UL - Universal Life Insurance

- Universal Life – Index

- Universal Life Descriptions

- NAIC - Universal Life Insurance Model Regulation (MDL-585): - 22p

- NAIC - ULMR - Universal Life Insurance Model Regulation (MDL-585) - Citations

- GMF - Guaranteed Maturity Fund

- GMP - Guaranteed Maturity Premium

- R-Ratio

Most of us have forgotten the original concept of universal life.

-- Michael R. Tuohy, Tillinghast

1988 - SOA - The Future Economy - Society of Actuaries - 24p

- WHO CONCEIVED THIS INSTRUMENT? - Universal Life Insurance

- Subject to responsibility being accepted (and documented) by somebody else, we hold that the father is George R. Dinney, and the place of conception Winnipeg, Canada.

1981 - SOA - Who Conceived this Instrument?, by EJM, Ernest J. Moorhead (Jack), The Actuary, Society of Actuaries - 2p

- Universal Life is not well understood and part of the mystery about it may well be due to a failure in my communication......

- .......Universal Life was developed in 1962 as a generic plan, which means that it subsumes all other life insurance products.

1987 - Book Chapter - The Search for New Forms of Life, by G. R. Dinney, The Search for New Forms of Life. In: MacNeill, I.B., Umphrey, G.J., Chan, B.S.C., Provost, S.B. (eds) Actuarial Science. The University of Western Ontario Series in Philosophy of Science, vol 39. Springer - link.springer.com/chapter/10.1007/978-94-009-4796-2_19

- Hopefully it will continue to be developed and sold in a responsible manner.

-- Randall P. Mire

1983 - SOA - Universal Life (rsa83v9n32), Society of Actuaries - 22p

- This topic was described under the topic heading "Completely Flexible Life Insurance Plans (Universal Life Insurance Plans)'' in the June 1981 semi-annual report of the former (C4) Technical Subcommittee.

1982-1. NAIC Proceedings

- The dollar amount of universal life insurance in force in the United States increased sevenfold between 1983 and 1987.7

- 7/ See American Council of Life Insurance, Life Insurance Fact Book (1988 ). (p23)

-- Statement of Kenneth W. Gideon Assistant Secretary for Tax Policy Department of the Treasury (DOTT)

1989 1019 - GOV (House) - Life Insurance Company Taxation, Charles Rangel (D-NY) --- [BonkNote]

- It is illuminating to note that the development of Universal Life, the major product innovation in individual insurance, resulted when a securities executive was put in charge of an acquired life company.

[Bonk: Who was the "securities executive"? EF Hutton / California Life]

1985 1111 - Keynote Address - The Search For Competitive Advantage - William A. Sherden - p328

1985 - Proceedings of the Casualty Actuarial Society, VOLUME LXXII

Number 137 - May 1985, Number 138 - November 1985 - 378p

- Jim Anderson is revered, but I think he did a disservice to the industry by coming out with that product. [Bonk: product = Universal Life]

- UL is a horror. -- Who understands UL?

- The home office doesn't. Maybe they do now.

- The IT department doesn't.

- The owner doesn't.

-- Jeff Robinson

2003 - SOA - Do You Know How Much You're Spending? The Hidden Costs of Product Complexity, Society of Actuaries - 19p

- The concept of Universal Life has been the subject of speculation and discussion by many people over many years.

- To my knowledge, the first detailed written presentation of the concept appeared in a paper presented by James C. H. Anderson at the 1975 Pacific Insurance Conference.

- Because of the high level of flexibility provided in a "Universal Life" style Adjustable Life product.....

-- David R. Carpenter

1979 - SOA - Future Trends and Current Developments in Individual Life Products (rsa79v5n44), Society of Actuaries - 24p

- Richard F. Fisher sums up his viewpoint thus :

- Universal Life is marketed as a tax-free money market fund, or other short-term investment vehicle, with term insurance available to be purchased from the fund.

- Current high short-term yields are illustrated for very long periods of years.

- Continuance of the term piece has all the problems of continuance of term insurance purchased in any other way.

- The product will result in term coverages that lapse at high ages, disappointed beneficiaries, tax questions.

1981 - SOA - More on Universal Life, The Actuary, Society of Actuaries - 2p

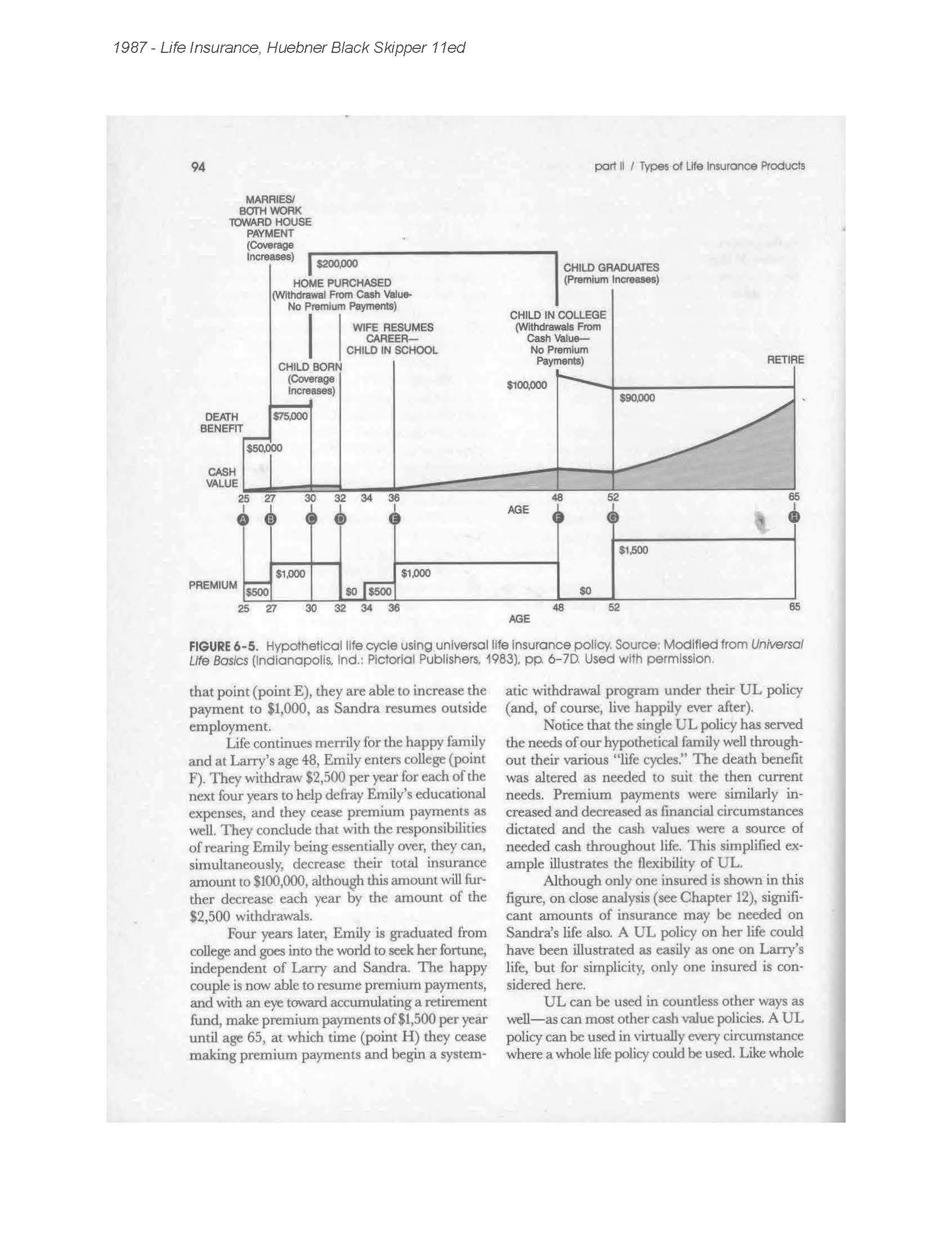

- Universal life insurance is more flexible than whole life.

- You can change the amount of your premiums and death benefit.

- But any changes you make could affect how long your coverage lasts.

- If your premiums are lower than the cost of insurance, the difference is taken from the cash value.

- If the cash value reaches zero, your policy could lapse.

- The company will send you a report each year showing your cash value and how long the policy might last.

- The estimate is based on the cash value amount, the cost of insurance, and other factors.

- Review it carefully.

- You might need to pay more in premiums to keep the policy in effect until the maturity date.

- The December, 1980, revisions of the standard valuation law and the standard nonforfeiture law for life insurance allow the commissioner of insurance for each state to issue a regulation pertaining to these types of policies.

- Thus, such policies would no longer have to be "forced into a mold," which was intended for more traditional plans, in the calculation of reserves and nonforfeiture values.

1981-4, NAIC Proceedings

- III. FUNDED PLANS OF LIFE INSURANCE (UNIVERSAL LIFE) AND ANNUITIES (LATER CHANGED TO UNIVERSAL LIFE AND RELATED PLANS OF LIFE INSURANCE AND ANNUITIES)

1982-4, NAIC Proc.

- ...nominees for the hard questions are:

- Are short-term new money investments appropriate for a product designed to meet life-long insurance needs?

- Is it appropriate for buyers, or potential replacers to compare “new money” with “portfolio” sales illustrations without explaining the profound differences between them?

- How will the great continuing planning and service needs of Universal Life policyowners be provided for?

- Who will satisfy these needs and how will they be compensated?

- Does anyone believe that a policyowner can figure it out all by himself, or that an 800 number in the home office will suffice?

-- Dale R. Gustafson

1981 - SOA - More on Universal Life, The Actuary - Society of Actuaries - 2p

|

1982-2 |

Bill White, chief actuary, New Jersey, reported on their special project pertaining to universal life.

Reports and results have been mailed to each insurance department. Some of the questions New Jersey conveyed included: (1) are these policies participating or non-participating; (2) the "Bait and Switch" potential; (3) disclosure; (4) Federal Income Tax aspects; (5) non-forfeiture values; (6) replacement problems. The concern was not just with the "twisting" replacements, but what was the impact of justified replacements on the solvency of replaced companies. |

|

1982-2 358 |

1982-2, NAIC Proceedings |

- ACTUARIAL

- 1975 (originally) - SOA - The Universal Life Insurance Policy, by James C.H. Anderson, Society of Actuaries - 10p

- 1981 - SOA - Universal Life (RSA81V7N412), Moderator: Samuel H. Turner, Society of Actuaries - 16p

- 1983 - SOA - Universal Life Valuation and NonForfeiture: A Generalized Model, by Shane A. Chalke and Michael Davlin, Society of Actuaries - 72p

- 1999 - SOA - A Brief History of Universal Life, by Douglas C. Doll, Society of Actuaries - 4p

- COMPANIES

- E.F. Hutton, Life Insurance Company of California, Life of Virginia, Prudential, MetLife, Great-West, Stock Information Group?

- LAW REVIEWS

- LEGAL CASES

- PEOPLE

- George R. Dinney, James C.H. Anderson, Shane Chalke, Christian DesRochers, Maurice

- REGULATION

- National Association of Insurance Commissioners

- Model Regulations, Proceedings, Working Groups

- STATES

- New York