Universal Life - Evolution

1980-1984

- New York reports that they have determined that Section 216 and 208, (a) and (b), and perhaps other sections of their law, prohibit the issuance of universal life type products.

- Their law is currently being amended to permit such policies.

1982-2, NAIC Proceedings

- Chalke and Davlin point out that a policy that provides whole life benefits assuming 10 percent interest is not a whole life plan if the guaranteed cash value is only 4 percent. Such a plan is term insurance only for a period of years.

-- THOMAS G. KABELE

1983 - UNIVERSAL LIFE VALUATION AND NONFORFEITURE: A GENERALIZED MODEL, by SHANE A. CHALKE AND MICHAEL F. DAVLIN,

- Maybe he is not getting all the disclosure he needs, as far as the continuing benefit is concerned, when the interest rates change from that illustrated.

-- Gary P. Monnin, Senior Vice President, Chief Actuary of American Founders Life Insurance Company

1982 - SOA - Universal Life (rsa82v8n111), Society of Actuaries - 14p

- 2. Report of Universal Life Advisory Committee

1983-2 (674)

Limits on premiums, TEFRA??, GMP

- Ted Becker of the Texas State Board of Insurance also said the group had questions on whether or not some limitations should be put in the contract as to the total amount of future premiums to be accepted.

Universal Life Model Regulation - https://www.naic.org/store/free/MDL-585.pdf

PAGE 3

The guaranteed maturity premium for flexible premium universal life insurance policies shall be that level gross premium, paid at issue and periodically thereafter over the period during which premiums are

allowed to be paid, which will mature the policy on the latest maturity date, if any, permitted under the policy (otherwise at the highest age in the valuation mortality table), for an amount which is in accordance with the policy structure

PAGE 5

Drafting Note:

- Although highly flexible, universal life insurance is generally

considered a permanent life insurance plan. - Most companies encourage a premium level which will provide lifetime insurance protection.

- Every universal life insurance policy of which the drafters are aware has a “net level premium” that could be computed which would guarantee permanent protection.

- As a result, it is expected that most universal life insurance policies will be sold as permanent plans.

1985-89

- We designed commission rules that anticipated a relatively large number of rollovers of existing policies; full commissions are paid provided the new Universal Life face amount is at least two times the face amount of the replaced policy.

-- Mr. Norton, not a member of the Society, is Vice President of The Lincoln National Life Insurance Company

1986 - INDIVIDUAL LIFE INSURANCE RETENTION AND REPLACEMENT STRATEGIES, Society of Actuaries - 24p

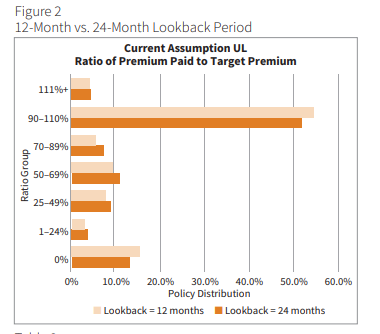

- In our Universal Life products, we need to find that critical point, or what is as important, what is the best level of premium relative to the target premium.

- You don't want all target premiums.

- In fact, the lower the premium is, the closer to the minimum premium, the happier we are.

- How do we communicate that to our agency people?

-- RICHARD SCHWARTZ, (responsible for the product marketing function for the agency distribution systems for the Sun Life Group of America)

1986 - ORGANIZING THE PRODUCT DEVELOPMENT FUNCTION, Society of Actuaries - 46p

1990s

2000s+

- If your training process for your agents is to sell at target premium, for example, and target premium carries the policy to maturity at a 7 percent rate, if you’re only crediting 6, it’s not making it there.

- So keep an eye on how you’re training your agents to sell your products and try to avoid problems up front in the product performance before they become a premium risk problem.

-- Joseph E. Paul, Clarica Life Insurance Company, Vice President and Pricing Actuary

2001 - SOA - Investment Strategies to Maximize Investment Yield, Society of Actuaries - 25p