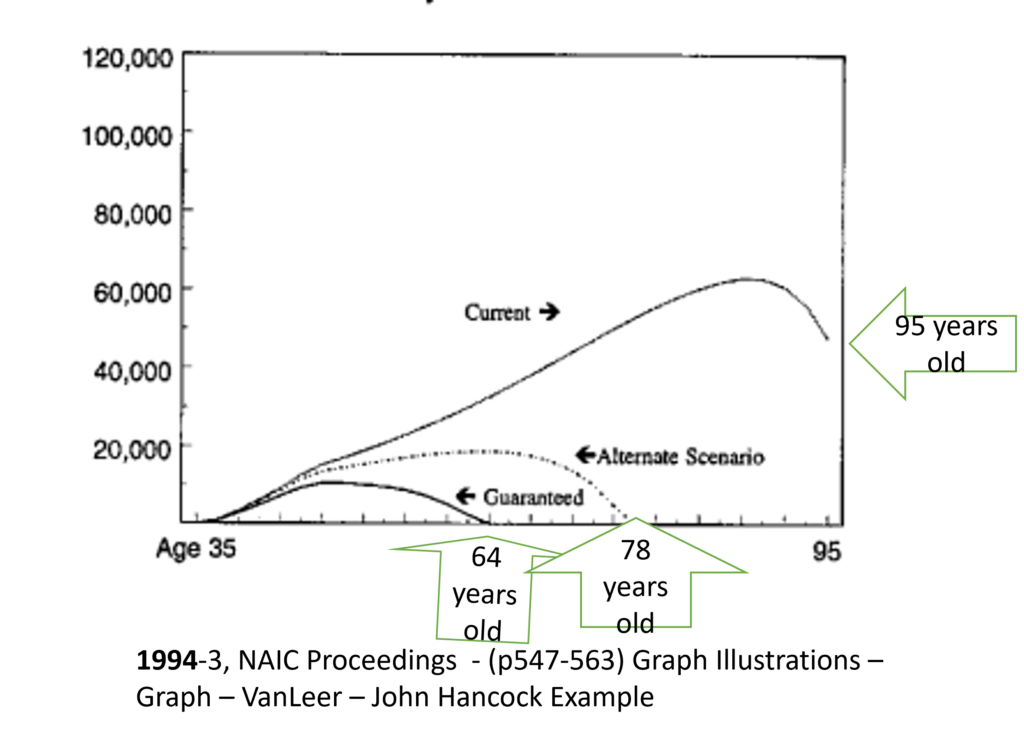

1994-3 NAIC Proceedingsm IllustrationsVanLeer John Hancock

-

-

2009-Legal-Case-Blumenthal-v-NYL-Defendant-Expert-Report-Illustration-at-issue-Graph-p17of24

-

- 2012 1011 - ThinkAdvisor.com - What's a L.I.R.P.?, By David C. McKnight --- [BonkNote] --- [link]

-

- ⇒ If properly structured, the expenses within the plan can cost as little as 1% of the annual account balance over the life of the program.4

- 4 - An equity indexed-based L.I.R.P., at preferred rates, using a minimum non-MEC face amount of $173,161, an increasing death benefit option, a $10,000 annual premium for 15 years, and an 8% rate of growth, has an internal rate of return in year 25 of 6.99%, or average annual fees of 1.01%.

-

- Illustrations

- Wicka - How do agents use these

- NGEs - Non-Guaranteed Elements

- 1994-1, NAIC Proc. - ACLI - Richard Minck, American Council of Life Insurance - He said the most striking change in life insurance in past years was in the non-guaranteed elements.-

- 2017 1106 - LIBGWG - Life Insurance Buyer's Guide Working Group - (A) - NAIC - [BonkNote]

- NGEs - AAA, Cude, Mealer, ACLI

- email to Jennifer

- Term vs. Permanent

- As long as you pay the premium

- 1990-1A, NAIC Proceedings - NAIC / LIMRA - Universal Life Disclosure Form - Focus Group Summary --- [BonkNote] --- 10p

- Also, because most people presume that if you pay your premium continuously, your policy will remain in effect, quite a few people had a hard time understanding how or why the policy would terminate in policy year 31.

- This was simply foreign to their way of thinking.

- 1994-3, NAIC Proceedings - Life Disclosure Working Group – NAIC

- Richard Weber, Merrill Lynch Life ... suggested that the illustration show ... how the policy values are paying the premium.

- Mr. Morgan said that this issue needs specific attention because many complaints were received in the state insurance departments on this issue. (p521)

- 2017 1115 - Letter - ACLI to NAIC (LIBGWG-Life Insurance Buyer's Guide), Redlined Draft - 12p

- Unlike a term policy, which can end after a specified number of years, permanent life insurance will continue to the policy’s maturity age so long as premiums are paid.

- (Note that this isn’t exactly accurate for UL, where policies can continue as long as the cash value is sufficient to pay the policy charges. We may want to make that distinction. ) --- [Bonk: ACLI Wording and Strikethrough-?]

- [Bonk: Without Strikethrough]

- (Note that this isn’t exactly accurate for UL, where policies can continue as long as the cash value is sufficient to pay the policy charges. We may want to make that distinction.)

- Unlike a term policy, which can end after a specified number of years, permanent life insurance will continue to the policy’s maturity age so long as premiums are paid.

- 1990-1A, NAIC Proceedings - NAIC / LIMRA - Universal Life Disclosure Form - Focus Group Summary --- [BonkNote] --- 10p

- As long as you pay the premium

- Minimum Premium, planned premium, target premium, glp,

- gmp - ulmr

- plan of insurance

- libg

- Birny vs x

- Universal Life

- 2012 1011 - ThinkAdvisor.com - What's a L.I.R.P.?, By David C. McKnight --- [BonkNote] --- [link]

- market conduct - Sources - Sheet

- Social Media

- Lawsuits

- bonknote.com/2023-0224-liac-life-insurance-committee-a-naic/ --- Chat Box - [from Jules [Bonk] to Everyone - "Is Birny correct in saying that the regulators have found the illustrations to be misleading or whatever words he used? [pic-18:42]

- bonknote.com/2001-lc-solarchick-vs-metropolitan-life/

- 42 - Solarchick vs. Metropolitan - Binder - 528p

- bonknote.com/mdl-1091-lc-metropolitan-life-insurance-company-sales-practices-litigation/

- 1998 - Report of The Metropolitan Life Insurance Companies Located In New York, New York As Of December 31, 1998, By Examiners of The State of New Jersey Department of Banking And Insurance Division of Enforcement And Consumer Protection Market Conduct Examination Unit - 44p

- MDLl-1091 -

- 42 - Solarchick vs. Metropolitan - Binder - 528p

- 1999 1221 - Letter - ACLI to SEC - re Supplemental Submission on Proposed Registration Form N-6 for Insurance Company Separate Accounts Organized as Unit Investment Trusts that Fund Variable Life Insurance Contracts; File No, S7-9-98 - 27p

- Target Premium

- Decades - Lawsuits - pages

-

AN EVALUATION OF THE INVESTMENT PERFORMANCE OF UNIVERSAL LIFE INSURANCE: 1984-1993HILL, BRUCE ARMITAGE

- 1977 10 – Changing Times – Adjustable Life Insurance - (p17-19) --- [BonkNote]

- Add PDF

- October 1995 Actuarial Update

- 1996 - LR - A Different Approach to Term vs. Whole Life Insurance, by Neil Rubenstein - 46p

- https://files.eric.ed.gov/fulltext/ED118816.pdf

- B. Individual Projects and/or Small Group Activities

- 1. A student might obtain sample applications and contracts from local life insurance companies or agencies and under the guidance of a teacher or possibly an agent fill out these items to better grasp the idea of what information insurance companies want and the requirements which must be met.

- 2. Students might be interested in investigating-the historical development of life insurance and discovering the various interesting aspects of the early industry

- BonkNote - Update

- NAIC Docs

-

2024 0214 - 'How is this legal?': A 72-year-old woman's life insurance policy is being terminated — despite her premiums being paid on time every month since 1987, TikToker says. How did this happen?, by Bethan Moorcraft - https://www.yahoo.com/finance/news/legal-72-old-womans-life-143000791.html

- 2000 - Book - Confounded expectations : the law's struggle with personal responsibility, by Jarecke, George W., 1953-

- archive.org/details/confoundedexpect0000jare/page/119/mode/1up

- Chapter - Conclusion: Vanishing Remedies - LC - Goshen v. Mony - p116-119

- 1969 - LR - Ownership and Transfer of Interests in Life Insurance Policies, by Lewis D. Asper - 45p

- Professor Vance was persuaded that the early statutes exercised an unusual influence on the development of insurance law.13

- 13 See Vance, The Beneficiary's Interest In A Life Insurance Policy, 31, YALE L.J. 343, 349-54 (1922)

- 1922 - LR - The Beneficiary's Interest in a Life Insurance Policy, by William Reynolds Vance - 18p

- Professor Vance was persuaded that the early statutes exercised an unusual influence on the development of insurance law.13

- https://www.bonknote.com/level-the-playing-field/

- NAIC - IULSG - Anderson

- 1) for companies and Consumers - [Bonk: Unfair Trade Practices ?]

- 2) LIAC - Conference Call - My Question - Birny, Anderson and Ohio Commissioner

- Mutuals v Stock Companies

- NAIC - IULSG - Anderson

- congress.gov/111/crpt/hrpt702/CRPT-111hrpt702.pdf

- REPORT ON THE ACTIVITY OF THE COMMITTEE ON FINANCIAL SERVICES FOR THE ONE HUNDRED ELEVENTH CONGRESS

- SECURITIZATIONS OF LIFE SETTLEMENTS

On September 24, 2009, the Capital Markets Subcommittee held a hearing entitled ‘‘Recent Innovations in Securitization. - INSURANCE - Insurance Regulatory Modernization.

- During the 110th Congress, the Capital Markets Subcommittee held a series of hearings on reforming insurance regulation and approved a number of incremental reforms, including a bill to strengthen the corporate governance standards and improve the effectiveness of risk retention groups, as well as other legislation described below. In the 111th Congress, the Committee will reconsider these previously approved reforms and, as part of its ongoing comprehensive review of the oversight of the financial services industry, will evaluate new policy alternatives for modernizing insurance regulation.

- Financial Guarantee Insurance.

- The financial guarantee insurance industry lies at the center of the ongoing credit and liquidity crisis that has roiled financial markets in recent months. Turmoil within this sector has caused tens of billions of dollars of losses to investors and financial institutions, and an unraveling of many secondary debt markets.

- Federal aid to insurers.

- Regulation of Insurer Systemic Risks. As part of its overhaul of systemic risk regulation, the Committee will look at the role insurance plays in the economy and its interconnectedness with other sectors of the financial services system. As noted above, insurers offering financial guarantee products, like AIG and the municipal bond insurers, have demonstrated that insurers and their holding

companies can create systemic risks. The Committee therefore will work to identify solutions aimed at mitigating the systemic risks posed by insurers or their holding companies.

- Regulation of Insurer Systemic Risks. As part of its overhaul of systemic risk regulation, the Committee will look at the role insurance plays in the economy and its interconnectedness with other sectors of the financial services system. As noted above, insurers offering financial guarantee products, like AIG and the municipal bond insurers, have demonstrated that insurers and their holding

- Guarantee Funds. To protect policyholders in the event of an insolvency of an insurer, each State has in place a system of guarantee funds. In this period of growing financial insecurity, the Committee will monitor the effectiveness of these systems to protect policyholders in the event of an insurer’s insolvency and study whether changes should be made to the present guarantee system if broader changes are made to the regulation of insurance.

- Insurance Investments. Insurance companies seek to match long term obligations with long-term investments. In doing so, many insurance companies invest in real estate, with an emphasis on commercial real estate. As the real estate sector faces unprecedented loss, life insurance companies sought capital and surplus relief from State regulators in late 2008. The Committee will monitor the financial health of insurance companies. Separately, the Committee may also examine the two investment pools in Massachusetts, one for property-and-casualty insurers and one for life insurers, working to help fund the development of affordable housing, commercial and industrial real estate, small business, and other community projects.

- Retirement Products. Given Americans increased reliance on personally controlled retirement savings and the proliferation of increasingly complex retirement products, the Committee will continue to monitor the response of the insurance industry to these developments, including review of the expected impact of the Security and Exchange Commission’s recently finalized indexed annuities rule, Rule 151(A). In its review, the Committee will explore the ability of financial regulators to adequately protect consumers of annuity products, especially in the current volatile markets, and

whether any gaps in functional oversight exist. - International Developments. Though regulated on a State-by State basis, the business of insurance has for many decades transcended State boundaries. The capital pools provided by the reinsurance industry and the adoption of international trade agreements have long since made the insurance industry a global one. For these reasons, the Committee will continue to monitor developments in international insurance regulation. As part of the larger topic of insurance regulatory reform, the Committee will also explore how the current State-by-State insurance regulatory system fits into an increasingly evolving global insurance marketplace.

- https://www.investor.gov/introduction-investing/investing-basics/investment-products/insurance-products/variable-life

- https://www.tiaa.org/public/pdf/monthly_performance.pdf

- https://content.naic.org/sites/default/files/inline-files/cipr_events_2012_cipr_symposium_program_handout.pdf

- CIPR White Paper: State of Life Insurance Industry Implications of Industry Trend

- https://theinsuranceproblog.com/cash-value-life-insurance-what-you-need-to-know/

- https://www.mass.gov/info-details/understanding-the-sales-materials-illustration

- https://www.forbes.com/advisor/life-insurance/secret-of-quotes/

- https://www.forbes.com/advisor/life-insurance/in-force-policy-illustrations/

• Dinallo v Bernanke

https://wvvw.governmentattic.orgM3docs/FedReserveResponseComgCmtees 2012-

2013.pdf

Nolhga Magazine

• Dinallo v Dinallo

• Dinallo v Geithner

2010 0127 - GOV (House-OGR) - The Federal Bailout AIG, Edolphus Towns (D-NY)

. [BonkNote]

• Dinallo v NAIC

2010 0910 - WSJ - 'Systemic Risk' Stonewall: Some bailout questions the Fed still

hasn't answered

[BonkNote]

Writing in our pages in February, former New York Insurance Superintendent Eric

Dinallo said that "policyholders would have been protected" in the event of an AIG

bankruptcy.

• That seemed clear enough. but then Mr. Dinallo immediately added that an AIG

bankruptcy "would have been bad for those same policyholders.'

• 2010 0202 - WSJ - What Learned at the AIG Meltdown: State Insurance

Regulation Wasn't the Problem, by Eric Dinallo - [link]

So which was it?

• State insurance regulators and industry analysts have since told us that Mr.

Dinallo was wrong when he suggested that policyholders would have suffered.

• McRaith Woodall / Paulson

YouTube - McRaith - You can talk now...

- https://fcic-static.law.stanford.edu/cdn_media/fcic-docs/2007-11-05%20FRB%20October%202007%20Senior%20Loan%20Officer%20Opinion%20Survey.pdf

- https://fcic-static.law.stanford.edu/cdn_media/fcic-docs/2006-09-00%20Treasury,%20FRB,%20FDIC,%20OTS%20and%20NCUA%20Notice%20of%20Proposed%20Illustrations%20of%20Consumer%20Information.pdf

- 2000-1, NAIC Proceedings

- (p824) - Discuss Policy Statement Concerning the Protection of Insurance Company Assets in the Insolvency of a Diversified Financial Holding Company

- 1989 NAIC Letter Industry - Too Complicated: Policy Information Universal Life Product Development WG

- Selections

- https://www.bonknote.com/consumer-liaison-committee-naic/

- Task Force on Life Insurance Disclosure System – LIDS – NAIC

- 2020 1110 - LIAC - NAIC - Presentation (p22-39) - CEJ, Birny Birnbaum - Re-Engineering Life and Annuity Illustrations and Disclosures - NAIC Life Insurance & Annuities (A) Committee - 124p

- [ ] - 2019 0830 - Letter - CEJ / Birnbaum to NAIC (LIIIWG) - Response to Recent Comments by the ACLI and NAIFA -

- [ ] - 2019 1115 - LIIIWG - CEJ, Birny Birnbaum -

- 2021 0811 - LIAC - NAIC - Summer National Meeting, Proceedings - 43p

- New Computer

- CSPaN download

- Marcy Kaptur

- John Sununu

- price of life insurance policy,

- 2013 / 2014 0314 - GOV (House) - Who Is Too Big To Fail? GAO’s Assessment Of The Financial Stability Oversight Council And The Office Of Financial Research - mp3-yes --where from

- Subcommittee on Oversight and Investigations

- McHenry, references AG Testimony re: not prosecuting big businesses

- 2000 - Statutory Issue Paper No. 89 - Separate Accounts - Finalized March 13, 2000 - Original SSAP and Current Authoritative Guidance: SSAP No. 56 - Type of Issue: Life Specific - 26p

- VIDEO-Senate-Error

- 2006 0711 - GOV (Senate) - Insurance Regulation Reform - [PDF-152p, VIDEO-Senate-error]

- 2008 0729 - GOV (Senate) - The State of the Insurance Industry: Examining the Current Regulatory and Oversight Structure - The Current State of Insurance Regulation, Oversight and Ways to Enhance Consumer Protection, Promote Competition and Efficiency, and to Address What Role, if any, the Federal Government should play - [PDF-472p, Video-Senate-Error]

- 2009 0305 - GOV (Senate) - American International Group: Examining What Went Wrong, Government Intervention, And Implications for Future Regulation - (CSPAN) Government Intervention and Regulation of AIG - [PDF-72p, VIDEO-CSPAN - VIDEO-Senate-Error]

- 2009 0317 - GOV (Senate) - Perspectives on Modernizing Insurance Regulation - [PDF-160p, VIDEO-Senate-Error]

- Chairman Bernanke on Financial Regulatory Overhaul - [VIDEO-CSPAN]

- The recent financial crisis clearly demonstrated that risks to the financial system can arise not only from banks, but also from other financial firms -- such as investment banks or insurance companies -- that traditionally have not been subject to the type of regulation and consolidated supervision applied to bank holding companies.

- https://www.c-span.org/video/?281625-1/chancellor-exchequer-economic-situation

- Banking, Housing, and Urban Affairs - Hearings to examine 21st century communities, focusing on climate change, resilience, and reinsurance.

https://www.c-span.org/video/?513424-1/banking-housing-urban-affairs

- How long does it take for a Transcript of a Government Hearing Take?

- Example: 2022 0908 - GOV (Senate) - Current Issues in Insurance

- Where is "The Record"? As in "we'll put it in "the Record"?

- Ex: Royce, NP Article

- 2010 - Dodd-Frank Hearing PDFs

- Write Letter - RE: Videos

- House, Senate

- 2009 0318 - GOV (Senate) - Lessons Learned in Risk Management Oversight at Federal Financial Regulators - [PDF-181p, VIDEO-Senate-page

- Senate - Banking, Housing, and Urban Affairs Committee - Subcommittee on Securities, Insurance, and Investment

House

- 2008 0312 - GOV (House) - Municipal Bond Turmoil: Impact On Cities, Towns, And States - [PDF-262p, Video?-<WishList>

- Barney Frank - youtube.com/watch?v=J5UaGbZAi2w - 09:24 - <ToDo>

Senate - Banking - Page

- 2019 0912 - GOV (Senate) - Developments in Global Insurance Regulatory and Supervisory Forums

Senate - Banking - CSPAN

- 2019 0515 - Senate Banking Hearing on Oversight of Financial Regulators

- 2017 0511 - Housing Finance System - Mel Watt

- 2017 0502 - Banking, Housing and Urban Affairs

- 2016 0714 - Evaluating the Financial Risks of China

- 2016 0623 - Bank Capital and Liquidity Regulation Part II: Industry Perspectives

- 2016 0607 - Bank Capital and Liquidity Regulation

- 2016 0519 - Improving Communities' and Businesses' Access to Capital and Economic Development

- 2016 0414 - Examining Current Trends and Changes in the Fixed-Income Markets

- 2016 0405 - Assessing the Effects of Consumer Finance Regulations

- 2016 0303 - Regulatory Reforms to Improve Equity Market Structure

- 2015 0930 - Oversight of the Securities Investor Protection Corporation

- 2015 0729 - The Role of Bankruptcy Reform in Addressing Too-Big-To Fail

- 2015 0723 - Measuring the Systemic Importance of U.S. Bank Holding Companies

- 2015 0722 - Oversight of the Financial Stability Oversight Council Designation Process

- 2015 0525 - FSOC Accountability: Nonbank Designations

- 2015 0708 - The Role of the Financial Stability Board in the U.S. Regulatory Framework

- 2015 0521 - EXECUTIVE SESSION to mark-up original legislation entitled “The Financial Regulatory Improvement Act of 2015.

- 2015 0430 - Hearings to examine insurance capital rules and Financial Stability Oversight Council (FSOC) process.-

- https://www.c-span.org/video/?403711-1/examining-insurance-capital-rules-fsoc-process

- 2015 0325 - FSOC Accountability: Nonbank Designations-

- https://www.c-span.org/video/?104568-1/fsoc-accountability-nonbank-designations

- https://www.c-span.org/video/?104525-1/capital-formation-reducing-small-business-burdens

- https://www.c-span.org/video/?104579-1/examining-regulatory-regime-regional-banks

- https://www.c-span.org/video/?99312-1/banking-housing-urban-affairs-securities-insurance-investment

- https://www.c-span.org/video/?98175-1/federal-reserve-accountability-reform

- https://www.c-span.org/video/?97728-1/regulatory-relief-community-banks-credit-unions

- https://www.c-span.org/video/?95826-1/improving-financial-institution-supervision-examining-addressing-regulatory-capture

- https://www.c-span.org/video/?93583-1/assessing-enhancing-protections-consumer-financial-services

- https://www.c-span.org/video/?93006-1/banking-housing-urban-affairs-economic-policy

- https://www.c-span.org/video/?91793-1/examining-gao-report-expectations-government-support-bank-holding-companies

- https://www.c-span.org/video/?91912-1/examining-gao-report-expectations-government-support-bank-holding-companies

- https://www.c-span.org/video/?91002-1/makes-bank-systemically-important

- https://www.c-span.org/video/?292071-1/systemic-risk-monitoring-regulation

- https://www.c-span.org/video/?13617-1/dark-pools-flash-orders-high-frequency-trading-market-structure-issues

- 2015 0325 - GOV (Senate) - FSOC Accountability Nonbank Designations - [PDF-165p, VIDEO-CSPAN -todo]

- Ratebook Examples

- Videos / Audios

- Requests

- Illustration Examples

- Bumenthal

- Adjustable Life - Legal Case

- LIRP - Walker v LSW

- Vanishing Premiums - 1991-1992 SOA Final Report Task Force

- Vogt

- 1993 gov who - John Hancock

- 199x - NAIC -

- Illustration Narrative Examples

- NAIC LIIIWG Examples

Universal Life is not well understood and part of the mystery about it may well be due to a failure in my communication......

- .......Universal Life was developed in 1962 as a generic plan, which means that it subsumes all other life insurance products.

1987 - Book - The Search for New Forms of Life, by G. R. Dinney

- paulson - Couldn't tell you how bad it was

- Dorgan

- 2008 1003 - President Bush and Secretary Paulson Statement

- https://www.congress.gov/event/114th-congress/senate-event/LC35970/text?s=1&r=44

-

05/16/2019 - Oversight of Prudential Regulators: Ensuring the Safety, Soundness... (EventID=109501)

Financial Services Modernization

- [PDF-Can't Find, VIDEO-CSPAN]

- Financial Services Modernization Act of 1999, would repeal part of the Glass-Steagall Act of 1933

Markups

- Scism

- NAIC

- 582

- 580

- ULMR

- 2008 0924 - THE FUTURE OF FINANCIAL SERVICES: EXPLORING SOLUTIONS FOR THE MARKET CRISIS

- Federal Financial Market Rescue Plan, Part 2

- https://www.c-span.org/video/?281318-102/federal-financial-market-rescue-plan-part-2

- Bernanke, Paulson

- 2011 0316 - GOV - Securities Lending in Retirement Plans: Why the Banks Win, Even When You Lose -

- FEBRUARY 12, 2010

Systemic Risk Monitoring and Regulation

The committee heard testimony on the tools financial regulators need to monitor the systemic risk for financial institution - https://www.c-span.org/video/?292071-1/systemic-risk-monitoring-regulation - 2011 0510 - GOV - REVIEWING THE FINANCIAL CRISIS INQUIRY COMMISSION'S FINAL REPORT

- [PDF-88p, Video-Senate]

- Senate - COMMITTEE ON BANKING,HOUSING,AND URBAN AFFAIRS UNITED STATES SENATE

- Finding the Right Capital Regulations for Insurers

- [PDF-105p, VIDEO-CSPAN]

- Senate - COMMITTEE ON BANKING, HOUSING, AND URBAN AFFAIRS - SUBCOMMITTEE ON FINANCIAL INSTITUTIONS AND CONSUMER PROTECTION

- 2015 0325 - GOV - FSOC Accountability Nonbank Designations

- [PDF-165p, VIDEO-CSPAN -todo]

- [PDF-165p, VIDEO-CSPAN -todo]

- The State of the Insurance Industry and Insurance Regulation

- MP4 -2015 0708 - GOV - The Role of the Financial Stability Board in the U.S. Regulatory Framework

- [PDF-109p, VIDEO-CSPAN]

- Senate - BANKING, HOUSING, AND URBAN AFFAIRS

- 2015 0722 - GOV - Oversight of the Financial Stability Oversight Council Designation Process

- [PDF-48p, VIDEO-CSPAN]

- Senate - COMMITTEE ON BANKING, HOUSING, AND URBAN AFFAIRS - SUBCOMMITTEE ON SECURITIES, INSURANCE, AND INVESTMENT

- mp4 - 2015 0929 - The Impact of Domestic Regulatory Standards on the U.S. Insurance Market

- [PDF-152p, VIDEO-CSPAN, VIDEO-YOUTUBE]

- Subcommittee - Housing, Community Development and Insurance

- 2008 0923 - GOV - TURMOIL IN U.S. CREDIT MARKETS:

RECENT ACTIONS REGARDING GOVERNMENT– SPONSORED ENTITIES, INVESTMENT BANKS, AND OTHER FINANCIAL INSTITUTIONS, aka U.S. Credit Markets and Federal Rescue Plan- [PDF-138p, VIDEO-CSPAN]

- Senate - COMMITTEE ON BANKING, HOUSING, AND URBAN AFFAIRS

Media

- Videos

- X - Van Mueller

- 1985 - GOV - Beck - VP

- 1991 - GOV - Executive Life - Garamendi

- 199x - GOV -

- Guy - You owe us

- Chicago Woman -

- ACLI / Pacific Life - Sutton - Disclosure

- 2004 - GOV -

- Insurance Commissioner Turnover - Bill Nelson

- 2009 - GOV - AIG Collapse

- Caroline / Liddy - 17-20bn

- Gov - FTC, J Robert Hunter,

Selections

- 1988 NAIC Oregon Lttr - 2 page

- 1970s - NAIC LIAC Index

- Ratebook Examples

- 1987 Best's Flitcraft

- MetLife

- Prudential

- Minnesota Life - Adjustable Life

- Universal Life

- 1987 Best's Flitcraft

- 1977 - Changing Times - Adjustable Life - redo

- Illustration Examples

- Legal Cases

- 1985 -

- Vogt

- Blumenthal

- Vanishing premiums

- SOA - 1991-1992 Task force

- NAIC - 199x -

- Linda Lanam

- Chris Kite

- ACLI

- Legal Cases

- MarkUps

- Scism

- LIIMR

- LISMR

- Binder - Basics

Snippets

- Walker v LSW - Agent - Why would pay anymore than minimum premium?

- Blumenthal v New York Life - Defendant's Expert Witness - Product Performance Chart

- Make Example of Vogt v State Farm

GOV Hearings

Videos- ????

- 2006/07/18 - PERSPECTIVES ON INSURANCE REGULATION

- https://www.banking.senate.gov/hearings/perspectives-on-insurance-regulation

- "An Error has occurred"

- 2006 0711 - GOV - Insurance Regulation Reform

- [PDF-152p, VIDEO-Senate - error]

- Senate - COMMITTEE ON BANKING, HOUSING, AND URBAN AFFAIRS

Youtube-

-

2008 0828 ?? - Dinallo on MBIA deal - Youtube - [link]

People

- Donna Claire

Legal Cases

- Blumenthal vs New York Life

- New York Life - Expert Witness Report

- Sanderford - Actuarial Absurdity

- Faye v Aetna

- Wishlist -

- Fairbanks vs Farmers

- Agent - 3 hours UL Training

- Johnston x2 v Conseco

- Video

- Judge - 1st Principles - Premium

- Judge - Dad said don't buy Flexible Premium

- Video

- v Lincoln

- Walker v LSW

- Video - Illustration doesn't show Cost

- NAIC - 199x - 1) no room 2) Confusing

- Video - Illustration doesn't show Cost

- 1990's

- Prudential

- MetLife

Books

- General

- Scientific Revolutions

- They Say, I Say

- Archives

- The Hidden Factor: Why Thinking Differently Is Your Greatest Asset, By: Scott E. Page, The Great Courses

- Technical

- The Politics and Mysteries, EW

Letters:

- AAA

- Donna

- Laura

- ACLI

- Reeder

- Lovendusky

- Regulators

- Teresa Winer

- Cliff

- Academics

- David Lange