Universal Life Descriptions

- Universal Life is not well understood and part of the mystery about it may well be due to a failure in my communication......

- .......Universal Life was developed in 1962 as a generic plan, which means that it subsumes all other life insurance products.

1987 - Book Chapter - The Search for New Forms of Life, by G. R. Dinney

Universal Life is a ratebook and more, all by itself.

- If you say you have Universal Life, you in fact have more of a product than you probably have in your current portfolio at the present time.

-- Mr. Eason

1983 - Individual Life Insurance, Society of Actuaries - 22p

- Broken down to its simplest basis, Universal Life has eliminated the concept of "plan of insurance".....

-- Christian J. DesRochers

1983 - Universal Life, Society of Actuaries - 24p

- The term “universal life insurance policy” means a life insurance policy where separately identified interest credits (other than in connection with dividend accumulations, premium deposit funds or other supplementary accounts) and mortality and expense charges are made to the policy.

- A universal life insurance policy may provide for other credits and charges, such as charges for cost of benefits provided by rider. (p01-21)

2021 - NAIC Valuation Manual - 330p

Universal Life

- Unlike adjustable life, where a current plan is defined, but is subject to change, a universal life policy at any time has only a "minimum" and a "maximum' plan....

- The adoption in 1983 of the Model Regulation for Universal Life provided recognition that these policies could be configured as whole life policies.

1989-1 (p662), NAIC Proceedings

- Universal life is permanent insurance combining term insurance with a cash account earning tax-deferred interest.

- Under most contracts, premiums and/or death benefits can fluctuate (within the contract’s bounds) with policyholder preference.

- The policy stays in effect as long as the cash value is sufficient to cover premiums.

- Additionally, the insurer usually guarantees the cash value will not fall below a minimum value.

- The cash value of the policy can also be used to pay the term insurance portion of the policy.

2013 - State of the Life Insurance Industry: Implications of Industry Trends - 220p

THEN, 1970s - 1999

- The contract <Universal Life> is a lot like the Adjustable Life concepts of The Bankers and Minnesota Mutual, with the significant, additional flexibility that a plan change is not required each time there is a change in premium payments.

-- SPENCER KOPPEL

1979 - FUTURE TRENDS AND CURRENT DEVELOPMENTS IN INDIVIDUAL LIFE PRODUCTS, Society of Actuaries

"Completely Flexible"

- The completely flexible life insurance plans are sometimes called "universal life insurance plans.

1980-2, NAIC Proceedings

- The Universal Life product is viewed by most as an evolutionary product, not as a revolutionary product, in terms of its design and structure.

- Consider some of the characteristics of flexible premium annuities: flexible premiums; disclosure of loads and expense charges; crediting of current interest; and annual reports.

- Also consider features of the Minnesota Mutual Bankers Life "Adjustable Life" product like the adjustable face amounts, the ability to make unscheduled premium payments, and prospective nonforfeiture compliance demonstrations.

- Combine these features and you essentially have a Universal Life contract.

-- Samuel H Turner (Life of Virginia)

1981 - Universal Life, Society of Actuaries

"Buy Term and Invest the Rest"

- In the last two years a new product has surfaced - combining the buy term and invest the rest into one product which is tax sheltered from the buyer's point of view.

- This product is the so-called Universal Life.

-- Stanley B. Tulin

1981 - THE FUTURE OF PERMANENT LIFE INSURANCE, Society of Actuaries

"Special Life Insurance Plans".

- The topic also includes varying premium plans such as Adjustable Life Insurance Plans, Completely Flexible Life Insurance Plans (sometimes referred to as "Total Life Plans" or "Universal Life Plans") and Indeterminate Premium Life Insurance Plan.)

- This topic corresponds to the topic "Varying Gross Premium Plans" which was included in the June 1980 report of the (C4) Technical Subcommittee.

1981-1 NAIC Proceedings

JESSE M. SCHWARTZ:

- Why are people so reluctant to call Total Life <Universal Life> permanent insurance?

MYRON H. MARGOLIN:

- Universal Life type products are, I suppose, permanent.

- It is a semantic question whether they are permanent life or not, but clearly they are not the traditional cash value products as we have known them..."

1981 - SOA - The Future of Permanent Life Insurance (rsa81v7n36), Society of Actuaries - 22p

"Funded Plans"

- III. FUNDED PLANS OF LIFE INSURANCE (UNIVERSAL LIFE) AND ANNUITIES (LATER CHANGED TO UNIVERSAL LIFE AND RELATED PLANS OF LIFE INSURANCE AND ANNUITIES)

1982-4, NAIC Proceedings

- A few companies have introduced a product known as Universal or Total Life.

- The concept involves...the company withdraws an amount sufficient to pay the premiums for an annual renewable term coverage for the amount selected for the for the current policy year. (p70)

1982 - Book - Life Insurance - Huebner and Black

[Bonk: This passage was in Chapter 5 titled "Term Insurance]

- Similarly, life insurance contracts such as universal life and indeterminate premium and adjustable life are all forms of life insurance possessing the same risk-shifting attributes as their more traditional predecessors.

- They merely afford purchasers greater flexibility in designing their contracts so as to meet their individual needs."

-- STATEMENT OF THE AMERICAN COUNCIL OF LIFE INSURANCE <ACLI>, BEFORE THE NASAA/NAIC JOINT REGULATORY INSURANCE PRODUCTS STUDY COMMITTEE

1982-1, NAIC Proceedings

- In fact, it is accurate to describe Universal Life as a generalized version of the actuarial formulas underlying traditional life insurance products.

- In other words, it is possible to produce any traditional plan of insurance from the generalized formulas underlying universal life.

-- Alan Richards, president and chief executive officer of E. F. Hutton Life Insurance Co.,

1983 - GOV - Tax treatment of life insurance: Hearings before the Subcommittee on Select Revenue Measures of the Committee on Ways and Means, p448

- The "unbundling" of services and other product differences between Universal Life and Ordinary Life cause current literature to be inapplicable, as well as insufficient, for Universal Life.

1984 - American Academy of Actuaries - STATEMENT 1984-32, Academy Journal - p217

-

One could almost argue that universal life is an outgrowth of deposit term.

-- Fred Jonske

1984 - INDIVIDUAL TERM PORTFOLIO MANAGEMENT. Society of Actuaries -

- A universal life policy with a large insurance component can become a close substitute for renewable term insurance...

1984 - GOV - THE TAXATION OF INCOME FLOWING THROUGH LIFE INSURANCE COMPANIES, U.S. Treasury Department - 80p

- Mr. Montgomery <Regulator> commented on the flexible premium universal life policy and the fact that it is not really a whole life policy, but a term policy until the premium is actually paid.

1988-2, NAIC Proceedings

Commissioner Hager of the Universal & Other Plans (A) Task Force stated that there appeared to be disclosure problems with universal life plans and that the identification of these items should be placed on the Actuarial Task Force agenda.

Some of the items identified which should be disclosed:

- (1) what is guaranteed versus what is not;

- (2) adequate disclosure of the fact that a premium quoted will not support the contract for the whole life if the policy is a universal life policy;

- (3) disclosure of the guaranteed surrender values on a flexible premium policy."

1988-2, Universal Life Insurance Model Regulation, Proceeding Citations

- The first universal life policies showed compliance on the minimum plan-a yearly renewable term policy.

- Deductions for benefits were within the statutory mortality table, and expense loads were either level, or met the definition of expense allowance for a yearly renewable term policy.

- The adoption in 1983 of the Model Regulation for Universal Life provided recognition that these policies could be configured as whole life policies.

1989-1, NAIC Proceedings

- It's very possible to have a 25-year term with zero cash value, using a UL product.

-- LAWRENCE SILKES

1990 - LIFE PRODUCT DEVELOPMENT UPDATE, Society of Actuaries

- He said many consumers cannot distinguish between universal life and whole life.

- He said a narrative explanation was needed because many did not understand the numbers or the fact that a universal life policy might drain the cash value until there was no coverage left.

-- He - Mr. Barkacs <Western Southern>

1994-3. NAIC Proceedings

- I think you really have to make sure that people understand volatility, whether you solve for a policy blowing up or values being halved.

- I think you have to catch people's attention, and that is all to the good.

-- Mr. Coleman (Prudential) Technical Resource Group (NAIC)

1994 - PROBLEMS AND SOLUTIONS FOR PRODUCT ILLUSTRATIONS , Society of Actuaries

NOW, 2000-2020

NAIC WORKING GROUP - Current / Recent

|

Brenda Cude No Date

|

Comment [BJC2]: Permanent insurance is a term used only by the industry – not by consumer educators. We would prefer – Life insurance comes in two basic types: Term and whole life (also referred to as permanent insurance). |

ACLI: 1) Dynamic, Conference Call (10/18/18 ?), Michael Lovendusky

2) "Permanent (cash value) insurance ", ACLI Brochure "What You Should Know About Buying Life Insurance." page 2

Birney Birnbaum: Permanent,

2018 NAIC Valuation Manual - "The term “universal life insurance policy” means a life insurance policy where separately identified interest credits (other than in connection with dividend accumulations, premium deposit funds or other supplementary accounts) and mortality and expense charges are made to the policy. A universal life insurance policy may provide for other credits and charges, such as charges for cost of benefits provided by rider. (Used in VM-20.)

2018 Life Insurance Buyer's Guide - "cash value insurance"

- Universal life and variable life contracts include those contracts which have terms that are not fixed and guaranteed relative to premium amounts, expense assessments, or benefits accruing to the policyholder.

2003-3 (p579), NAIC - Financial Stability Task Force

Life Insurance Buyer's Guides

|

2018 |

"cash value insurance" |

| 1993 |  |

2018 Life Insurance Buyer's Guide - "cash value insurance"

Outside of the NAIC Working Group Participants

States

Texas - Universal life insurance is more flexible than whole life. You can change the amount of your premiums and death benefit. But any changes you make could affect how long your coverage lasts. If your premiums are lower than the cost of insurance, the difference is taken from the cash value. If the cash value reaches zero, your policy could lapse.

The company will send you a report each year showing your cash value and how long the policy might last. The estimate is based on the cash value amount, the cost of insurance, and other factors. Review it carefully. You might need to pay more in premiums to keep the policy in effect until the maturity date.

ACADEMIC

In fact, a UL <Universal Life> policy will turn out to provide term life insurance, whole life insurance, or endowment insurance, depending on the premiums paid and other policy factors.

2015, Life Insurance, Black Jr., Skipper, Black III, (Huebner Series)

ACTUARIAL

Video: Exam MLC Problem 297 "Learning Objective "Universal Life." Question: Calculate the Level Annual Premium that results in an account value of 0 at the end of the 20th year." - UW- Madison / SOA - <Bonk: Goal: use a Universal Life policy to design a 20-year term policy.>

"Dynamic Products" are products with premiums and benefits that can fluctuate from month to month, depending on the premiums the policyholder pays, the withdrawals the policyholder makes, the investment returns credited to the policy, and the mortality and expense charges deducted from the policy."

"Some common names for dynamic products include universal life, variable universal life, unit-linked life, and adjustable life."

2000, Life Insurance Products and Finance, page 288, D.B. Atkinson and J.W. Dallas

"While many of the original intentions of issuers of universal life was to make clear the exact costs of life insurance by showing and charging exactly the interest, mortality and expenses incurred, most insurers do not observe this at the present time."

2007, ACTUARIAL ASPECTS Of Individual Life Insurance And Annuity Contracts, page 15 Easton and Harris

"The typical "present value of future benefits less the present value of future net premiums" formula is challenging to apply to flexible premium universal life policies, since neither "future premiums" nor "future benefits" are known for any particular policy."

2018, Statutory Valuation of Individual Life and Annuity Contracts, page 323 | 5th Edition, Claire, Lombardi and Summers

Universal life insurance: A type of permanent life insurance that allows the insured, after the initial payment, to pay premiums at various times and in varying amounts, subject to certain minimums and maximums. To increase the death benefit, the insurance company usually requires the policyholder to furnish satisfactory evidence of continued good health. Also known as adjustable life insurance.

---

Adjustable life insurance: A type of life insurance that allows the policyholder to change the plan of insurance, raise or lower the policy’s face amount, increase or decrease the premium, and lengthen or shorten the protection period.

2017 - GLOSSARY OF INSURANCE-RELATED TERMS, ACLI FACT BOOK

Universal life insurance: A flexible life insurance policy allowing the policyholder to change the death benefit from time to time, and vary the amount or time of a premium payment.

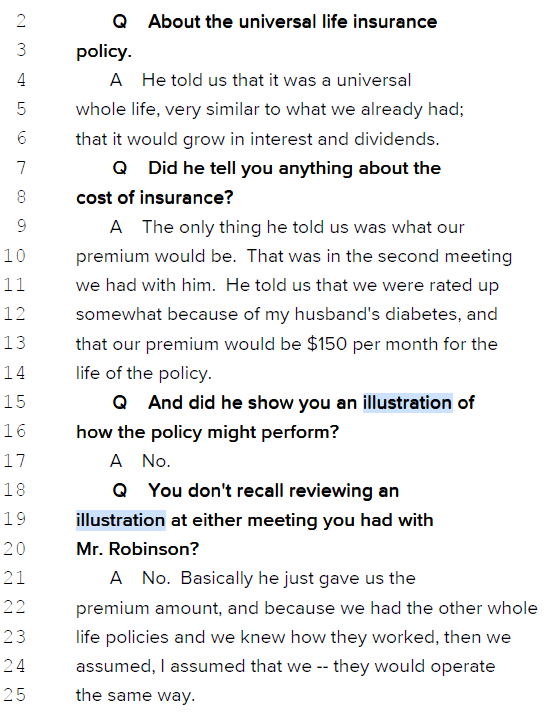

LEGAL CASE - Vogt v State Farm

"Mrs. Vogt’s testimony reveals that the Vogts’ actual grievance with the policy performance arose from their agent’s alleged oral representation in 1999 that if they paid a $150 premium each month, their $100,000 policy would remain in force and would never lapse. (Ex. A at 17:17-20:12.) No such representation appears in the policy, and the policy itself and the illustration Mr. Vogt signed contradicts any such expectation. If such an oral representation was actually made by the agent – now deceased – it was unique to the Vogts."

DEFENDANT STATE FARM LIFE INSURANCE COMPANY’S SUPPLEMENTAL EVIDENCE IN OPPOSITION TO PLAINTIFF’S MOTION FOR CLASS CERTIFICATION, Case 2:16-cv-04170-NKL Document 186 Filed 01/19/18 Page 2 of 5

VIDEO DEPOSITION OF BEVERLY VOGT

10 Taken on behalf of the Defendant

December 13, 2017

Case 2:16-cv-04170-NKL Document 186-1 Filed 01/19/18 Page 5 of 21

Case 2:16-cv-04170-NKL Document 186-1 Filed 01/19/18 Page 5 of 21